By Bill Studebaker, CIO & President, ROBO Global

March was a tumultuous month for the market as COVID-19 and a dislocation in the oil market brought significant de-risking and a rise in volatility to levels not seen since the Financial Crisis. For the month, the ROBO index declined -12.5% and the HTEC index declined -7.8%, each performing slightly better than the ACWI’s -13.49%, while the THNQ index underperformed slightly, declining -13.9%. While the near-term outlook is uncertain, we expect the market will begin to price a recovery before year-end, in part due to likely rotations in leadership. Whatever the shape of the recovery—U, L, or V—we feel confident that this shift will include a rebound across the robotics and artificial intelligence landscape.

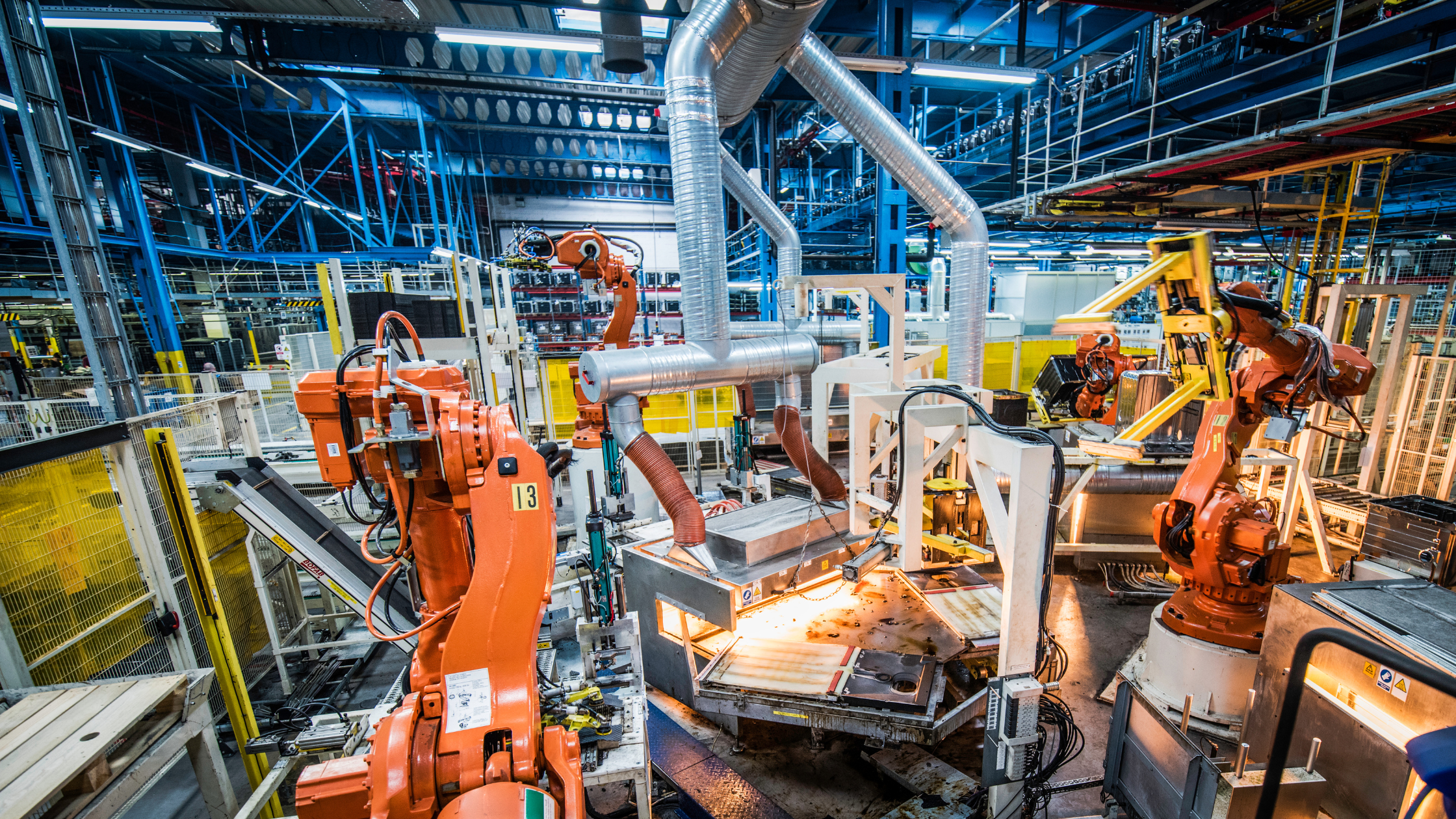

Healthcare technology is already playing a central role in combating COVID-19 (see How COVID-19 innovation today provides investment insight into tomorrow). As new healthcare innovations tackle this and myriad other illnesses, they are helping to drive down medical costs and expand access to care. This is just one example of how technology is changing the way we live and work, and the already rapid transition to a technology-driven world is only going to accelerate. As we look past the current crisis, foundational technologies like robotics are poised to improve productivity, lower costs, and drive growth in nearly every industry, making them vital to enabling a post-COVID economic recovery.

At the moment, ROBO Global is investing primarily in disruptors that we think will gain share coming out of the current crisis, especially in the areas of artificial intelligence, automation, enterprise software, and healthcare technologies. We aim to capitalize on three distinct waves of growth ahead, each driven by robotics and artificial intelligence:

Wave 1: Supporting stability and business continuity

Wave 2: Institutionalizing new ways of working

Wave 3: Learning from the crisis to prioritize tomorrow’s tech transformation

History tells us that bear markets don’t start with a recession—they end with a recession. And after big sell-offs, small-caps, mid-caps, and early cyclicals tend to do best. If history repeats itself, our index portfolios are positioned to benefit from the pending market cycle. The fact that each of our indices boasts a strong balance sheet with high levels of net cash is an added plus.

A quick glance at history reveals that crises and disasters consistently set the stage for change—almost always for the better. The global flu epidemic of 1918 led to the rollout of national health services in many European countries. The twinned crises of the Great Depression and World War II set the stage for the modern welfare state that includes the powerful combination of democracy, welfare, and capitalism. In these and many other instances, times of upheaval have enabled radical change.

Some believe the COVID-19 pandemic is our once-in-a-generation chance to remake society and build a better future. Once the battle against the coronavirus is finally over (a fight I am confident we will win), robotics, AI, and healthcare technologies will help create a better world for us all.