This week, we discuss the recent rebound across the 3D printing market, Fulgent's use of its sophisticated AI technology for COVID testing, and Netflix's incredible growth despite the competitive landscape of media streaming. Please enjoy these insights from our research team.

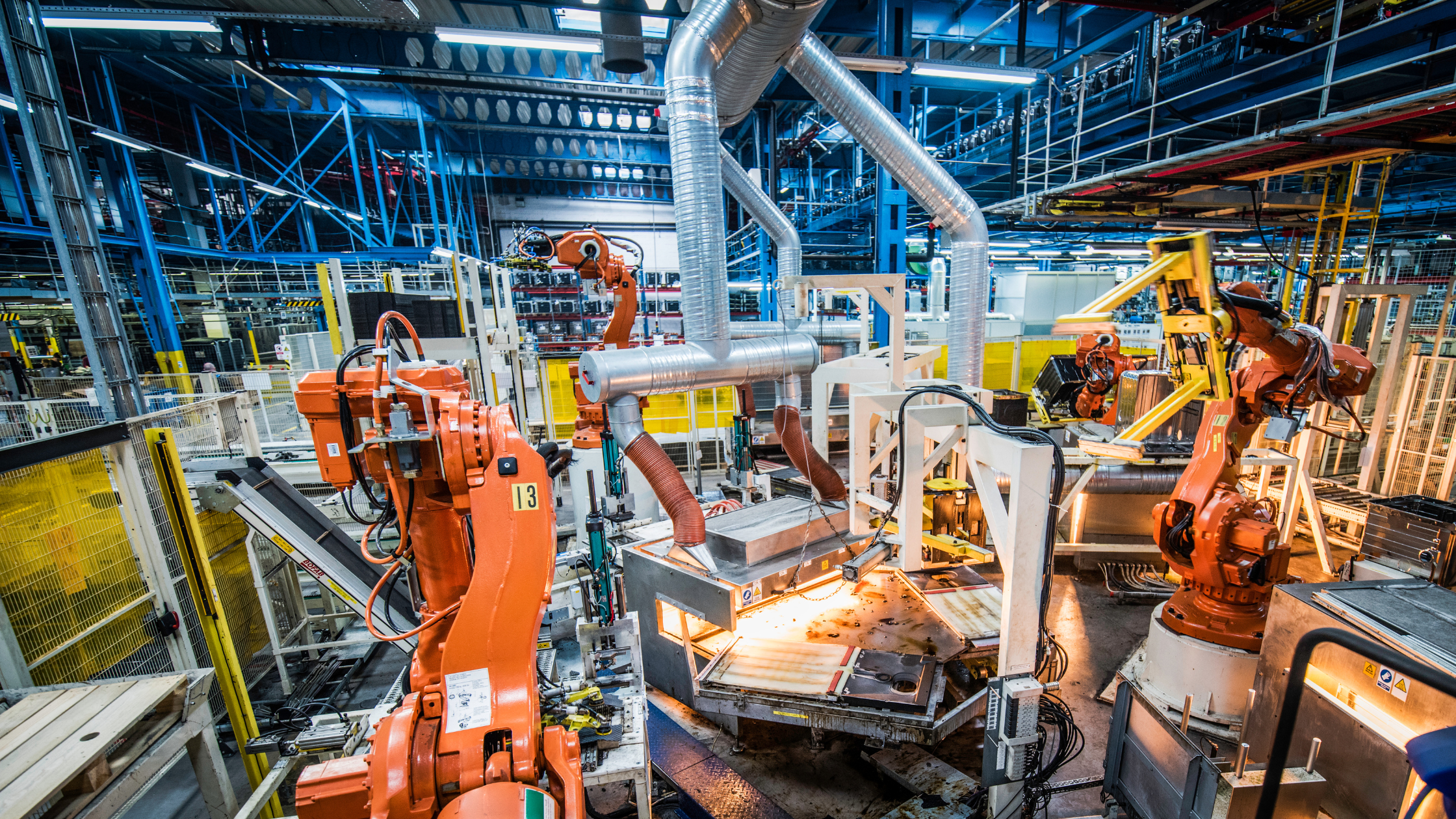

All Eyes on 3D Printing

3D Printing stocks in the Robotics & Automation Index have been on a tear in the past three months. 3D Systems more than quintupled in value, Stratasys more than tripled, and Materialise jumped more than 50%. Belgium-based Materialise, whose software solutions form the backbone of 3D printing systems and medical applications, had been on a strong growth trajectory prior to the COVID-19 downturn; while 3D Systems and Stratasys had failed to grow or even turn a profit in the five years up to 2019, facing increasing competition from the likes of HP and other entrants in this attractive market.

