Geopolitics, tweets, Fed, trade wars, recessions, yield curves, and other noise drove summer-like volumes and choppiness across the global markets. The narrative is confusing, and the market isn’t sure how to react. If the Fed doesn’t ease as much because things aren’t that bad, is that good? If the Fed joins the rest of the central banks around the world in a race to zero and beyond because the economy is at risk, is that bad?

As a result of the confusion, August was the second-worst month for stocks this year and a sharp contrast to climbing bonds. The ROBO Global Robotics and Automation Index declined 5.27%, the ROBO Global Artificial Intelligence Index fell 4.01%, and the ROBO Global Healthcare Technology and Innovation Index declined 3.60%. In comparison, the ACWI Net Total Return index also contracted 2.37%.

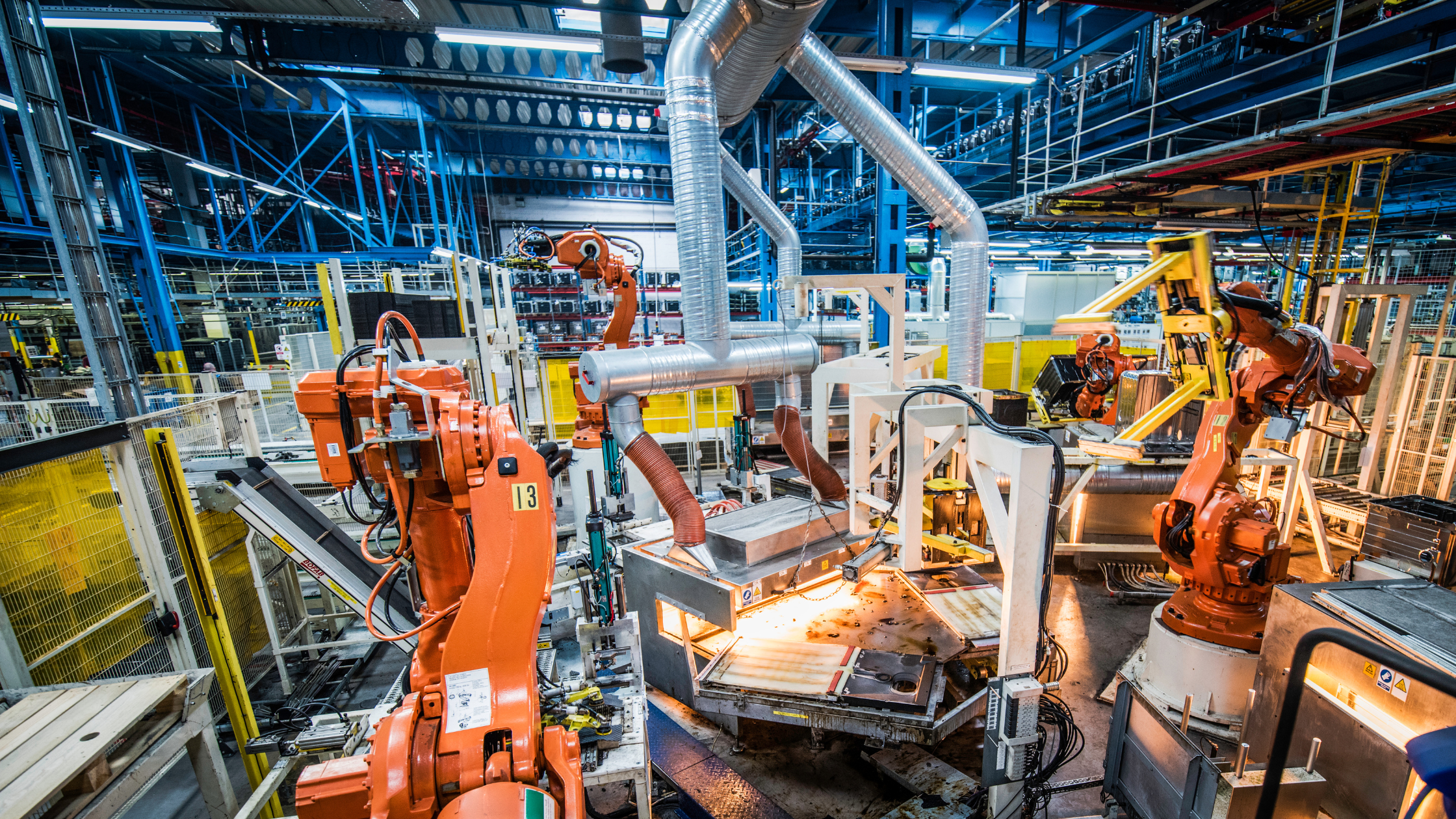

While manufacturing continues to weaken and the US-China trade dispute shows no sign of a resolution, US consumers continue to power the economy thanks to positive wage growth and a tight labor market. However, it’s prudent to be prepared for more bouts of volatility, and we don’t recommend trying to trade around short-term moves. Instead, focus on the long-term, remain disciplined, and use bouts of volatility as opportunities to hone in on the secular trends inherent in the theme of robotics and artificial intelligence. The trends are many:

- The ability to capture large amounts of data has exploded in the last three to five years. Now that sensor can be applied to everything, exponentially more data can be collected from every process or transaction—all in real-time. Any device with a chipset has the potential to be connected to a network and begin streaming large swaths of data 24/7.

- Complex algorithms now give us the capability to do predictive analytics from every conceivable angle. Machine learning (ML), a subset of artificial intelligence (AI), continues to upgrade workflows and simplify problem-solving for customers with every new interaction.

- Companies now have the tools they need to capture meaningful data surrounding processes and problems; develop specific solutions for real-world challenges within their organizations; and improve reliability, efficiency, and sustainability.

Myriad technology discoveries and advances are being combined to innovate and disrupt the way the entire world lives, works, and plays. In short, convergence is a concept that we should all get used to. All of this sounds like nothing but growth to us, and we believe investors who stay committed to this exposure will be well rewarded.

By Bill Studebaker, President & CIO, ROBO Global