The Robotics & Automation Index (ROBO) returned 3.0% in the second quarter of 2021, while the Healthcare Technology & Innovation Index (HTEC) rose 9.8%, and the Artificial Intelligence Index (THNQ) increased 9.5%. Mergers & Acquisitions continue at a brisk pace, with four members of the ROBO Global indices receiving takeout offers. In this report, we look at the key trends and big movers across our innovation portfolios and discuss why the set-up for robotics, AI, and healthcare technology stocks remains attractive.

Webinar Transcript:

Jeremie Capron:

Welcome to ROBO Global's July investor call. My name is Jeremie Capron. I'm the director of research. I'm talking to you from New York City. And with me on the call today, are senior research analysts, Lisa Chai and Nina Deka. And here's the agenda for today's call. We'll be reviewing our three technology innovation portfolios. That's ROBO, HTEC, and THNQ, T-H-N-Q, and we'll be taking your questions. So, please feel free to type them into the Q&A box. And we will try and address as many as possible after our prepared remarks.

I'd like to kick off with a brief summary of our firm today. We are a research and investment advisory company that's focused on robotics, AI, and healthcare technologies, and we are the creators of research-driven index portfolios that are designed to benefit from these megatrends. Today, there's over $4 billion tracking our strategies here on the New York Stock Exchange as well as in Europe and Asia. And the most notable is probably ROBO, R-O-B-O, which started almost eight years ago. And we also run THNQ, the artificial intelligence index that we call THNQ, and HTEC, which's the healthcare technology and innovation index. And our strategies combine a research-driven approach with the benefits of index investing in the ETF wrapper.

The portfolios are selections of best-in-class companies from around the world that is small, mid and large caps. They are more or less equal-weighted and rebalanced quarterly. I want to mention that these portfolios have a very high active share. That means relative to broad equity indices, the overlap is very low. Most stocks in our index portfolios are not in the S&P500 or in global equity indices.

On the next slide, I want to show a little bit more about the composition of our three portfolios. We started with ROBO, which's at the center, and that covers the entire robotics and automation value chain. So, the bubbles that you see around it, they represent the enabling technologies that make robots and autonomous systems possible like sensing, like computing, like activation, and some of the key areas of application like factory automation, like logistics and warehouse automation, or consumer, and healthcare. And in the past three years, we started two additional portfolios around areas that really stand out in terms of the potential disruptive impact. So, THNQ is designed using a similar recipe to ROBO in terms of the sub-sector approach and the research-driven selection of companies. And that's focused on artificial intelligence. And HTEC, the same recipe focused on the healthcare technology revolution.

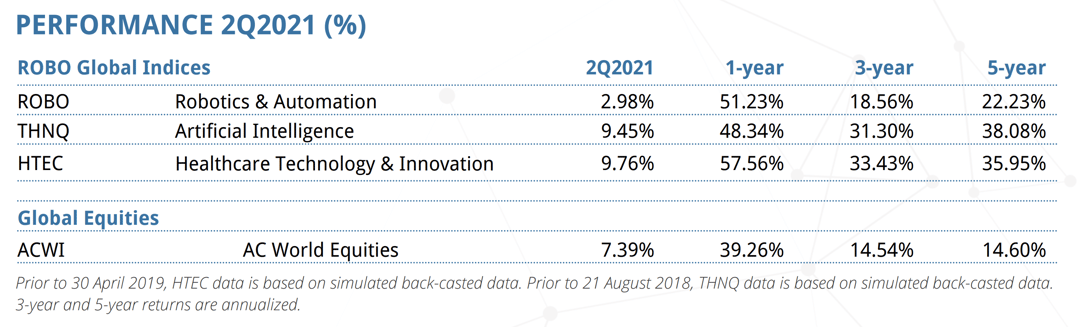

Let’s talk about returns and what happened in the quarter. In the second quarter, we saw global equities continue their historic recovery from the lows of the COVID-19 shutdowns. We saw another quarter of large gains. You can see at the bottom of the table here, the All Country World Index was up around 7% in Q2 and two of the three ROBO Global indices outperformed. ROBO was up 3%, HTEC and THNQ were up more than 9%. And you can also see here that the three strategies have largely outperformed over the past one, three and five years. And please note that the three and five-year numbers for HTEC and THNQ include a backtest for periods prior to inception whereas for ROBO, these are all actual returns given that the index is nearly eight years old now.

