Tune in for a discussion about the current trends in disruptive tech along with what to make of the Q4 performance across our innovation indices: ROBO, THNQ & HTEC.

Webinar Transcript:

Jeremie Capron:

Hello everyone. Welcome to our January 2023 investor call. My name is Jeremie Capron, I'm the Director of Research here at ROBO Global, and I'm talking to you from New York. And with me today, my colleagues, Lisa Chai and Zeno Mercer. And we are going to talk robotics, automation, AI, healthcare technologies. We're going to share some thoughts about the recent market developments, and then we'll take a closer look at some of our index portfolios. And the first one is ROBO, R-O-B-O. That was the first Robotics Automation Index. It started more than nine years ago, in 2013. The second one is THNQ, T-H-N-Q. That's the Artificial Intelligence Index. The third one is HTEC, H-T-E-C. That's the Healthcare Technology and Innovation Index. And these portfolios combine research with the benefits of index investing. They're composed of best-in-class companies from around the world.

We have small, mid, large caps that we research, and we score on various metrics. And the highest scoring stocks make it into the portfolios. And then we'll be taking your questions, so feel free to type them into the Q&A box at the bottom of your screen. And I think for all of us in investment industry, we're glad to turn the page on the year 2022, which certainly was one for the history books in terms of the hardships delivered to equity and bond investors, but especially to big tech, where we've seen some of the most brutal declines after two years of euphoria. And the ROBO Global Innovation indices were not immune to that, and they underperformed global equities for the year 2022, but certainly not to the same extent as some of the more concentrated, disruptive technology indices out there. Within this new year, 2023 is a year of opportunity, because there's a huge contrast between the declines that we saw in the stock market, and what automation companies are telling us and showing us in terms of their record order intake and their, in many cases, record order backlogs.

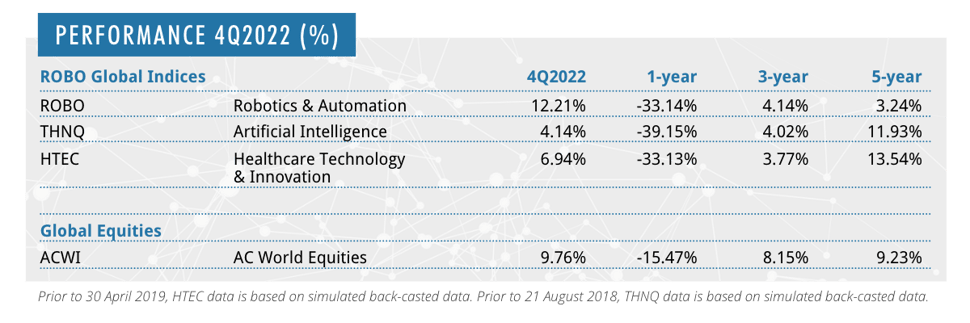

So in the final quarter of the year, the ROBO Global Innovation indices saw pretty good gains, and some green shoots that may be setting the stage for growth to come. So let's start with robotics and automation, and the ROBO index portfolio that was up 12% in Q4. It outperformed global equities by a little more than two percentage points, with some pretty strong gains in Europe, that was up 25%. And also in logistics automation, that was up some 20% or so. And I think it's worth discussing today, logistics automation here, because this is an increasingly important part of the robotics industry.

And many investors in public equities are just not exposed to this massive growth opportunity. In fact, since we launched the ROBO index in 2013, this has been the best performing of the 11 sub-sectors that composed the portfolio. We saw a total return of more than 300%, 340% through the end of 2022. And that's after the substantial decline last year, when the sector was down more than 40% in 2022. So what's going on here is that there is an arms race to automate supply chains and warehouses around the world. And that race was started by Amazon, which is now running one of the largest warehouse robotics operations in the world. And that's really enabling increasingly short delivery times from click to order to delivery. And everybody else in the e-commerce industry is basically scrambling to compete with this operational excellence. And it's not only about the boom in e-commerce, but also, traditional retailers that are building omnichannel operations that are then feeding that huge transport and logistics industry, that is facing a significant label shortage issue nowadays.

So there's tremendous growth in demand for logistics and warehouse automation, and it's important to understand that more than 90% of the 20,000 or so warehouses in the US today have no automation at all in more than 90% of those warehouses. So, we've identified the best in class companies that are at the forefront of this trend. And today, we have 10 ROBO index members that are focused on that, and they account for about 14% of the portfolio. So you will find companies like Daifuku in Japan, that is the global leader in material handling equipment. You have GXO, that is used by some of the largest blue chip companies to outsource their order fulfillment or logistics operations. You'll have companies like Zebra, that is the global leader in automatic identification and other track and trace technologies for supply chain. And Zebra was actually an early investor in Fetch robotics that's made the headlines this year.