We see several drivers for this renewed investor interest. First, the public listing of Desktop Metal in a reverse merger with a blank check company just three years after launching its first products, having raised around $400m in venture funding. At $2.5 billion, Desktop Metal’s public valuation represented multiples of the more established public companies in the sector. It has since risen to over $6 billion. Second, signs of demand recovery after a difficult year with significant disruptions at two of the largest users of 3D printing: the aerospace and automotive industries. 3D Systems reported significantly better than expected demand trends in the final months of 2020. Third, an increasingly apparent inflection in the trajectory of adoption of additive manufacturing, not just for prototyping, but also for the industrial production of critical components, such as jet engine parts, medical devices, and consumer products. 3D printing stocks currently represent around 6% of ROBO.

As Competition Intensifies in COVID-19 Testing, Fulgent Makes Strides

In the wake of the new COVID-19 vaccine launches, many bears have been doubting the durability of the COVID-19 testing market over the long term. While we do expect demand to decelerate gradually, we believe the testing market for SARS-CoV-2 is here to stay for a long time. That said, we do expect the market to evolve, and eventually it will be only the market and technology leaders that will remain. For example, we expect in the next few years for 100% of COVID tests to be a part of a broader panel, similar to those today that test for the flu and other respiratory viruses, and only the companies that can offer scale and fast turnaround times will maintain market share over the long run. The HTEC Index is very well positioned for this trend with companies such as Fulgent Genetics, Quidel, Hologic, DiaSorin, and several others.

Fulgent, a high-tech genetic testing company, is particularly well positioned for the long run. What makes Fulgent unique is its use of AI to enable high-speed and easily scalable computing. This is what helped them develop the COVID test quickly, including the at-home collection test launched last fall. The company also uses more sophisticated technology to manage the entire testing process, like a digital health platform that scans a barcode on the patient’s mobile for appointment check-ins, and also reports back results within a day. These benefits helped Fulgent sign several marquee clients last year, including the NYC Health and Hospitals Corporation. Over the long run, Fulgent’s new COVID-19 testing clients should drive an opportunity to cross-sell its broader genetic testing platform.

Undisputed Leader in Streaming Media

Despite concerns on slowing subscriber growth in 2021 amidst the vaccine rollout as lockdowns are expected to lift, THNQ Index member Netflix reported strong revenue, impressive subscriber adds, and positive commentary around free cash flow generation. Perhaps the most important news is that Netflix has now become an FCF story as the company is targeting FCF breakeven in 2021 with near 20% operating margin. During the fourth quarter, Netflix added 8.5 million subscribers worldwide versus the company’s expectation of 2.5 million subscribers, bringing its total subscriber count to 204 million, a 22% increase from a year ago. Even with competitive offerings from Amazon Prime Video, Hulu, AppleTV, and HBO, we believe Netflix has been able to grow subscription adds while raising prices across most regions by providing the best digital experience from a user standpoint. Netflix now has the largest library of content and its technology platform is farther along than competitors in using artificial intelligence for providing a unique personalized experience.

As some may know, Netflix uses AI and machine learning for making movie recommendations to personalize the home page with the user’s favorite actors and genres. But Netflix also uses AI for location scouting for movie production and optimization of bandwidth. Specifically, the machine learning algorithm is used to analyze past viewing data to predict bandwidth usage to help Netflix decide when to cache regional servers for faster load times during peak demand. The continuing deployment and utilization of these AI capabilities will only allow Netflix to expand its user base and widen the defensible moat as the streaming war continues on.