At the 2018 Automatica Fair in Munich, the International Federation for Robotics (IFR) presented a preview of the annual sales statistics for the robotics sector at the CEO roundtable. The final statistics will be published by IFR in cooperation with VDMA in October.

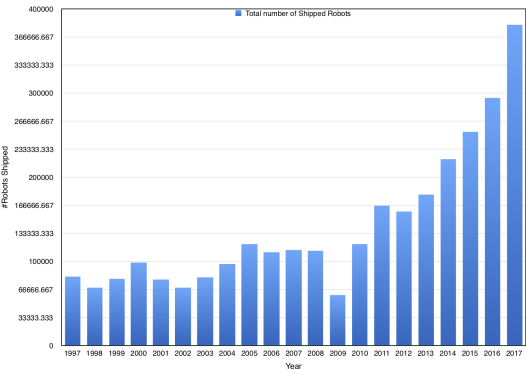

The preliminary numbers are interesting in many ways. First of all the sales of robots increased by 29% year-over-year during 2017. The total number of shipped robots went up to 381 thousand units, of which 2/3 are sold in Asia. Combined US, Europa, and other regions only represent 1/3 of the total market.

The by far biggest increase in sales was in China where the annual growth for 2017 was 58%. The growth is not only impressive but it is increasing every year.

The Chinese salaries have increased close to 350% over the last decade, which in part motivates the need for increased automation. Also today 30% of all cars are manufactured in China, but few of them are sold internationally. There is a need to increase the quality of cars manufactured in China, which again motivates an increased adoption of robot technology.

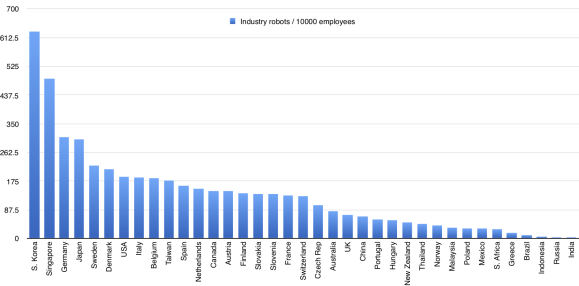

The adoption of robotics/market maturity is often measured by the number of robots deployed / 10,000 industry workers. South Korea has the highest penetration with 681 robots / 10,000 workers. The world average is 74 robots per 10,000 workers. China has 68 robots per 10,000 workers. The number has increased significantly over the last decade, but their adoption rate is still not even average and as such one would expect to a continued robust growth in adoption of robotics technology in China.

It is interesting to note that a country such as Vietnam has seen an increase in sales of 410% year-over-year which could be a direct consequence of the increased salaries in China. It is now cheaper to manufacture elsewhere in Asia and as such, there is an increased pressure on China to automate or the manufacturing will move to other countries with lower salaries.

Europe saw 20% year-over-year growth, while Americas saw 22% annual growth. Other regions saw a 7% annual growth. The early numbers for 2018 do not indicate any slow-down.

Overall the manufacturing industry is seeing robust growth and there are no immediate signs of any slowdown in the utilization of robotics technology. We are also seeing an increased utilization of sensor technology to make the processes more adaptive, and the use of collaborative robots opens entirely new markets, while the use of machine learning enables faster systems integration. The integration of new technologies is expected to increase the penetration into new markets.

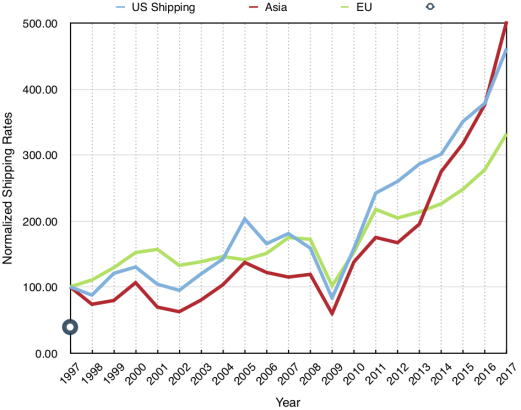

The sales figures across all regions continue to increase. The normalized sales curves since 1997 are shown below for the regions Asia, US and Europe. Every region has robust growth but it is clear that the biggest growth, in particular since 2009 are in Asia/China.

Europe saw 20% year-over-year growth, while Americas saw 22% annual growth. Other regions saw a 7% annual growth. The early numbers for 2018 do not indicate any slow-down.

Overall the manufacturing industry is seeing robust growth and there are no immediate signs of any slowdown in the utilization of robotics technology. We are also seeing an increased utilization of sensor technology to make the processes more adaptive, and the use of collaborative robots opens entirely new markets, while the use of machine learning enables faster systems integration. The integration of new technologies is expected to increase the penetration into new markets.

By Henrik Christensen, ROBO Global Advisor