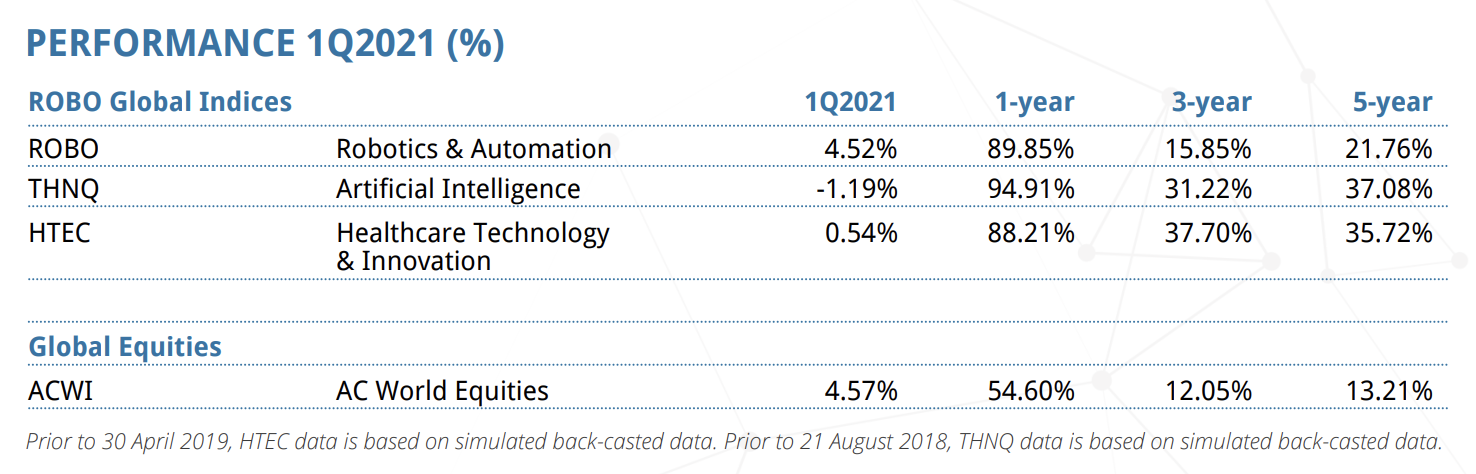

With tech stocks trailing and cyclical and value stocks catching up as the economic recovery continues to broaden, the ROBO Global innovation indices exhibited the benefits of diversification. The Robotics & Automation Index (ROBO) returned 4.5% in the first quarter of 2021, the Healthcare Technology & Innovation Index (HTEC) rose 0.5%, and the Artificial Intelligence Index (THNQ) decreased 1.2%.

In this report, we discuss why robotics, AI, and healthcare technologies continue to look attractive and note the current key trends and big movers across our index portfolios.

Webinar Transcript:

Erin Shepherd Martinez:

Welcome to the ROBO Global April investor call and welcome to the second quarter of the year. Today on the call, we're going to have Bill Studebaker and Lisa Chai, walking through all the key highlights from the last three months and looking at some of the trends we expect to see throughout the rest of the year. As always, if you'd like to ask any questions, you can put that in the question box in the Zoom window, and you can also email us at info@roboglobal.com. And we'll make sure to follow up with you. So, I will hand it over to Bill.

Bill Studebaker:

Good morning. Thank you, Erin. We look forward to giving you a quick update on our third-quarter results. We want to spend just a few minutes updating you about who we are. We're going to provide a review of the first quarter and talk about all three of our innovation indices starting with the ROBO index, moving on to our healthcare index HTEC, and then onto our AI index THNQ. Then we’ll be happy to answer any questions after that.

Many of you know us as the creators of the first robotics and automation index, which we did nearly eight years ago, but we now have added two proprietary indices THNQ and HTEC. THNQ is our newest index, with a focus on AI. That index went live in 2018 and was launched on the NYSE a little less than a year ago. We also have our healthcare innovation index as well.

What really makes us unique is that we are solely focused on providing research-driven strategies where we identify the best-in-class companies across robotics, AI, and healthcare technologies. We are actively following an excess of 350 names across 42 of our subsectors in 27 different countries. What's also quite unique about ROBO Global strategies is our very low overlap with traditional indices. You'll find the S&P as an example, less than 3% of our ROBO Global exposures are captured there. We then interweave a strong ESG filter into our index, which we think is very interesting to do that a lot of other folks have not been as acute in doing.