Let me make a few comments on the market and our outlook. I think it's really important to say first. The pandemic is not the only key driver of market sentiment anymore. What we've seen is that economic indicators continue to point to a much faster economic recovery than in prior global recessions. The snapback recovery is supported by enormous fiscal and monetary policies that have been introduced by major governments all around the world and central banks, but important to say that unlike 2009, we're seeing real monetary growth across all key regions of the world. Here in the US, there are now more than two and almost $3 trillion of excess savings that have been accumulated since the start of the pandemic. And that's thanks to the CARES Act, more recently, the American Recovery Program, but increasingly we're also seeing rising wages participating in that savings accumulation. We think that is going to unleash very significant spending going forward. And so, we have the highest inflation in more than 10 years, but assuming that the threat from the virus continues to recede, we expect that cyclical recovery will continue to gather steam over the next several quarters.

Our portfolios are very well positioned to continue to outperform in this environment. Think about how businesses are striving to cope with this new environment where technology has proven critical in supporting distributed work, in supporting e-commerce, and automation. And so last year, we saw that the digitization of the economy had been turbocharged. Well, I think it's fair to say that this continues very strongly into 2021. And the ROBO strategies are specifically focused on technology disruptors that are positioned to gain share as this digitization of the economy accelerates. And many companies have been massive beneficiaries of this shift in our portfolios, especially companies in the areas of artificial intelligence, factory and logistics automation, enterprise software, healthcare technology. So, we'll talk a little more about that as we go through each of the three portfolios.

The last point I want to make before moving on is M&A, mergers and acquisitions. That was in focus again in the second quarter. We saw five takeover offers for our portfolio companies. We'll come back to some of these acquisitions later, but I want to stress that M&A is a very important aspect of our investment strategy. Since the start of the ROBO portfolio, seven almost eight years ago, 25 ROBO index members have received a takeout offer. And for THNQ, the AI index, which is now three-year-old, we are now at nine takeovers. And for HTEC, we're at eight takeovers after just two years. So, this has provided a very nice tailwind to performance.

Now, let's talk about ROBO. I want to go into ROBO. A real quick reminder, this is a research-driven index of best-in-class robotics automation companies from around the world. It covers the entire value chain, core enabling technologies, and key applications across manufacturing, logistics, healthcare, and so on. And as you can see on this performance chart here, it's outperformed the world equity index over time, including in the past year, three years and five years. The ROBO index was up 3% in Q2. It rose 5% in Q1 and last year, 44%. So, we're still in a very firm upward trajectory here. Eight of the 11 sub-sectors, saw gains. So, on that slide, you can see a recap. The main sub-sectors for ROBO on the right-hand side in the table, and then a pie chart that shows the composition.

Best performing sectors were food and Ag, computing and AI, and healthcare. That's for Q2. Now, if you think about what happened in Q2, we saw defensive rotation in the equity market. We saw large cap growth stocks. We gained the lead over value and cyclicals, and that primarily benefited the computing and AI and healthcare sub-sectors. So, you think about stocks like Nvidia, that was up 50%, Intuitive Surgical, that was up 25%, Illumina was up 24%, all very strong gains.

In the meantime, industrial automation stocks... And a reminder, that's around 40% of the index by weight. These industrial automation stocks pulled back after the strong gains in Q4 and Q1. And I think it's really... Especially so in Japan where we saw a good number of stocks down double digits during Q2. It's really important because our view is that the cyclical recovery in industrial automation remains in the very early stages. We're entering the fourth quarter of improvements in what historically has been a series of expansion cycles of 10 to 14 quarters. So, we have four quarters into what's an average 12 quarters expansion. And so, we see a very high probability that factory automation earnings will reach a new high in the cycle.

Quick word on China. China had the COVID lockdown first. Automation stocks there remain on a clear V-shaped recovery. They have powered through despite some macro tightening in China during the quarter. China stocks account for just enough, 5% of the portfolio. And they were up 15% during Q2. So, you can see a number of our China holdings here. We have natural language processing specialist, iFLYTEK. They are focused on voice. Yeah, that stock was up more than 40% in the quarter. You can see industrial automation companies like Shenzhen Inovance, HollySys, that's been a member for several years. And HollySys, by the way, is now in play. The former CEO and the private equity group have suggested a tender offer. So, we see that's another takeout candidate here.