Fetch robotics makes autonomous mobile robots for warehouses and distribution centers and manufacturing and so on. You'll find companies like Manhattan Associates, that is a leader in the warehouse management system, so that is on the software side. You'll find a company like Cardex, that is based in Switzerland, that makes automated storage and retrieval systems. And then you have Auto Store from Norway, which is a warehouse robot technology company that invented the cube storage automation. That is a very dense solution for auto fulfillment, that you can basically bring into an existing warehouse and automate it in a turn turnkey fashion. And so, Auto Store was the best performing stock in the ROBO index in Q4, it was up more than 65%. That's coming after a very volatile year since it went public at the end of 2021. They're doing really well. You look at a sales growth that's well over 50% year over year, and business that's already very profitable with EBITDA margins over 50%.

So, that's logistics. But as many of you know, the ROBO portfolio is exposed to many other very strong robotics applications, from manufacturing to healthcare and business process and food and agriculture. And in fact, the ROBO portfolio is very diversified. And it's not only across the 11 sectors, but also across market cap. You have about 40% in large caps, but more than 60% in small and mid-cap companies. And it's also diversified across regions, and that's a truly global portfolio. In fact, you can see around 40, 45% in US stocks and about 55 to 60% in another 12 different countries. And the reason I bring this up today is because ROBO has virtually high exposure to Asia, at around 30%. And that's important because, first, Asia is where we're seeing the strongest growth in demand over the long term. And China already is the largest market for robots today.

And second, it's because we're seeing China reopening and relaxing, the vast majority of the COVID related constraints that have been in place and really holding back investments in the last two years. So with China reopening, we're quite optimistic when it comes to the Asian piece of ROBO. And that is not so much Chinese companies, but really, exporters into China. So we have about 20% in Japan. Companies like Fanook and Yaskawa in factory robots, and then you have a good number of the technology and market leaders in key components that go into automated systems, like high precision gears from Harmonic Drive or Nabtesco. You have linear motion control from THK, you have pneumatic components from SMC and so on. And with the big move in the Japanese yen in the last 12 months, the Japanese exporters have gained a significant competitive advantage that we think they will benefit from this year.

Now before I pass it on to Lisa, I want to come back to my earlier comment about the discrepancy between stock prices, and the reality on the ground in the automation industry where demand remains very strong, despite all the talk of recession. And I'm not saying it will not soften, but it's remarkable how the fundamentals have remained very strong. And at the same time, valuations have dramatically compressed. And so today, the ROBO index is trading around 20 times earnings. That is down from a high of more than 35 times, in 2021 at the high. And today, we're at the discount to the long-term average valuation. And in the meantime, we see the earnings of those best in class robotics companies. They've remained on that really good looking growth trajectory. In fact, we're looking at sales growth of 11% in 2022. And the expectations for this year, 2023, are also around low double digits. And that is significantly above what is expected from the broader market, the S and P 500 or global equities. So with that, we'll pass it on to Lisa to discuss healthcare technology

Lisa Chai:

Thank you, Jeremy. ROBO Global Healthcare Technology Innovation Index HTEC is a strategy that we launched in 2019 that captures the growth of the digital transformation that we're seeing in the healthcare industry today. It has a very strong focus on the next generation diagnostic solutions, as well as the innovation that we're seeing in medical IOT and data-driven technologies. After several challenging quarters, HTEC had a solid performance in the fourth quarter, increasing 6.9%. The performance was driven by robotics, medical instruments, and diagnostic sub-sectors, which all gained double digits. While under performance during the quarter were in genomics and data analytics sub-sectors. Overall, 2022 was a challenging year for HTEC index members versus a global market indices. So we were really encouraged by the strong performance during the fourth quarter with six of the nine sub-sectors posting positive returns. HTEC index for the year declined approximately 33% compared to broader market in the sea of 18% decline.

For the year, precision medicine was the best performing sub-sector, down just about 10%, while the genomics and data analytics were the worst performing sub-sectors. So with genomics declining over 60% 2022, we want to share our thoughts on the sub-sector and highlight a few of our index members that drove the performance. We strongly believe that we're still on the early innings multi-year cycle of genomic technology, taking a center stage in drug discovery, and also enabling that life-saving diagnosis for rare diseases in cancer. The index members in the space are truly transforming healthcare. The biggest reason for the selloff was that many of these companies were trading at very high valuations due to the strong growth prospects, and investors were waiting for the company to just grow into the evaluation. Overall, we believe the fundamentals have not changed. In fact, we're seeing breakthroughs and acceleration investments from large pharma to medical device makers in the genomic space.

