By Bill Studebaker, CIO & President, ROBO Global

What a difference a year makes. Investors climbed yet another wall of worry in December, enabling the bull market to rise to new record highs. It was a welcome mid-cycle refresh that can help extend the expansion.

In December 2018 we articulated our extremely bullish view on robotics and artificial intelligence. Penetration rates were at their nascent beginnings, and all arrows were pointing to decades of growth. At the same time, valuations were at the lowest levels in the history of the ROBO index. Today, just one year later, our bullish outlook remains. Valuations now stand just above historical averages, and earnings are set to enter a new upcycle.

For the month of December, the ROBO index gained 2.8% and importantly, 30.3% in 2019, outperforming global equity indices, despite significant exposure to non-US equities and small- and mid-caps, while global equity markets were driven by the US and large-cap growth stocks in general, including the S&P 500 (+29.2%), Russell 2000 (+23.8%), MSCI Europe (+23.2%), MSCI Japan (+16.7%), MSCI China (+19.8%), and MSCI EM (+16%).

As we move into 2020, we expect earnings to accelerate in both the ROBO and AI strategies. While many strategists have forecast anemic growth for the year ahead, we see another outcome developing. Early in 2019, we argued that in order to see a meaningful rotation of flows from the US to the rest of the world, investors would likely have to see sustained outperformance—and experience some ‘FOMO’ (Fear of Missing Out)—in order to change direction. However, given the trajectory of Cyclicals vs. Defensives throughout 4Q, it may well be that the inflection point we’ve been waiting for has already arrived.

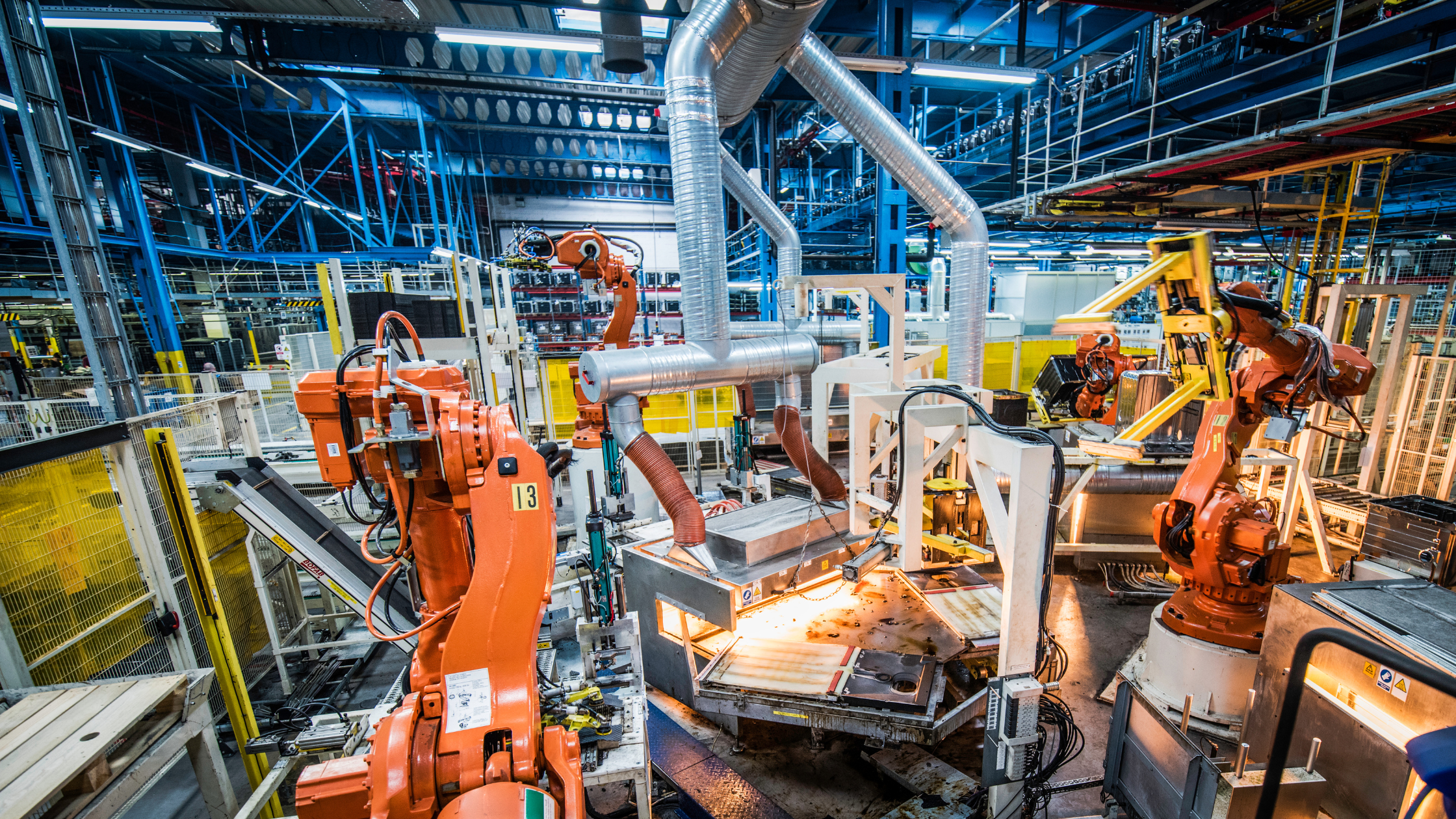

With 56% of the portfolio outside North America, the ROBO strategy should benefit from both international tailwinds and the index’s balanced diversification. The Asian flu has subsided, and we are seeing improvements in factory automation. However, Europe will be the one to watch in 2020 due to the relative valuation discount vs. the US at ~37%. With the Brexit overhang effectively cleared up, Eurozone equities could re-rate, and with 10% of ROBO in Germany alone, we remain optimistic. Happy New Year!