These are our three proprietary indices. ROBO captures 11 proprietary subsectors, THNQ also 11 and HTEC has nine proprietary subsectors that we classify. We're really trying to capture what is soon to be future growth and are not in many indices but should be. As you can see with our performance our industries have materially outperformed over one, three and five-year periods. However, performance is never a straight line. So, we did see some modest underperformance in the first quarter after a fairly large outperformance in 2019 and 20. During much of 2020, we saw the key beneficiaries of the turbocharging of digitization lead the gains. But again, we did see some modest profit-taking as would be expected in the first quarter.

The broadening of the economy and the market lifted cyclical and value stocks, which helped Robo given our strong technical bent exposure to small and mid-size companies. HTEC is also very favorably exposed towards smaller and mid-caps, so it benefited there as well.

Interestingly, the ROBO Global innovation indices have all continued to benefit from diversification, but also from the tremendous tailwind that we're seeing. And again, given our small and mid-cap exposure, this has been a noticeable benefit. Today we've seen three acquisitions, FLIR was acquired by Teledyne on January 2nd. Talend was sold to Thoma Bravo, a private equity firm for roughly a 30% premium. And just a few days ago, many of you recognize that Nuance was acquired by Microsoft. Interestingly, both FLIR and Nuance are incredibly old and established companies. FLIR was started over 43 years ago, and Nuance 30 years ago, both have gone through quite a few restructurings, but are great technologies that are now being augmented with other mature growth platforms. Teledyne was focused on aerospace and FLIR was focused on government security, but both offer best-in-class sensing. Nuance was an easy fit or easy way for Microsoft really to accelerate their push into healthcare and to make a big bet on AI healthcare. We think we’re going to continue to see significantly more M&A (Mergers & Acquisitions) in healthcare given the low single-digit levels of penetration and digitization. Talend just rounding out was a small French cap company that was acquired again by Thoma Bravo, really to help them accelerate their shift in spending in the cloud as a key data management vendor.

Just moving on to discuss ROBO, as you can see, ROBO continues to outperform or has continued to outperform global indices and we're quite comforted by our view that 2021 is going to be a boom year. As the global economy reopens, this is going to help international, sick volt, and again, small and mid-cap companies where ROBO has been exclusively focused.

Moving into some of the sector highlights: 3D printing was the best performer in the first quarter, as you can see was up 43%, but was actually up roughly 166% the over the last year, reflecting the transition that we're seeing from a prototyping technology into manufacturing technology. The momentum is gaining steam and healthcare along with industrial manufacturing are the principal drivers of the growth of 3D printing, which was expected years ago but is taking off now. We anticipate it to really prosper as it now supplies new sources of productivity and efficiency and growth. We think that we are in the early days of harnessing the innovation in 3D printing as an example in healthcare. Organ and bone printing for pre-surgical procedures shows a lot of promise and we're just scratching the surface here, which is going to it is resulting in lower costs and significantly better patient care.

Logistics and warehouse automation performed quite well in the quarter. That subsector was up about 6%, however, over the last 12 months more than 100%, which is reflecting the rapid shift to e-commerce and the need for capital investment to service, what is becoming really, as we all know the preferred way to shop.

If you look at our proprietary classification by subsector you can see applications are roughly 58% of exposure while technology is 42%. Just a couple of anecdotes here. We are seeing a little bit of evolution and movement in the sectors and how they are growing manufacturing, industrial automation.

AI computing has been growing and healthcare has continued to emerge as a growing area and still is logistics, automation. Right next to that you can see the performance of the various subsectors over the first quarter and over the last year. Shifting to a couple of the performers in the quarter, iRobot was the best performer in the ROBO robotics & automation index, up 52%.

Many of you know iRobot as being a leader in autonomous robotic cleaners. They deliver earnings well above expectations and guidance with revenue up 20% year over year and internationally actually up 27. Their product mix continues to shift towards premium vacuum cleaners while their direct sales to consumers have more than doubled.

iRobot is starting to really benefit from their growing install base of connected robots. Now more than 10 million units, which is going to enable the company to engage more intimately with consumers and selling them more value-added services. These are basically mini Teslas running around your house that are collecting vast amounts of data. Materialize conversely, was the worst performer in the index, down 34%, but over the last 12 months is still up 86%. This is a Belgium-based manufacturing company with leading positions in 3D printing software and medical applications. It sold off for the quarter for the first time in its 30-year history after reporting revenues to decline year over year.

