By Bill Studebaker, CIO & President, ROBO Global

What a month—and what an end to the month. The final week of February began with investors making small moves to reduce their risk in response to the global outbreak of the Coronavirus. This slight downturn quickly escalated into a violent five-day global sell-off as concerns about global supply chain disruption, demand shortages, and public health pummeled the markets. By that Friday, global markets recorded their worst week since the financial crisis of 2008, with the ACWI down -8.1% for the month. The ROBO Global indices closed slightly higher with the ROBO Index down -7.5% and the THNQ Index down -5.7%.

Clearly, no one saw it coming—neither the Coronavirus nor the magnitude of its impact. Fear of the unknown has quickly captivated investors’ minds and, as a result, dealt a significant blow to markets, effectively washing away the gains of the prior 12 months. And yet as painful as the sell-off has been, now is the time to take a deep breath and carefully reassess your portfolio. I promise the sun will shine again.

While I am certainly no expert in epidemiology, I am encouraged that new COVID-19 cases in China have fallen sharply since mid-February. As the scene continues to play out, it is beginning to look like this beast of a virus can be tamed. Now it’s up to the rest of the world as new cases continue to rise daily. Though mortality rates seem to be only half of what China experienced, it is vital for local governments to take appropriate steps in the coming weeks to mirror China’s success in slowing the virus following the dark days of mid-February.

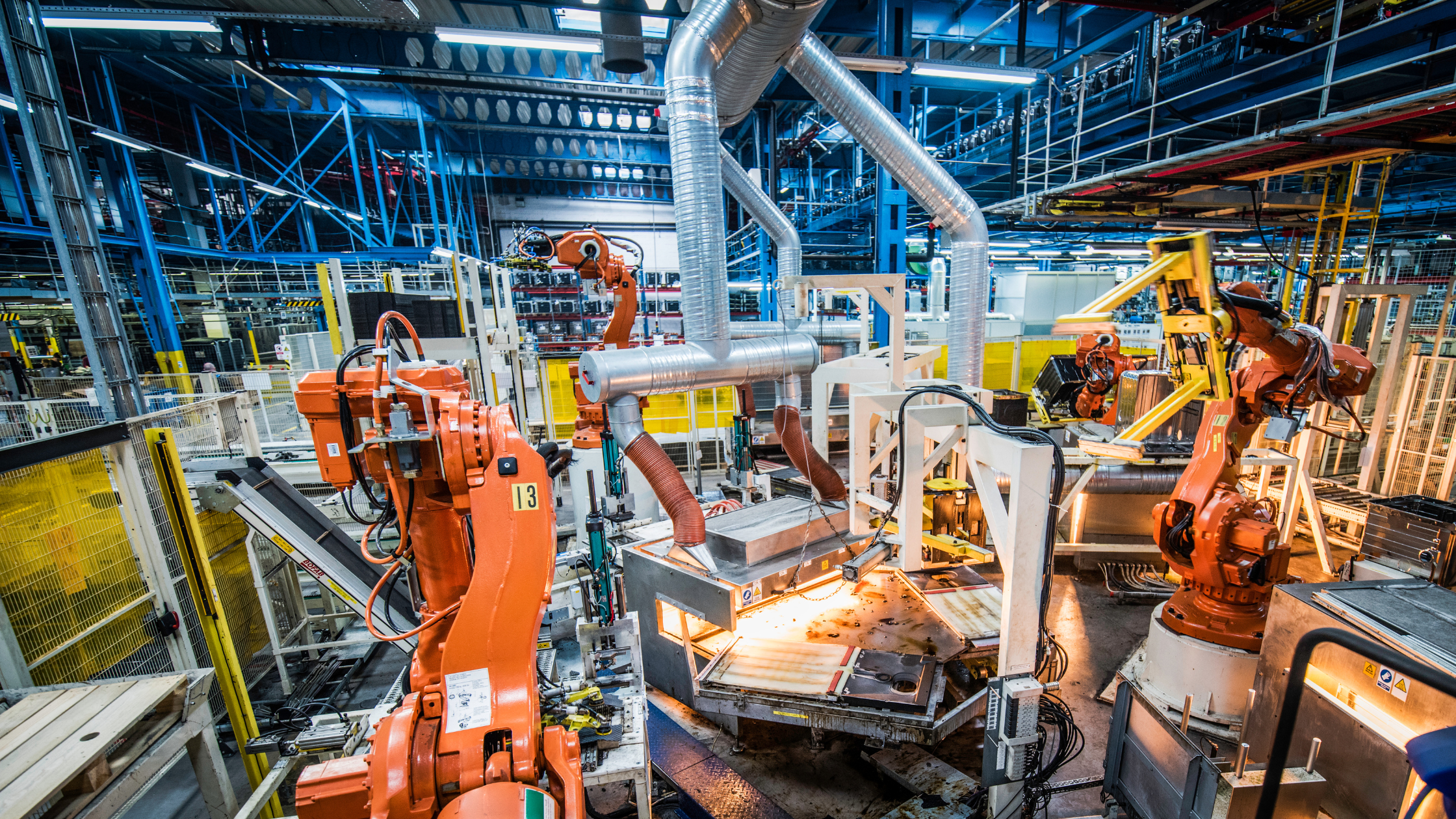

With all of this taken into consideration, we think the astonishing new low for the 10-year yield is now at a bottom, and we remain comfortable averaging into equities—especially in robotics and artificial intelligence. Exogenous shocks like the Coronavirus have only elevated the need for more automation. For example, China is rushing to deploy robots and automation technology to prevent the disease from spreading. The need to close factories and halt production of goods in response to the virus is a symptom that the Chinese government clearly understands can be cured with the aid of robotics and other automation. The added benefits, of course, include long-term reductions in labor costs and increased productivity. Robotics and automation are coming to the rescue to help Chinese factories that have or will soon re-open to revive production rates as quickly as possible.

Robots are also proving their value in other important areas. With travel and transportation bans in effect in China, and with stores, restaurants, and schools temporarily closed, robots are being deployed for a wide variety of crucial services, from disinfecting hospitals and streets to delivering food, drugs, and other supplies.

While the Coronavirus has stolen the headlines, we would be remiss if we didn’t highlight yet another takeout in the ROBO Global index. (Yes, even in this market environment, M&A happens!) In today’s quickly changing world of manufacturing, RAAI (robotics, automation, and AI) continues to enable the next generation of machine vision technology. One top player in the space is ISRA Vision—makers of machine vision solutions that are transforming businesses and helping to create the smart factories of the future. On February 10, 2020, industrial image processing company Atlas Copco offered ISRA Vision 50 euros/share—a premium of 43%—resulting in a 1.1B Euro partnership between the two companies. The deal illustrates the importance and trajectory of machine vision solutions as companies in myriad industries strive to create more effective, more efficient manufacturing processes and to enable truly smart factories. (For more details regarding ISRA Vision and the recent deal with Atlas Copco, see ISRA Vision AG: Delivering the next generation of machine vision.)

The Coronavirus created tidal waves of change in February, both in how we react to and manage global epidemics, and how the markets respond to such a threat. And yet, even in this dynamic environment, robotics and AI technology have demonstrated tremendous value. As we head into spring and anticipate the decline of the health crisis, we look forward to increased innovation across the space as companies, healthcare providers, and consumers alike continue to reimagine the future of RAAI.