While we saw steep selloff and maybe some of the valuation resets were necessary, we're already starting to see the genomic companies recovering from some of the deep losses that we saw in the past year. Companies in genomics and precision medicine sub-sectors, for example, like VeriCite, Garden Health, and Exec Sciences, are starting to show sign of recovery. For example, index member VeriCite beat and raised the forecast during fourth quarter, driven by higher than expected sales at their cancer diagnostic test. VeriCite uses AI enabled genomic technology to speed up medical diagnosis so doctors can provide early treatment for those at high risk for thyroid and prostate cancer. Meanwhile, Garden Health declined over 70% last year, as the growth slowed to just less than 20% top line growth from 30% growth from the prior year. They're emerging to be an important player in the liquid biopsy market in the areas of colorectal cancer.

And the shared prices may continue to be volatile, but they do have one of the most interesting portfolios in cancer monitoring, profiling, and diagnostics. They are in the early stages building this platform and demonstrating the power of genomics and epigenomics, which is an area that you're going to hear more about in the coming quarters. Shares of garden are already getting a good balance for the year. We think many of these transformers of healthcare are truly oversold as investors de-risk their portfolios in the last year. Exact Sciences, another index member, which specializes in cancer diagnostics, have shared price gain of 50% during the fourth quarter. And [inaudible 00:14:50] but another 20% was a good indication that these companies were in an oversold situation. So while the companies in our genomic sub-sector did experience tremendous volatility in the past year, the severe multiple compressions have also provided significant upside opportunity for 2023.

Long-term drivers and demand for genomic technologies have only strengthened, and we believe that our index members are very well positioned for rest of the year. Meanwhile, we're also very excited about the medical instrument sub-sector, which holds the biggest waiting for HTEC at about 25%. It experienced strong gains during the quarter, driven by hospital procedural recovery, and a very large M and A deal for one of our index members. In November of last year, we saw one of the biggest ever acquisition in the med tech industry, with Johnson and Johnson acquiring a biomed, our HTEC index member that we have held since the creation of the strategy. The biomed was acquired for 16.6 billion by J and G during the quarter, a 50% upside from the closing price. The company developed the world's smallest heart pump, and had over 18 years of profit growth, and was well on its way in disrupting the 77 billion dollar cardiovascular industry when it was acquired.

While medical instrument sub-sector gained about 12% during the quarter, it did negatively impact the attribution for the year, due to heavy weighting of the index and ongoing supply chain disruptions that hit many of the device companies. Longer term, we are very bullish in the medical instrument sub-sector, as many of these index members not providing just the essential products for the medical procedures, but we're seeing tremendous innovation accelerating and environments seems to show signs of improvement as people are getting more checkups, and book their appointments for their surgeries that they have held off during the pandemic. As we look out into the year, we'd feel really strongly that our index numbers with next NextGen Healthcare Solutions will continue to be in strong demand as the world goes back to the pre-pandemic levels. And our HTEC is very well positioned to benefit from much of the secular growth drivers out there. Thank you. And now I will turn to Zeno, who will discuss THNQ.

Zeno Mercer:

Thanks, Lisa. Now I'm going to talk about the ROBO Global Artificial Intelligence Index THNQ, which provides exposure to companies around the world leading the AI revolution across infrastructure in both broad and vertical applications that are expanding GDP, creating new markets, and improving human condition. We launched the index in 2018, and the space has seen incredible growth and progress since that time. It would be remiss to not talk about generative AI and chat GPT, but first, we will cover some Q4 highlights and performance. The index row is 4.4%, with a continued fall in valuation down to around 4.7 EV sales at the year end, with performance down 45% since the November 2021 peak, where it was trading at 9.2 forward EV sales. So reported Q3 earnings saw sales growth of 18.5%, which is below the long-term average of 23%. And on the flip side, we saw EBITDA growth accelerate to 32% growth.

So, breaking down the performance, we saw eight out of the 11 sub-sectors in the positive territory, with semiconductor, consumer, business process, factory automation and e-commerce up. While we saw what had been a multi-year long sub-sector darling, network and security down 8.1%, with companies like CrowdStrike down 36% on conservative guidance cuts for 2023. Big data and analytics was down 4.7%, and I'd like to highlight that Ford EV sales have dropped from a relative high of 13X down to 4.2X. A company I want to talk about quickly in that sub-sector, and big data analytics. Alteryx, which is transitioning from a pure play observability platform into a more deployable, automation platform for the enterprise, was down 9%, even with a 12% top line beat and guidance raised 14% for revenue and a 30% EPS raise. We also saw Mongo DB and Splunk decline, and these are all now at or below all their pandemic gains.

We were optimistic going into 2023 that this is the year of AI primetime for adoption and deployment. From a financial perspective, out of our 68 holdings, 90% are projected to have positive EPS this year, with as many as 5% expected to cross that threshold in the profitability. So looking at how we deploy and look at our index and allocation, we have 54% into infrastructure currently. And breaking that down, we've got big data analytics, semiconductor, network and security, cognitive computing, and cloud providers. So I want to briefly highlight SEMI, which represents the largest waiting here.