This was entirely tied to the pandemic headwinds. Importantly, we believe that Materialize going forward is positioned to benefit from the continued adoption of 3D printing and disrupting the healthcare industry with leading applications for medical training personalized implants, and pre-surgical applications.

Erin Shepherd Martinez:

Before we jumped into HTEC, we just got a question about using 3D concrete printing to raise the walls on a Ford platform in a housing development. And the question was specifically if we see any potential in this new innovative application of industrial 3D printing.

Bill Studebaker:

Well, I think that again, we are in the early days of moving from prototyping technology to manufacturing technology, and the opportunities are virtually endless. Years ago, if you looked at the big 3D printing companies, the public companies back in 2012 and 2013, you had a combined market cap of, probably in the neighborhood of $13-15 billion with revenues that were in the billion-dollar range. So, the applications are emerging, and we think offer a lot of promise in several different areas.

Shifting to HTEC, as you can see the portfolio performed significantly in 2020 rallying close to 70%. We did see some modest profit-taking in the quarter, which was expected, but we are really excited about healthcare and the future of healthcare, which historically has been sick care, but we are moving to a world of prediction prevention, individualizing medicine, which is going to result in lower patient costs and in better patient care. We think the outlook is very encouraging as we go forward.

Shifting gears quickly just to some of the outperformers. Medical Instruments was not the top performer Genomics was, but we did want to highlight this because it is the biggest subsector within HTEC and it was one of the better performers, given the size of the exposure. We're beginning to see a big tailwind in demand as given what occurred with the pandemic. A lot of procedures were postponed and with the economy now opening people are going back to their doctors to get elective and non-emergency procedures done, which is providing a meaningful tailwind for this subsector.

Telehealth was one of the worst performers in the quarter. Fortunately, it is only 3% of our exposure. Most of that was related to the pullback and Teladoc. Obviously, Teladoc was a massive outperformer in 2020 as the pandemic hit, celebrated virtual care demand. We did see some profit-taking and there is some concern over Amazon's cares entry. However, we think their acquisition of Livongo is going to help disengage them from the competition and they have already shown their expectation continued growing over 30% for the next several years. As a leader in enabling physicians to connect to patients in their homes. We think, again, the opportunity is quite meaningful. With that, I'd like to pass it over to Lisa as she goes into more detail on the HTEC subsectors and then will discuss our AI index THNQ.

Lisa Chai:

Okay, thank you, Bill. So as we go deeper into the HTEC portfolio construction, it's important to note that we have nine subsectors, and this is a very diversified exposure of where we are seeing technology and innovation impacting the healthcare industry today. We can't stress enough that we have a very strong emphasis on companies that center around treatments and diagnostic tools around early prevention and early detection. And I think that's really what makes us unique. We think that is ultimately the Holy grail of finding a cure for rare diseases and cancers. Companies in the genomic sector, data analytics, telehealth, medical instruments, and diagnostics are just some of the examples of subsectors where we're seeing next-generation technologies are being adopted in the clinical settings for improved patient experience and minimally invasive procedures.

For example, companies like Exact Sciences are using genomic analysis for cancer detection wearable digital health devices from Dexcom monitors and delivers treatments for diabetes. It's hard to deny the power of these solutions. These devices are really a way of the future as physicians are looking for many ways to improve their diagnosis and improve patient outcomes. Our top performer in the first quarter, Fulgent Genetics, shares were up 86% for the March quarter. It's a $2.6 billion market cap company. As you can see, Fulgent is not a household name, they continue to expand its next-generation sequencing platform after seeing record revenue growth last year mostly driven by the COVID-19 testing solution.

Its FDA-approved diagnostic tests use molecular technology to detect antibodies and viruses such as COVID and flu viruses. Shares are up more than 600% in the past 12 months as they have increased their revenues by 10 times in the past year or so. We think that testing capabilities, especially around the rapid testing for various infections and diseases are here to stay. And we should see more innovation coming from Fulgent going forward.

