By Erica Allaby, Content Manager

After over a decade of seemingly endless political turmoil in the United States, the concept of passing bipartisan bills has felt more like a pipe dream than a reality. But last month, one subject presented itself that received overwhelming support from both sides of the aisle. The U.S. Senate sweepingly passed an industrial innovation bill into legislation, intending to invest in the development of homegrown, key technologies.

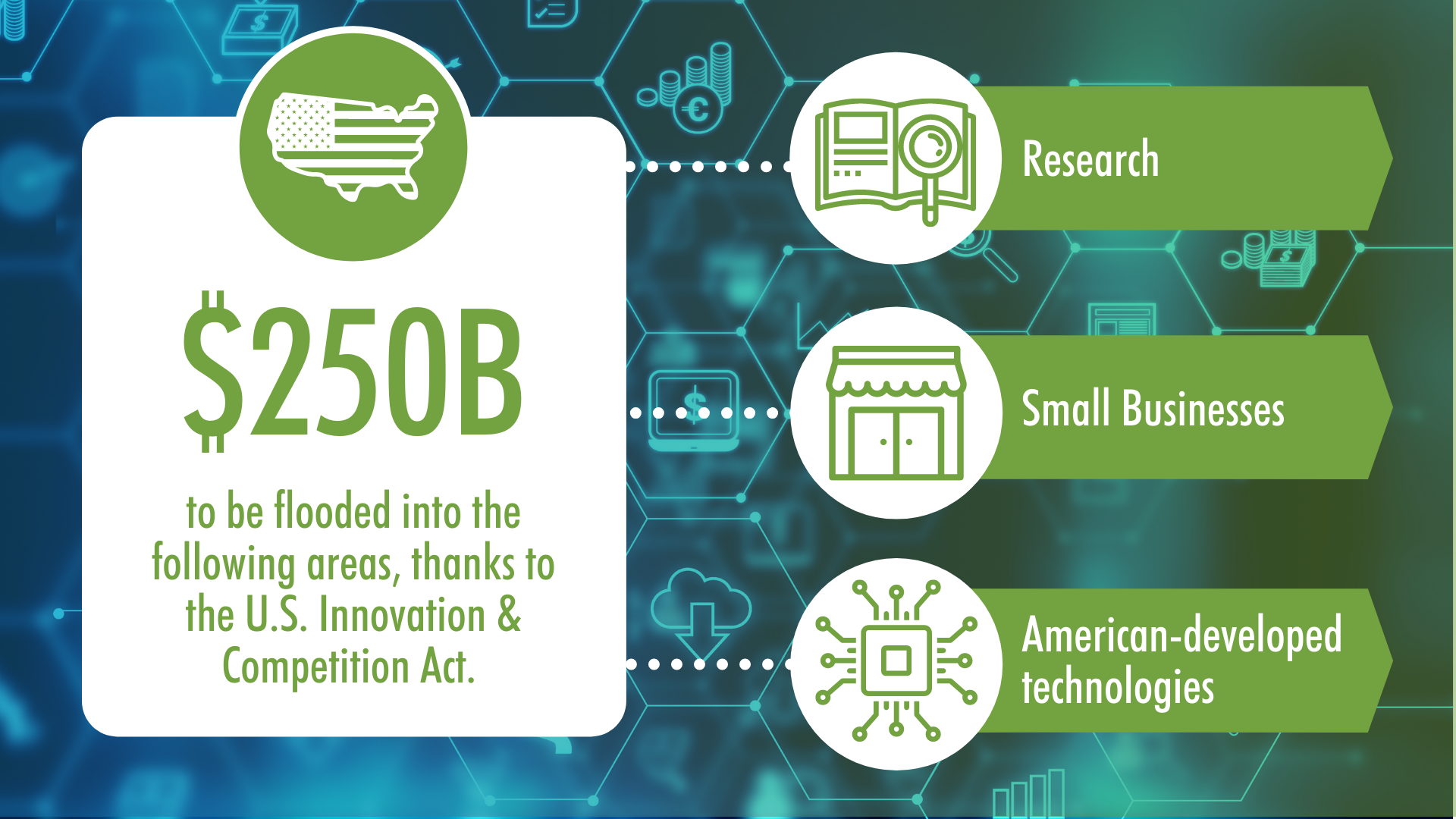

The U.S. Innovation and Competition Act is aimed at spurring innovation through increased industrial funding, ultimately upping the US’s global status for technological developments. The bill allows for a whopping $250 billion to be flooded into research, small businesses, and American-developed technologies. These aren’t your average industrials, with funding going to industries ranging from semiconductors, to robotics, to quantum computing, to AI.

