January 2022 has been a tough start to the year providing, in our opinion, investors another real opportunity to make money. The market has been hit by rising inflation and discount rate expectations and, as a result, a rotation from growth to value/cyclicals. As a current or potential ROBO Index investor, we want to inform you about how ROBO is positioned, as well as stress the opportunity around automation and robotics going into 2022 and beyond.

The current drop in share price may be unsettling for investors. That is understandable. The sudden tech rout has sent stock valuations tumbling to their lowest level since the first few months of the pandemic. Adding salt to the wound, this shift arrived just as positive key earnings for some of the key ROBO constituents began. But if we take a deep breath and step back, we can see that much of the froth has already subsided for many market segments. Headline multiples have contracted to more reasonable levels, and expectations have been meaningfully (and appropriately) curtailed.

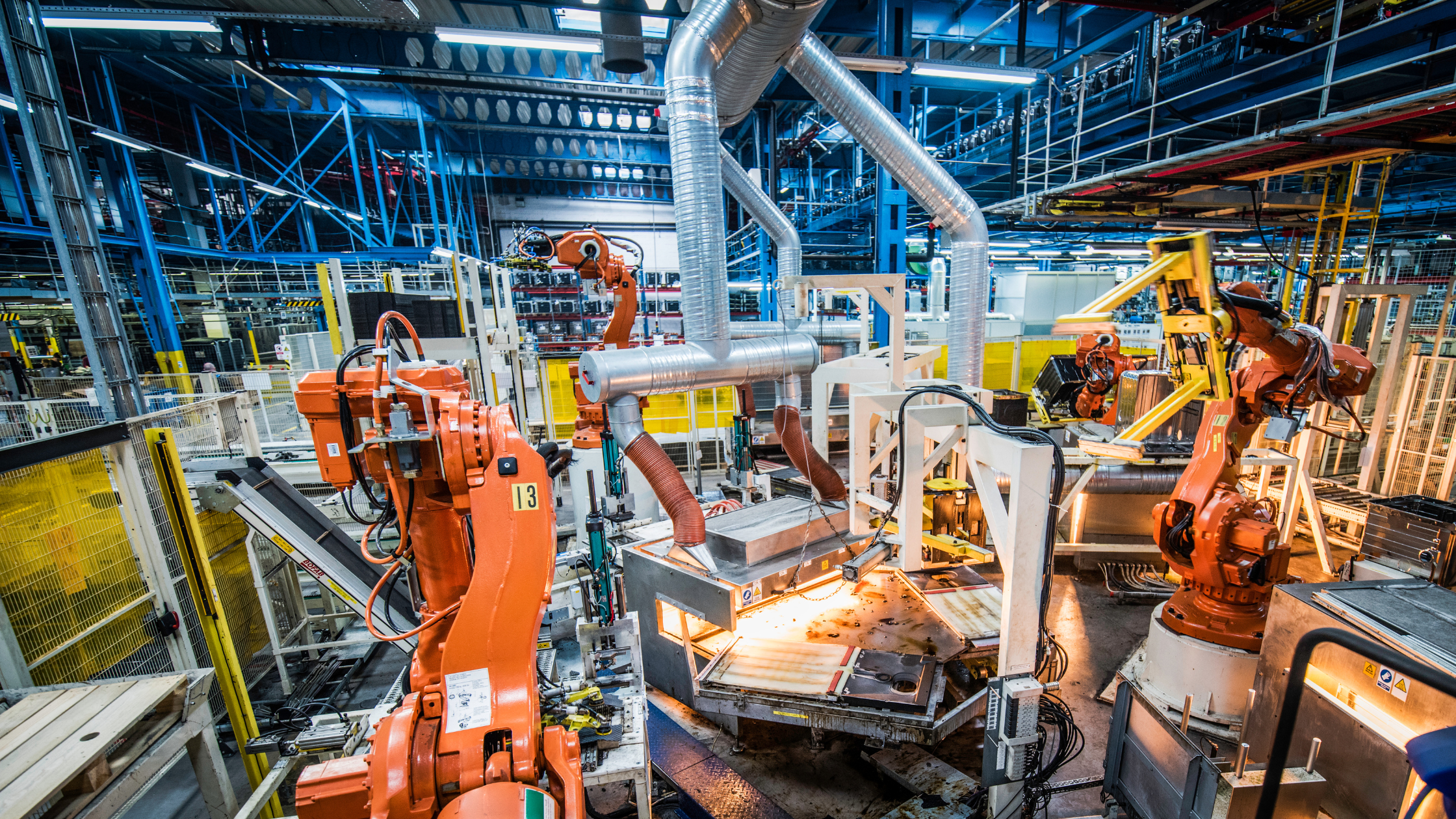

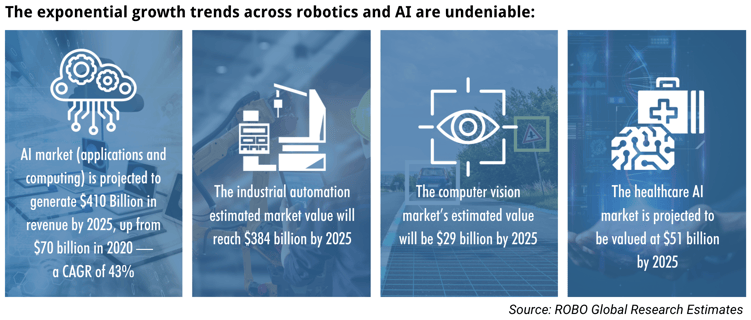

Importantly, the question remains: Will robotics, automation, and AI continue to grow in 1, 3, and 5 years? We believe the answer is unequivocally YES, which is why investors need to stay invested in this theme. Downturns are never pretty, but we continue to believe that robotics, automation, AI, and healthcare technologies represent one of the most powerful investment opportunities of our generation. The pandemic proved that point, creating an urgent call to automate which accelerated the adoption of existing technologies and increased demand for more research and development.

Given the healthy reset in valuations, we would like to illustrate why we believe this presents a great buying opportunity for our investors:

- ROBO is a battle-tested portfolio with an 8+ year history of successfully navigating markets by selecting best-of-breed companies that exhibit dominant market share and technological leadership, as well as maintaining global diversification with no concentrated bets—the top 10 positions represent less than a 20% weight, and we rebalance quarterly to smooth out volatility and maintain that vital diversification.

- ROBO is currently trading on 27x forward EARNINGS, just 10% above its long-term 24.6x historical average, with 10 names with EV/Sales <1x, making it a much more balanced portfolio from a valuation standpoint. Furthermore, about 10% of the portfolio trades at a 52-week low while 40% are 10% from their 52-week low.

- Roughly 40% of the ROBO portfolio captures exposure to cyclical/value areas in Manufacturing, Industrial, & Logistic Automation, which we believe are in the early days of a multi-year recovery.

- Almost 60% of our companies in ROBO are net cash positive vs 17% of the S&P 500. In addition, 94% of index members in ROBO are profitable based on forward earnings, and that is a testament to the companies that go through our rigorous selection with our proprietary screening.

- All data represents as of 1/27/2022 from ROBO Global Research

- A company that is net cash positive = a company that holds no debt, or debt on the balance sheet is less than cash.