This week, we dive into recent ROBO acquisition activities, the massive growth occurring across telehealth, and how some e-commerce companies are providing key AI analysis to both small and big businesses alike. Please enjoy these insights from our research team.

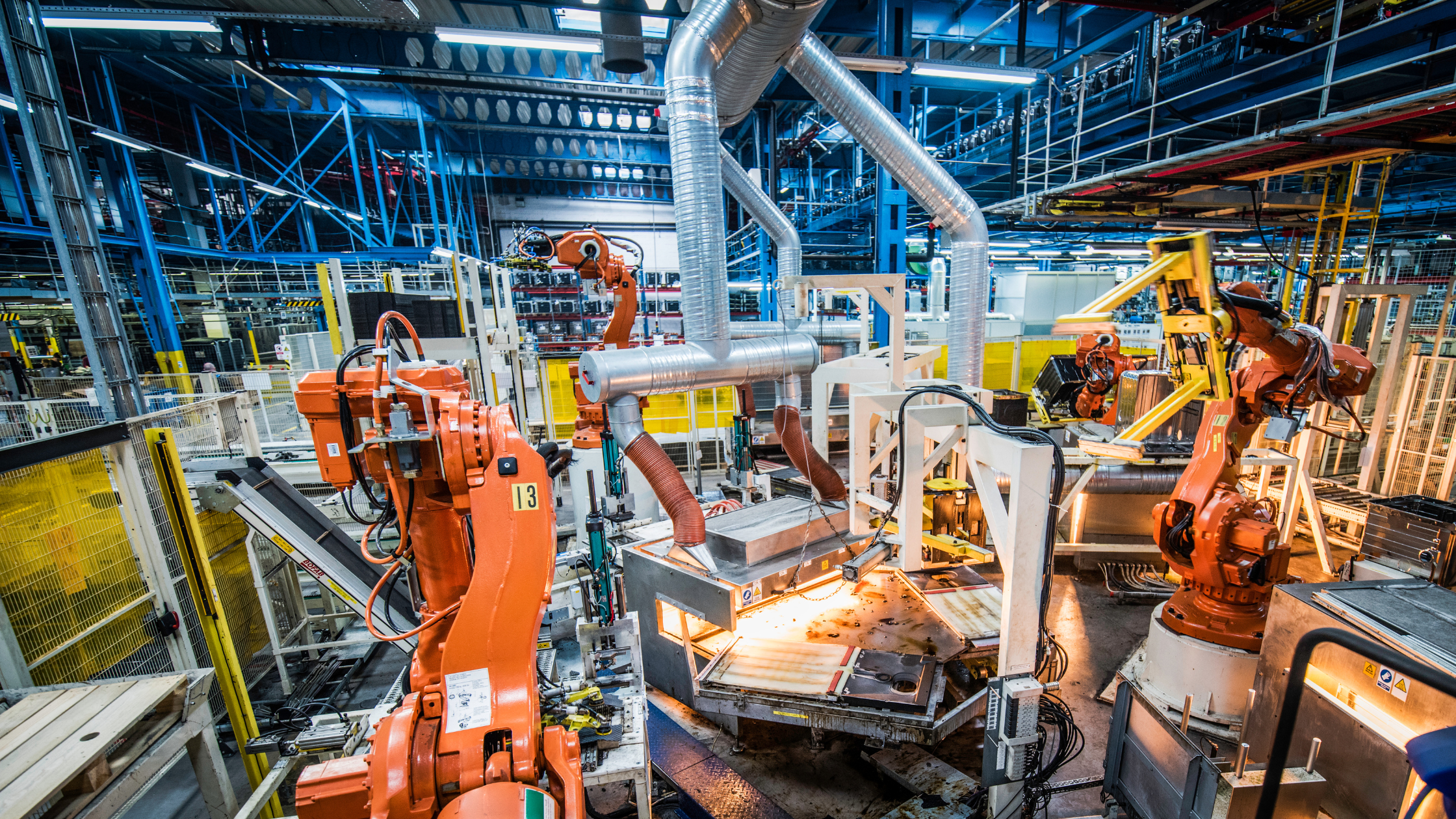

Major Merger & Acquisition Movements in ROBO

Varian Medical Systems, the leader in hardware and software products for treating cancer with radiotherapy, and a member of the ROBO Global Robotics & Automation Index (ROBO) since inception in 2013, has agreed to be acquired by Siemens Healthineers. The healthcare subsidiary of German conglomerate Siemens AG, a member of the ROBO Global Healthcare Technology & Innovation Index (HTEC) will pay roughly $16bn or 23x EBITDA and a 42% premium to the average share price in the prior 30 days.

The company is re-entering the radiation oncology market, after exiting it nearly ten years ago to focus on medical imaging. Varian has developed an AI-driven holistic therapy solution with the ability to personalize treatment based on the patient’s anatomy and position at the time of treatment. This allows for the better targeting of tumors, reducing radiation doses to healthy tissue, and potentially improving overall outcomes.

This marks the third takeover of a ROBO index member in the last year. Qiagen, a leader in molecular diagnosis, and ISRA Vision, a leader in computer vision, also agreed to be acquired earlier this year. This is the nineteenth attempt to acquire a ROBO index member since the inception of the Robotics & Automation index in 2013, reflecting the increasingly high value given to robotics, automation and AI technologies by large companies, and supporting the index 14% annualized return in the past five years.

Teladoc & Livongo: Better Together

Telehealth deal flow continues to rise, with record levels of investments taking place across private and public companies. Two HTEC companies, Teladoc and Livongo, compounded this trend with the announcement of one of the largest healthcare mergers of the year. The pending $18.5 billion combination of Teladoc and Livongo will create one of the largest and most comprehensive virtual care companies in the world. Livongo is the leader in remote chronic care management, offering a device to help people manage their chronic illnesses at home. Teladoc provides remote doctor visits. The deal creates a strong cross-selling opportunity, as both companies offer complementary services that they can sell to each other’s customer base.

Aside from their cross-selling opportunities, there is ample room for growth within both companies’ core businesses. Greater consumer awareness and new legislation will continue to support growth. Just last week, a new bill was introduced in Congress to extend the telehealth services coverage during the pandemic (which expired in July). The bill would add another $400 million to the industry, including the improvement of broadband capability for better access in rural areas.

E-commerce Companies Enabling Small Business Growth

Consumers crave innovation and convenience, and they have been the driving force of the advancement that we are seeing in Artificial Intelligence today. Our e-commerce companies in the THNQ Index provide measurable business benefits using advanced AI capabilities to enterprises of all sizes with its AI hardware, AI software and services. Index members such as Shopify, Mercado Libre, and Etsy are just few of the companies that are helping build key data assets. They have access to the most valuable merchant data the sellers can use for personalization, payment and dynamic merchandise to engage with their customers. By providing the tools and taking the complexity out of handling e-commerce, these vendors are helping merchants navigate in the ever-changing commerce environment.

Our newest index member, Etsy, a global marketplace for unique and creative goods, delivered 137% YoY revenue growth this past quarter. Etsy has one of the best growth opportunities in the e-commerce sector, applying a combination of computer vision and natural language processing to pursue a $250B TAM opportunity. We see a strong path of growth for Etsy as they capitalize on the surge in e-commerce adoption using an AI-powered engine to add value for their customers.