The bill was passed in a landslide, highlighting the critical importance of the race for AI in the U.S. and abroad. In fact, PwC estimates that the deployment of AI could add up to $15.7 trillion in global GDP by 2030. We expect this funding to spur immense development in innovation and will contribute to the growing opportunity for those looking to invest across the spectrum of disruptive technology.

Understanding China’s Growing Dominance in AI

To truly understand how we got to this moment in the U.S., we must first look east. While the U.S. was once at the forefront of disruptive technology, we’re witnessing an undeniable shift in technological leadership as China continues to prioritize its position in high-tech manufacturing. As the stakes continue to grow in the race for AI dominance, China’s competitive edge is now pushing fellow global leaders to embark on a robotics rat race.

There are a few specific catalysts for China’s recent shift into its position as an AI superpower, the most prevalent of which is the country’s “Made in China 2025” program. This state-led policy was passed in 2015 with the forward-looking initiative of growing into high-tech dominance. The program aims to overhaul the infrastructure of China’s manufacturing industry by not only driving down costs but also—and perhaps most importantly—by improving the quality of everything it manufactures, from textiles to automobiles to electronic components.

RELATED: How the Race for AI Dominance Will Determine Tomorrow’s Superpowers

The ten-year plan, set to be achieved by 2025, is focused on innovation in nine sectors. According to the policy, the following tasks serve as government priorities:

-

-

improving manufacturing innovation

-

integrating technology and industry

-

strengthening the industrial base

-

fostering Chinese brands

-

enforcing green manufacturing

-

promoting breakthroughs in ten key sectors

-

advancing restructuring of the manufacturing sector

-

promoting service-oriented manufacturing and manufacturing-related service industries

-

internationalizing manufacturing.

-

Preliminary World Robotics data for China from the International Federation of Robotics suggests a sales increase of industrial robots by 19 percent in 2020, despite the massive industrial impacts of COVID-19.

“In China, where the coronavirus lockdown came into force first, the robotics industry started to recover already in 2020. In total, 167,000 industrial robots were shipped,” said Milton Guerry, President of the International Federation of Robotics.

What’s exciting for anyone with an eye on the robotics industry is the fact that this growth represents only a tiny fraction of the potential for robotics penetration across China’s manufacturing facilities—and for investors in the companies that are delivering, or are poised to deliver, on the promise of robotics and AI-driven manufacturing advancements.

Getting in on Innovation

The passing of the U.S. Innovation and Competition Act comes at a critical time as many believe that the race for automation and robotics isn’t one that America can lose. Similar to the “Made in China 2025” policy, the U.S. Innovation and Competition Act mirrors many of the same initiatives—only six years delayed. In a statement from the White House following the passing of the bill, President Joe Biden said that “it will empower us to discover, build, and enhance tomorrow’s most vital technologies—from artificial intelligence to computer chips, to the lithium batteries used in smart devices and electric vehicles—right here in the United States.”

For the U.S. to pick up the pace of innovation, the passing of this bill was critical. This political focus can be compared to the global attitude during the space race and the Cold War: get ahead or be left behind.

Developing state-of-the-art technologies that rival those of China will allow for the U.S. to fully get its finger back on the pulse. This is especially true when it comes to developing powerful 5G networks, establishing strong cybersecurity to prevent future digital attacks, and building the core technologies required by the likes of self-driving cars, smartphones, the Internet of Things, and more. These technologies will play a pivotal role in our future and are also captured across the ROBO and THNQ indices.

Beyond immediate funding, this bill should also help to increase overall productivity for workers and encourage more Americans to step into the world of STEM. By focusing on increasing the skills and ability to adapt to an AI-assisted workplace, we can also strengthen today’s existing and emerging workforce so they can thrive in the future.

RELATED: Preparing Our Workforce for the Future of Work

The Upside for Investors

These investments in innovation have nothing but upsides for investors looking to capture the growth of disruptive tech. Like the ROBO Global portfolios, this bill isn’t about picking the winners and losers of the industry, but rather broadly investing in technologies that have the potential to change our world. This initiative should accelerate global AI competition beyond the U.S. and China.

With funding flowing first into research, both private and public companies will be able to harness these developments. This spur of innovation should further increase the role robotics and AI technologies play in those companies, expanding the investment universe.

From robotics to AI to healthcare technology, companies and investors choosing to embark on this journey will be rewarded. For those looking for a way to capture the growth of these rapidly evolving industries, ROBO (robotics and automation), HTEC (healthcare technology), and THNQ (AI) are investment portfolios focused on providing investors with diversified, global exposure to those companies at the forefront of innovation.

If one thing is for sure, the U.S. Innovation and Competition Act proves that AI and robotics will continue to demand attention on the global stage from the political to the private focus far into the future.