By: Bill Studebaker, CIO & President

Health is wealth. Without our health we have nothing—and the same goes for the market. That said, if recent investor behavior is any indication, it appears that the lab results from the market’s latest check-up remain inconclusive. In September, investors couldn’t seem to decide what action to take, which created a rollercoaster of market volatility throughout the month.

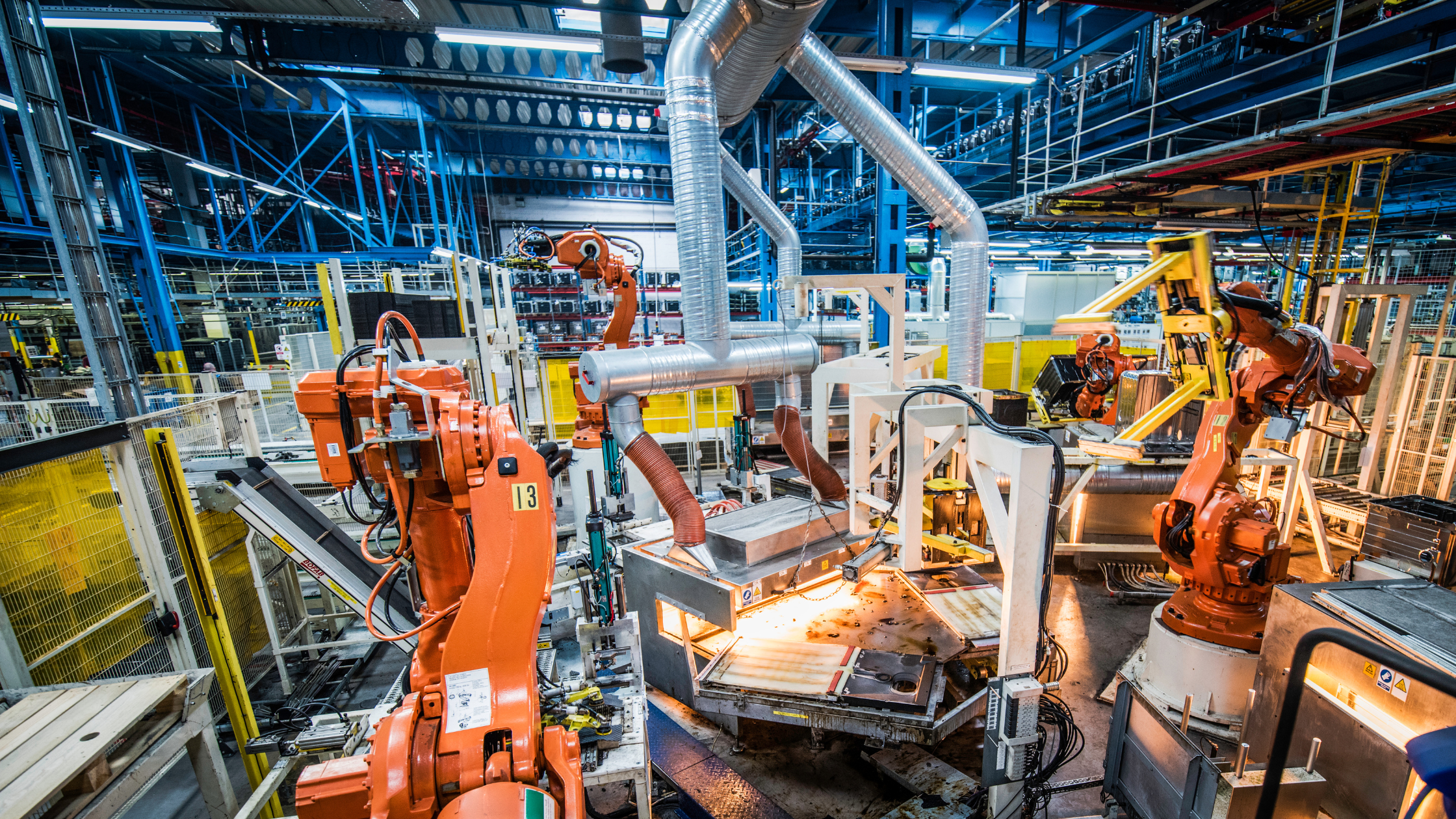

As we see it, however, the market is conclusive about one thing: the accelerating use of robotics and artificial intelligence. While the market has been digesting and reacting to the headlines—including the potential impeachment of Donald Trump, Elizabeth Warren’s recent rise in the Democratic primary polls, whipsaw headlines regarding the US-China trade war, rate cuts by the Fed, and poor reception to new issuances—from our perspective, the only change in the theme of robotics, automation, and AI is even greater growth ahead.

That said, that growth has not yet been realized (which is great news for long-term investors). In general, the markets remained in a holding pattern in September. Investor conviction was low, and it seemed like investors were scratching their heads, unsure of their best next steps. And there did appear to be some de-risking underway even before the drop in the first two days of October. Despite that skittish environment, the ROBO Global Robotics & Automation Index saw a gain of 4.94%, compared to a gain of 2.09% for ACWI.

With the news full of robotics and AI companies that are continuing to disrupt traditional industries, we’re not surprised to see ROBO outperforming, if only slightly. But, of course, one month and one quarter do not make a trend, and long-term wealth is created over time. The trend is real, and investors in the ROBO Index, we believe, will benefit in the years to come by staying invested in and committed to this theme that is facing undeniable growth.

In my opinion, secular growth stocks remain the most vulnerable sector of the market, and the recent momentum breakdown will not lead to a healthy or smooth rotation from growth to value. Why? Because that type of rotation would create too much portfolio destruction for active portfolio managers.

Another interesting market dynamic is that the relative strength of utilities has been fabulous this year. The Dow Jones Utility Average Index is up more than 24% so far this year—and that’s not including dividends! It begs the question: Have utilities become the new substitute for bonds? And if that’s true, perhaps the bubble isn’t in high-growth stocks after all, but in low-growth stocks that people think are ‘safe.’ As the market has shown us time and time again, when everyone goes to the side of the boat that feels ‘safe,’ it suddenly becomes the wrong side of the boat. Perhaps bond yields will keep inching lower and people will keep purchasing utility stocks because they feel safe. But safe from what, I wonder.

What lies ahead? It could be argued that with a relatively clear calendar for the central bank, as well as prevailing uncertainty on US-China relations and the outcome of Brexit, there isn’t an obvious risk event that could take markets higher. Yet, it could also be argued that there is less scope for panic on the initial growth and inflation misses. Or that, if there are downside surprises ahead, they may force a cutting cycle. No one knows the future, which has investors in one big waiting game. But what are we waiting for? The Fed? A resolution to the trade war? The outcome of Brexit (for which we’ve all been waiting for years!)? Amidst all these unknowns, all eyes are now on the upcoming earnings season, and ‘wait-and-see’ mode continues. When will the markets get tired of waiting?