Now, I just want to talk about a few of our holdings here and we'll talk about the top performers. Raven was up 51%. Raven is a pioneer in precision agriculture. It's agreed to be acquired by CNH International. That's one of the world's largest Ag machinery companies. CNH offered $2 billion that represented 30% or 35% premium to where the stock was trading before the announcement. A very nice multiple, 26 times EBITDA expected for 2022. So, you can see we're talking high takeout multiples in most cases. And this deal really follows an increasingly familiar pattern where you have a larger company that's looking to accelerate its digital transformation that goes to acquire a smaller player and robotics automation or AI.

And then the next stock is Nvidia. Briefly mentioned that already, was up 50%. Nvidia is up more than 16 times since it joined the ROBO index in 2016. So, another 50% gain in the quarter, Nvidia is the leader in GPUs, graphics processing units, and the company continues to benefit from very strong demand, outpacing supply. Demand is particularly strong for cloud computing, AI, gaming, 5G, automotive, cryptocurrencies. So, the management's come out and set expectations for high double digit growth for the next year. And that's going to be a combination of continued strength in demand and the pricing power that results from the short supply in many of their products.

Lastly, I want to talk about a new ROBO index member that was included in the latest rebalance in June, that's Estun. Estun Automation, that is a Chinese company that's focused on industrial automation. Estun is emerging as a dominant force in the China market. It's got the best market share gains amongst the domestic players. Its market share more than doubled in 2020, and it makes industrial robots. It makes CNC systems, servos, motion control systems, and so on. And we think Estun is the Chinese player that is the most likely to challenge global competitors in the China market over time. And that's because it's got the product quality, it's got the focus, it's got the best in-house componentry abilities. So, we think it can grow revenue at a 30% annual rate on average for the next three years.

And so with that, I want to remind everyone, you can ask your questions via the Q&A box, and I will pass it on to Nina. Thank you very much.

Nina Deka:

Thanks Jeremie. Hi, I'm Nina Deka, senior research analyst at ROBO Global. And I'm here to give you the quarterly brief on HTEC, our healthcare technology and innovation index. During the quarter, HTEC returned 9.8%. This outperformed the MSCI AC World Index, which performed at 7.4%, and the S&P Global Healthcare Index, which also HTEC outperformed, and S&P returned 8.9% during the quarter. So, at ROBO Global, eight of the nine sub-sectors delivered positive returns, and I'm just going to highlight a couple of them.

First, was our robotics sub-sector. As a sub-sector, it returned 15.7% during the quarter. It was led by a company called Globus. This is a leading med-tech company that's focused on musculoskeletal disorders. During the quarter, Globus returned 26% after the news of its launch of the market's first robotic screw that is designed for spine surgery, and it's going to further simplify the surgical procedure. The company also reported really strong Q1 earnings and, in fact, its enabling technology segment was up year over year by 86%. This is the part of the Globus business that captures the robotics technology. So, we're really glad that we have exposure in the robotic space because there's a lot more growth and penetration to come. For those of you who don't know, last year, a lot of the robotic stocks kind of took a back seat while the world focused on the pandemic, and so hospitals who would have bought a surgical robotic instrumentation, put those budgets on hold to instead focus on coronavirus. And so, this year we're seeing surgical procedures gain momentum. People are going back to the hospital to do those procedures that were delayed and hospital budgets are forming back to the projects that they were working on prior to the pandemic. So, this is setting up some pent-up demand. We're starting to come to fruition with some of these robotics companies and we should expect to see that play out for the next couple of years.

Another sub-sector I want to call out with strong performance of the quarter was precision medicine. They returned 14% in the quarter and this is our sub-sector that captures the therapeutics companies in HTEC. So, over the quarter, we saw innovation in CRISPR gene editing that drove some of the stocks as well as advancements in mRNA technology and more to come on that. Over time, we expect that continued innovation in genomics is going to help further innovation in precision medicine, for example, with companion diagnostics. When you can test the patient's tumor and figure out exactly what gene the cancer has, then the therapeutics company can come up with the appropriate therapy to treat that exact gene that's causing the cancer. So, we expect to see more of this for years to come, and that's being captured by our precision medicine as well as our genomics sub-sectors, and our process automation sub-sectors.