On the downside, HTEC experienced mixed performance in the precision medicine sector since they were one of our top performance last year. And during the quarter, there was a sharp pullback in Editas medicine with shares down 40%. There was really no negative news throwing the company during the quarter, Editas is a clinical-stage gene-editing company focused on developing transformative therapy to treat a range of serious diseases. Editas has been a top performer for us last year and we think the shares are just taking a breather as long-term growth prospects are strong.

In terms of rebalanced during the quarter, we have two additions to the index: Avanos Medical and Arrowhead Pharmaceuticals. These two companies were previously in our index in the past year or so, but due to scoring changes, they fell out middle of last year, and Avanos Medical, for example, is now medical instrument subsector. Avanos is a pure-play medical device company with a market cap of $2 billion to address pain management and chronic care while helping patients move from surgery to recovery. Pain management, which is about half of their revenues uses a thermal radio-frequency system using water-cooled technology to deactivate the pain that's causing the sensory nerves. The company had deep supply chain issues, most of 2019, and growth decelerated significantly. We had to downgrade some of their scores at the time and it appeared that leadership was a little bit uncertain given some other operational hurdles.

Most recently, we became bullish in Avanos as a fixer of supply chain issues and the company is on track to experience multiple growth factors to drive margin expansion. Especially now that elective procedures are on the rise, we believe that Avanos should benefit from this trend. Meanwhile, Arrowhead Pharma is in the precision medicine subsector. Arrowhead is a gene therapy company using RNA AI technology to find a cure for liver and cardiovascular diseases. They have strong partnerships with some large leading pharmas with multiple promising late-stage phased trials that are currently underway. Their market opportunity is huge. For example, hepatitis B virus infection affects 257 million people worldwide and causes 780,000 deaths per year according to World Health Organization. FDA-approved vaccines are available in the US but today there's still no treatment available for acute hepatitis B once contracted. So, it should be really a promising year for Arrowhead in 2021 once the trials are FDA approved.

The next strategy we're going to talk about is THNQ, our artificial intelligence index. It is our newest fund focused on pure play AI companies measured by revenue and investments around AI capabilities. It declined 1.2% for the quarter, underperforming the broader market indices after an outstanding performance in 2020. High growth technology companies, broadly speaking stalled in the first quarter as investors rotated into cyclical and value-oriented stocks. We think the vaccine rollout and optimism around the recovery in the economy and rising interest rates put pressure on technology-oriented shares as many took profit on these winners. We believe that despite volatility in the group, current spending around AI fueled by digital transformation initiatives remains strong.

We analyze dozens of companies on their outlook and increases in their R&D investments that show visibility remains strong and demand for AI capabilities and cloud activity will continue at a rapid rate. With a sharp pullback and valuation as well, we expect that M&A activity will also pick up meaningfully for the rest of the year.

In terms of subsectors, big data analytics, network security were in negative territory, while semiconductor, healthcare, and cloud providers had a strong performance. To go a little deeper into semiconductors during the quarter, it was THNQ's best performing subsector driven by the global supply shortage and strong demand. It is also one of the THNQ’s largest subsectors. These companies are enablers of AI systems and compute power on our smart devices that we use on a daily basis. We think without semis, we would not have access to the cloud services or see advancements in medical diagnosis or even have autonomous cars in the feature. Semis, as many of you know, is going through the most unusual time with supply constraints at the moment. We have been getting a lot of questions regarding the semi industry in recent weeks and the impact on THNQ and for ROBO. So, I'm going to spend some time talking about the industry trends.

What the semi industry is going through right now is unprecedented. We have spent a lot of time speaking to about a dozen players in the industry in the past few weeks and we're hearing that the supply shortage that they're witnessing today is the possibly worst in the history of semis. One OEM we spoke to it even mentioned that it was worse in 30 years of their operating history. And it is a very broad-based impact rather than just smartphone-driven or 5G driven. It started really with the semi industry that experienced unusual years with the US-China trade war in 2019 followed by the COVID pandemic last year, which suppressed supply as factories around the world were shut down for many months. So, we were already facing supply shortages for two years, going to 2021.

