By Bill Studebaker, CIO & President, ROBO Global

When COVID-19 first struck in early 2020, investors found themselves swimming in completely uncharted waters. The health crisis was, of course, the top priority, but the writing was on the wall for a severe economic blow. Once the US economy was locked down, the country was thrown into the most sudden and severe recession in history—including a stock market crash. What followed, however, was the greatest monetary and fiscal stimulus ever enacted by the US government, setting the course for one of the sharpest recoveries on record. Stock markets around the world seem to agree, with most major averages trading extremely well. While the rally has raised some concern that equity markets are disconnected from the fundamentals and do not reflect the risks that still loom, historically, equity markets historically move well ahead of the economy and are often the best leading indicators of what’s to come.

The rise of robotics and AI is testament to this reality. With robotics and AI actively being placed into action on the front lines as we work to solve the many problems of the novel coronavirus, companies that are delivering these technologies are helping to create a new economy. This is illustrated in the June performance that resulted in a 2.17% advance for the ROBO portfolio and an 8.96%. gain for the THNQ portfolio, vs. a 2.31% for ACWI.

The V-shaped recovery in the equity markets foreshadows a V-shaped recovery in the economy and earnings. Cautious investors may be overlooking the potential for operating leverage to fuel an earnings rebound, but the data tells a different story. MasterCard (MA) updated its last few weeks of transaction volumes (through June 21), and the results illustrate solid YoY growth across the US. Similarly, data from payment processing provider Shift4 Payments shows that merchants in 43 states saw a rise of at least 10% in volume for the week beginning June 28, compared to the week beginning May 31. Aggressive cost cutting in a downturn is what creates critical operating leverage when the economy recovers. With that in mind, we believe stocks are poised to move higher—especially economically sensitive equities like the small- and mid-caps to which our portfolios are heavily exposed.

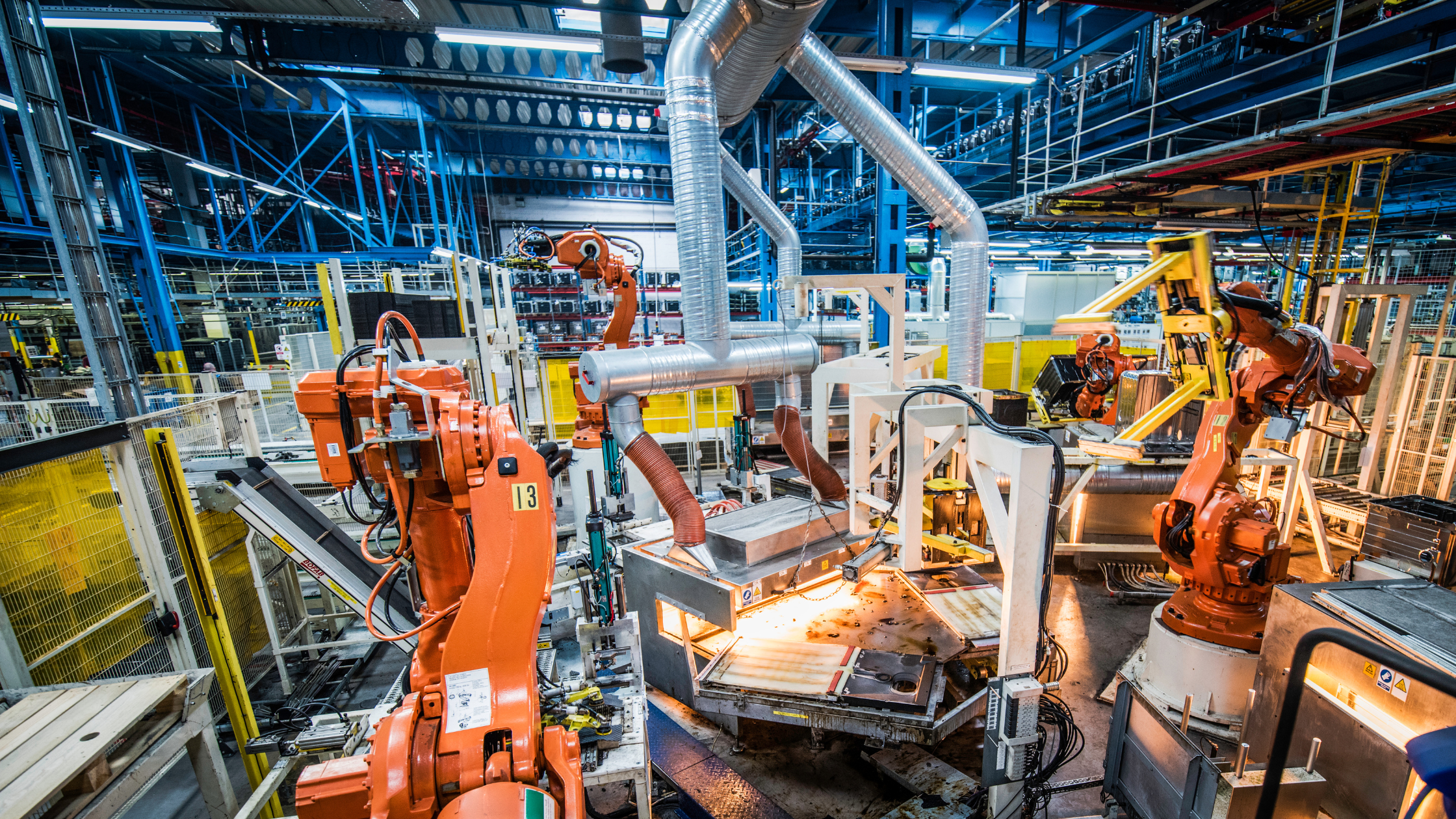

While investors appear bullish today, in a truly bullish environment, the cyclical rally from late May would have persisted with real and consistent buy-in. Instead, net exposure to cyclicals vs. defensives is still sitting near multi-year lows, while exposure to crowding is near 2019 highs. Cyclical names remain cheap and un-owned. With 35% exposure to actuation, industrial, logistics, and warehouse automation, ROBO is well positioned to deliver as the markets continue to heal and grow.

Valuations don’t look particularly cheap at the moment, but investors seem to be banking on the fact that margins will improve. Markets trade at peak multiples when earnings forecasts are at the trough of the cycle—like now. As we’ve already seen, bad news on the virus prompts fiscal and monetary responses that bode well for the markets. At the same time, good news on the virus, such as fewer COVID cases and advancements in the quest for a vaccine, is also good for markets. Investors who take these factors into account and act now are likely to reap rewards over the long term.