This week, we discuss Ambarella's growth into AI with its new computer vision capabilities, the major developments happening in the world of precision medicine, and the unprecedented valuation multiples of DoorDash and Airbnb. Please enjoy these insights from our research team.

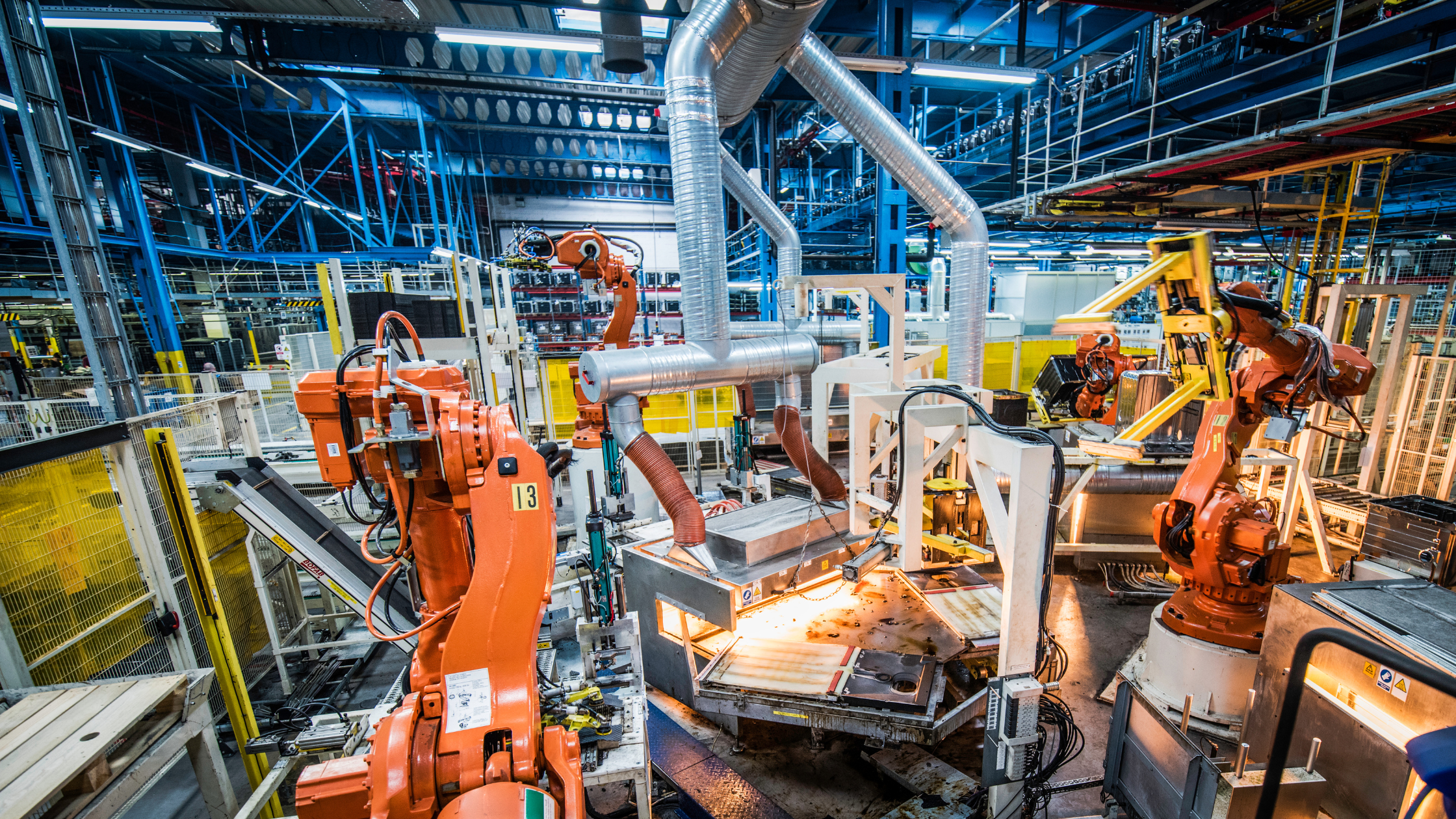

Ambarella Makes Strides in AI

Ambarella, a leader in video processing chips, hit an inflection point in recent months. The company is rapidly morphing into an AI company with computer vision capabilities attracting major players in the automotive and security industries. Ambarella’s shares have jumped over 50% in the past month as the company raised its outlook for the year and announced a $600m funnel of business opportunities in automotive, of which 70% is already won and major programs going into production in 2022 with Advanced Driver Assistance powered by Ambarella CV chips.

Computer Vision revenue now represents 10% of total, for only 4% of semiconductor volume. Notable to us is that Ambarella has been able to generate such a large funnel despite only having a SoC that supports functional safety standards (ASIL B) available beginning earlier this year. To a degree, that suggests the company may only be scratching the surface of potential OEM and tier-1 engagements. We believe the market may be starting to realize that Ambarella’s technology not only has strong potential in surveillance cameras but also in the automotive market.

RELATED: AMBARELLA: A CASE FOR A 'BORING' INVETMENT STRATEGY

Game-changing Developments in Precision Medicine

As the first COVID-19 vaccines are being approved and launched, other exciting developments are happening in the world of precision medicine. HTEC provides exposure to this innovation with companies like Vertex and Editas. Vertex Pharmaceuticals, a global market leader in cystic fibrosis treatment, recently published data with partner CRISPR Therapeutics showing transfusion-dependent beta thalassemia patients remained transfusion independent 3–18 after their treatment, and sickle cell disease patients were free of vaso-occlusive crises for 3–15 months following treatment. This treatment could be game changing, as one course could eventually replace a lifetime of treatments that these patients currently undergo.

In other news, Editas filed an Investigational New Drug application (IND) with the FDA to initiate a Phase 1/2 clinical trial for EDIT-301, a sickle cell treatment. EDIT-301 will be the first ex vivo CRISPR/Cas12a medicine to be trialed in humans, and it has already received Rare Pediatric Disease designation. This IND follows the recent announcement of strong preclinical data for this treatment. The company is also making progress with in vivo therapies for several genetic ocular diseases, and other ex vivo areas like cancer.

An Unsustainable IPO Frenzy

In recent days, DoorDash and Airbnb soared in their first day of trading, seeing unprecedented valuation multiples. Airbnb saw more than +$50 billion added to their valuation, ringing in at $100 billion; that is higher than all publicly traded US hotel chains combined. Meanwhile, DoorDash experienced a spike of +$25 billion on its IPO debut. With a current valuation hovering above $50 billion, or 20x sales multiple, it’s safe to say that investors are betting big on DoorDash, even as the company suffers deep losses in profitability. Longer term, we anticipate that DoorDash will face challenges in sustaining its growth levels as COVID lockdown restrictions ease.

When some of the euphoria around these new issues settle out, economic models, technology differentiations and defensible moats will matter. THNQ index members are experiencing powerful long-term trends as they have been developing and/or utilizing AI capabilities that will help boost productivity and gain competitive advantage to fulfill its growth potential for many years to come.