So today, while factories are generally back up in Asia, we are still having transportation issues with chips. There was also a perfect storm of unusually cold weather in Texas where many of the key fabs are located and there was even a fire at a key semiconductor company. So starting around December of last year and into 2021, demand has been really surging, causing continued supply constraint challenges. Where we're obviously seeing the biggest constraint is in the auto industry. And few automakers were now shutting down their plants and new smartphones and PCs may see continued tightness. So new introductions of some of these devices may be delayed here. So semi companies are aggressively expanding capacity at the moment to meet the demand, but overall play conditions will last through the rest of the year. Some of the lead times that we're hearing are extending to 52 weeks or more from the previous two to three months lead times. So, we believe that the inventory correction is not over, layering on top of all these events overall demand has also surged from key enablers building chip solutions to meet the demands of AI, data center, electric vehicles, IOT, industrial, and 5G networks. So, all these trends it's really hard to be fully negative because they're really a lot of bright spots as well.

We think that we are very well positioned as our index members, such as Microchip, Teradyne, ADI, ASML, and Nvidia to name a few have strong pricing leverage at the moment. There is a lot of also discussions and prioritizing what is important. And we're hearing from industry checks that AI electric vehicles and data center chips are seen as a priority.

So, these chips have higher selling prices and the capital equipment to produce these chips have already been ordered. Overall, we believe that the industry is the key enabler of the digital economy, and near- and longer-term semiconductor demand will continue to rise from the reopening of the economy and the supply environment might be tighter with coming quarters, but should even out in 2022 and beyond. So while we don't see the supply improving until 2022, demand will continue to surge and visibility surrounding what is being built today makes us really excited about our THNQ and ROBO members, who will be the beneficiaries of these demand trends.

So meanwhile, the big data analytics subsector declined 11% during the quarter and there were detractors for various companies. Big data analytics was one of our top performers in 2020, but it gave back some of the gains. THNQ index members, such as Alteryx, Appen, and Splunk, suffered losses driven by longer sales cycles and push-outs of large AI projects, as enterprises are still prioritizing the needs of the remote workers. As we see the massive cloud deployments that are continuing through this year with continued vaccine roll-outs throughout the world and some employees are returning to the office, we believe that AI solution providers will recover quickly as we need AI capabilities to extract intelligent insights in this data-driven world. Bill covered Talend earlier and I will just highlight that the stocks are 66% during the quarter and data analytic company Talend rose to 150% of the past 12 months or so with double-digit sales growth expectations. Another winner during the quarter as ASML, the company holds a dominant position in providing EOV semiconductor capital equipment for all the leading players in the semiconductor industry.

The most recent quarter demonstrated that EUV demand continues to be very robust with a healthy backlog. About 30 billion EUV orders reflect customers' desire to invest in disruptive technologies such as AI and edge computing. Tight supply capacity as I discussed earlier, has significantly increased ASMLs growth prospects and visibility over the next several years.

Meanwhile, Appen, a data analytics subsector company was a negative performance during the quarter. Appen is a leader in labeling data for training AI models with an AI-assisted platform. Appen was one of the companies that were negatively affected by AI projects getting pushed out, but we believe that enterprises are now focusing more on data quality and data integrity, and the long-term prospects for companies like Appen will recover as the economy continues to open as AI is playing a critical role in the data journey for all the enterprises that are undergoing digital transformation.

In terms of rebalanced changes, we had some meaningful additions during the quarter. We added five new companies to the index. MediaTek is a Taiwanese producer of integrated circuits powering more than 2 billion devices a year. Its core expertise and what it is known for is multimedia and its vision is to be a dominant player in enabling intelligent smart devices and appliances for the new digital world. Its AI platform solution differentiates itself by developing products with next-generation AI processing at the device level.

NICE is an Israeli-based cloud provider with core competencies in enterprise contact centers and also security solutions for the government. In most recent years, they've also introduced financial crime and compliance solutions using AI capabilities. The company has a long operating history with an industry-leading margin profile.

JFrog and C3.a, our recent IPO is in the past six to seven months in enterprise AI segments. They are market leaders in their respective spaces. We're very excited to have the opportunity to add these pure-play AI-driven software companies to the index.

Global Unichip is a company that was previously in the index, but the recent scoring changes brought the company back. Global Unichip is an early pioneer in providing Asics and designing wafer products. Its growth prospects are really driven by AI, supercomputers and data centers, and also blockchain over the coming years.