If you were here for our last call, you might remember me talking about SEMI being dead, long-live semi. And at that point in time, SEMI had been the worst performing index of the year, everyone was very nervous about the space, seeing declines and inventory build up. And what's happened since then is, A, we had the CHIPS Act passed, which was actually in the third quarter, but SEMI was our best performing sub sector, and we saw several companies, especially those tied to AI, which is all of our companies, cloud and automotive, outperforming the general, outside of THNQ, companies that have higher exposure to consumer markets, PC and Mobile, which is seeing a slowdown due to over-saturation, inflation, et cetera.

So we saw some companies with some great performance, and some of this is just a rebound, but they're still trading well off at any sort of high. So we had companies like Infineon up 38%, Amberella up 46%, ASML up 32%, and Nvidia up 20%. Piggybacking off that, we've seen over 200 million dollars in investments announced in US semiconductor manufacturing capabilities expected of the next decade, benefiting from the CHIPS Act passage. A couple other highlights include Amberella announcing a partnership with Continental for advanced driverless systems and smart dashboards. ASML announced plans to boost CapEx to produce their flagship extreme ultraviolet machines.

And this expected boost is expected to generate additional six to 10 billion dollars in revenue from their guidance by 2025. So, that's a pretty massive increase in their expected demand from their customers. Their customers being companies like Taiwan Semiconductor, Intel and Samsung and other big foundries. Despite this news, ASML is still trading 25% off previous highs. Now switching over to the applications, which includes sub-sectors, consulting services, business process, e-commerce, healthcare, factory automation, consumer, we saw consumer and e-commerce as leaders here with consumer up 13% and e-commerce up 6%. The flip side of this also, we had seen these two sub-sectors also, the other biggest laggers alongside semiconductor up until Q3. So we're seeing a sign of resurgence and reversal of oversold conditions, with strong performance from Shopify, Netflix, booking.com and jd.com. Now, I'd like to switch back over to what I previewed earlier, which was generative AI.

During the fourth quarter, we saw the introduction of the publicly available Chat GPT, which is from Open AI, which is partnered with and runs on index member, Microsoft's Azure AI platform. So I think everyone's thinking right now, what end markets, enterprises, human behavior changes could be affected? And how does that change the flow of value across society in organizations and governments? We expect Microsoft, for example, to integrate this tech across all products, as they have exclusive access to license the backend technology versus the public facing tech such as Chat GPT, which is what is available for us to play with right now. And so we expect this commercialization and subsequent downstream utilization to further benefit and accelerate the space and adoption of AI. Core enterprise products, page and image generation, communication, and even healthcare can be affected here. As a reminder, Microsoft acquired Nuance, which provides conversational AI and tools for healthcare such as transcribing.

And we are excited to see how that could help reduce administrative burden in the healthcare space. And overall, we're excited to see what can be built to improve positive human experiences here. So shifting back to that Azure AI platform, which is what this is running on, remember that, that itself utilizes many components that comprise the AI stack, which many people don't realize or think about. You see this on the surface, and then underneath is, think of an iceberg theory. So you've got other index members such as Pure Storage, Arista networks. And then many other involvement software development and developer operations that are in the index, that provide ongoing software support and tools to keep this uptime. To make sure it's running securely. So we expect increase of AI network and cybersecurity spend to come from increased utilization here. A recent McKinsey report that came out on the state of AI in this last Q4, highlighted that just about 50% of organizations that they surveyed have at least one business unit utilizing AI, with the highest percentage being robotic process automation.

And they're seeing very clear benefits on cost reduction and revenue increase. So there's a difference between adoption and exploring, experimenting, and then driving business. And right now, we're in between that exploring and experimenting stage. So we're really in the early innings here in terms of adoption and spend in the space. And we expect, for example, generative AI to be potentially a hundred billion plus industry over the next decade as it becomes more integrated into different products and parts of our lives. And I'd like to highlight that while we are seeing record layoffs, AI spend is expected to accelerate this year. So we even believe that, in a harsh environment, this trend will persist as the need for reliability, uptime, product modes, cost reduction will drive competitive economic demand. With that, I'd like to pass it back to Jeremie, and yeah.

Jeremie Capron:

Okay, thank you Zeno and Lisa, and now we are going to take your questions. So feel free to type them into the Q and A box at the bottom of your screen. And I want to remind everybody that at the end of last year, we published our 2023 trends report in which many of the more exciting growth stories around robotics, healthcare technology and AI are explained in detail. So please refer to that, report's available on our website at globalglobal.com.