And now I'm going to turn this back to Bill

Bill Studebaker:

Lisa, thank you for the update. Well, with that being said, we hope that was a sufficient sort of overview. We're happy to answer any questions you have. The first question was an interesting one that we get fairly often: what's the overlap amongst the three products and can a company qualify for all three indices? Actually, what you will find is all our indices have unique exposures. They have extremely low overlap as we discuss with traditional indices, but there's also very little overlap amongst our three indices. If you looked at THNQ and HTEC as an example, the overlap is only around 4%. For ROBO and THNQ it's about 14% and the same thing for ROBO and HTEC it's roughly around 12 to 14%. Lisa, do you have any other comments?

Lisa Chai:

I think the second question is can a company qualify for all three indices. Nuance is a perfect example where it qualified under ROBO as well as THNQ for their pure-play AI-driven business, as well as HTEC for their medical business. So 60% of the Nuance business came from the healthcare industry. That's one of the few companies. I wouldn't say we have many of those, but I would say there are some handful of companies that have the medical exposure, as well as are AI-driven as well as being involved in some of the robotic platforms.

Bill Studebaker:

Next question, is there a particular industry or technology catalyst that you're watching, which could accelerate robotics adoption? I'll take a quick stab at this. I have a hard time identifying one specific catalyst. I think that we're at an undeniable inflection point because of computing capabilities, which is essentially doubling every 18 months. And our cost of computing is decelerating, which is leading to an array of use cases, which a few years ago was just Elon Musk science fiction. So, as we look at the penetration rates across virtually all indices or all segments of the economy, we're at very low penetration rates, the most heavily automated area in the economy is obviously industrial manufacturing which is roughly around 40% sort of automated.

Interestingly, if you look at industrial use applications, it's estimated by the end of this year, we're going to have roughly 3.1 million industrial robotic installations. That compares to a global install base of industrial manufacturing employment, which is about 380 million people. So if robots are stealing our jobs, they're doing a bad job of it. If you actually look at robotic installations, compared to employment, you'll see people think that robots are stealing our jobs. In fact, there is no evidence to suggest that. The correlation between robotic installations and employment is virtually one-to-one. And you can see that with what's happened with Amazon over the last year has added robotic installations, but they've also added 500,000 people. So, we think that the area is an open field in every subsector.

Lisa Chai:

Yeah, I think the only thing I like to add is that in terms of the technology catalyst, is that we're seeing a lot of advancements in AI software. So, the next generation robotics that you're going to see that we think will possibly accelerate or spur some of the adoptions would be having the robots be more intelligent. So, and that is possible with some of the deep learning types of algorithm. We're seeing a lot of advancements in supervised learning algorithms that are going to allow the robots to make some human-like type of decision. It's going to be very exciting to see some of that technology innovation happening.

Bill Studebaker:

Okay. The next question is how do you qualify IPO's to get added to the portfolio. A question on SPACS. How do they qualify as an underlying company? First of all, what's important to recognize is that we're trying to identify companies that have high revenue purity. We didn't really discuss our industry selection process, but we now have a proprietary ranking system. When we look at companies based on 50% of factor ranking is related to the revenue exposure. The other 50% is related to identifying companies that have a strong market share leadership, have strong technology leadership, but also are investing aggressively such that you were going to see a pickup in their revenue mix, and you will also get the benefit of improved margins.

So that's essentially how we do it. We're not really throwing paint against the wall; we're trying to identify industry leaders.

Lisa Chai:

I think that's right. As a research analyst, whether you're an IPO, a SPAC, or a company that's been established for 30 years, you go through the exact same process getting into the portfolio. We have an investment committee, we discuss some of the scoring and factors, market leadership, technology, leadership, as well as what type of investments have you made. As well as the revenue period is a very important factor for us. So you must meet a certain type of threshold to get the scoring and then we go through the ESG filtering process as well to screen out the companies that are violating some of the ESG policies. So it's the exact same way. When we do look at a company that is new, we do get excited to understand a new story, but at the end of the day, it goes to the exact same research investment process.

Bill Studebaker:

Okay. Good question. Obviously, there's been a lot of tension related to electric vehicles, is this a growth area for AI, and are there companies that are well-positioned to support the hardware and software demand for EVs, and are these companies represented in the THNQ portfolio? Just briefly the answer is yes. We have strong exposure to autonomous vehicles in not only THNQ but also in ROBO as well through our computing processing and AI and sensing as well. So we do invertedly capture a lot of this growth but let me pass it over to Lisa to go into some more granular detail.

Lisa Chai:

We think that EVs are definitely one of the biggest growth areas for AI. A lot of people do interchangeably use the word EVs and autonomous. Even though they're not the same, but we are seeing that almost all of the EVs are using a lot of autonomous types of features. Right now, for the THNQ portfolio, the biggest exposure and companies that are supporting the hardware and software are companies in the semiconductor industry because EV still relatively very new, and we're still in the process of building them. Companies like Nvidia, ADI, Infineon, are enablers and ASML has been seeing a lot of orders for their EV equipment for companies that are producing these chips are going to go into the EVs. We also have a small exposure in Tesla in our cognitive computing subsector and that has also been a very good performer for us.

Bill Studebaker:

Other than robotic floor cleaners that are popular today, what are the next areas for domestic home robotic technologies? I'll take a quick stab and then pass the Lisa because Lisa just did a video with a member of the iRobot management team. I would say that you're probably not going to see too many advances over the near term. I know that Amazon is working on some domestic solutions, but I think you have to have a price point that works. There needs to be a value proposition. These are complex sorts of applications that you're trying to get done. I think it's going to take a little bit of time for this to play out - probably five to 10 years, but I'll pass it to Lisa for some more thoughts.

Lisa Chai:

We've seen a lot of interesting technologies out there. We've seen, kitchen robots, robots that can make pizza, and some of these items we think we're going to see a very meaningful kind of opportunity is really around that companion robot, as well as the personal robots. So robots don't necessarily have to mean that you must have arms and legs and have this robotic feature. It could really be a speaker that you could talk to. Right now, we do have a smart speaker, but it's more command-driven. I think going forward, we're going to have a digital assistant robot that you could not only ask questions and get answers, but actually have some dialogue with, and maybe they'll make some appointments for you. So if you say, Oh, what's today's state this robot will remind you that your dental appointment has to be booked. So maybe that robot will help you. So that digital type of robotic assistant with lots of, kind of the advanced software AI, is where we're seeing a lot of the home robotics system is being built today.

Bill Studebaker:

But I still think the sort of consumer applications is going to take a little bit of time to play out. Next question is, do you have a portfolio rebalancing policy? If so, please describe it. Yes, we do. We rebalance quarterly to smooth out the ride. Just so everyone kind of understands, our approach. We again, sort of look at this and try to give investors from point A to point B in as least turbulent aerospace as possible. That's why we're not concentrated, roughly our top 10 names in the 15% of our exposure. We were balanced and basically, trims are winners in buying the stocks that have gone down and essentially, we're buying in, or we're trimming 2% positions and adding to roughly 1% positions. And we do this quarterly to smooth out the ride.

The final question is ‘can you discuss your ESG filtering and provide some examples of companies that were filtered out?’

Lisa Chai:

So, we have during our investment process, as I mentioned earlier, we have these investment ideas through the investment committee, and then it has to go through the filtering looking at the environmental social governance. We use a third-party provider, Sustainanalytics. They're very well respected in the community. We also use the same principle guiding principle of the UN. So, we're very comfortable with using this third-party guidance. And in terms of examples of companies that are filtered out, the ones I can recall are in the energy sector, we went through some of the companies that regardless of how the robotic type of equipment that we were looking for, it did have some violation according to Sustainanalytics in terms of the environmental impact. So, there were a couple of companies that were removed.

Bill Studebaker:

We certainly appreciate everyone's time, and everyone has a busy schedule, so we'll let you all go, but we're excited about where we're going in terms of the growth and direction in robotics, AI, healthcare, innovation. And again, we try to capture companies that aren't in those traditional indices, and we think that it will likely complement many of your portfolios quite well. And we look forward to having conversations with you and helping to educate you further. So, with that, thank you for all your questions.

Lisa Chai:

Thank you.

About ROBO Global

ROBO Global is an index, advisory, and research company wholly focused on helping investors capture the unique opportunities of fast-growing robotics, artificial intelligence, and healthcare technology companies around the world. Our investment strategies adhere to the ROBO Global ESG Policy and are long term sustainable growth opportunities that benefit both society and investors.

With the expertise of our leadership team and strategic advisors from the industry, we help investors capture the growth and return opportunities presented by innovation across industries, from healthcare to industrials to consumer products. Our indices are used by a variety of investment vehicles listed on multiple exchanges around the world. We are present in Dallas, San Francisco, New York and London. www.ROBOGlobal.com.