In fact, if you look to the left here, we've got our sub-sector weightings. And the reason why we want to be diversified across all these areas; genomics, data analytics, tele-health, some years you're going to see more performance from some areas versus others, but the reason why we want to be diversified across is because we're looking at the long-term. We have high conviction that healthcare is going to be disrupted over the next decade. And a lot of these sectors work in tandem with one another. So, when one benefits, so does another, and by having that diversification in your portfolio, you can capture all of this. Just to give you an example, we've got several companies in process automation like Lonza and Catalent that stepped up and partnered with Moderna during the coronavirus to help manufacture the coronavirus vaccine at scale. So, when you see a company in one sub-sector perform well, there might be partners in other sub-sectors that are also going to gain.

Now, we'll just dive in a little bit deeper into Moderna. As mentioned, they were one of the manufacturers of the COVID vaccine as most people are aware. During the quarter, they were up 79%. Why? The vaccine came out last year. Well, there was a lot more information and news that came out about this company expanding market share. In fact, they continue to sign global contracts outside of the United States to deliver hundreds of millions of doses around the world. They're also furthering their clinical trial studies, so that eventually Moderna hopes to be able to use its vaccine in the younger population, teenagers, and also children.

Aside from that, this company... A lot of people just know about Moderna because they manufactured a vaccine, but what a lot of people are missing from an investor standpoint, is that Moderna created a platform. And they've been working on this platform for over a decade, and they have amassed a huge amount of data on mRNA types of therapy. So, this technology that they deployed, the reason why they were able to come up with the coronavirus vaccine so quickly is because they'd been working on it for 10 years. They've also invested heavily on their manufacturing capabilities so that now that they've proven to the world along with other companies; Pfizer, BioNTech, for example. Now that they've proven to the world that mRNA works and that it's safe and effective, Moderna now has this platform that they built that they can now manufacture other therapies on. And they've got over a dozen other therapies in the pipeline that they can lever this platform to come up with all these other therapies. So, we expect much more to come in the world of mRNA, and Moderna is very well positioned for that trend.

And then another company that really performed well during the quarter is Novocure. They were up 68% in the quarter. This is the maker of the Tumor Treating Field delivery system for cancer treatment. And they reported some positive data on phase three LUNAR trial for their technology for stage four non-small cell lung cancer. Long story short, this information should accelerate to the FDA approval process. And there's an independent review committee that came out and said that they expect, based on the strong performance, they are recommending that this product comes forward for this indication sooner than later. So, that moved the stock during the quarter.

And then last, I just want to bring up that we do a quarterly rebalance process similar to all three of our indexes; ROBO, THNQ, and HTEC. And at that time, because of our constant review process of evaluating companies, not just in HTEC, but adjacent spaces, we decided to include some new members and sometimes members get kicked out. So, new inclusions for the quarter were Hong Kong based, AliHealth, as well as Invtae, who was actually in the portfolio in the past, but got kicked out due to valuation. And now they've been re-included because the valuation fell back into line with our fundamental metric system. And then Beijing-based JD Health. So, with that, I'll stop and I'll pass it over to Lisa, who's going to tell you about THNQ.

Lisa Chai:

Hi. Thanks, Nina. T-H-N-Q, THNQ index, is a pure play artificial intelligence strategy that captures key players in the AI ecosystem. And it has had a very strong performance last year and while THNQ had a slow start in the first quarter with some profit taking, for the second quarter, the index has bounced back somewhat, and it's up over 8% year to date. It did under-perform slightly versus broader global market indices for the year, but on an annualized basis on back-testing, it is still outperforming on a three-year and a five-year basis compared to a broader equity index. And as Jeremie mentioned, since inception of index, nine index members have been acquired. We expect M&A activity, both strategic and financial, to remain high for the remainder of 2021, as companies look to acquire AI technology and capabilities. Every sub-sector was in positive territory, except for one during the quarter, which was the consumer sector. Network and security sub-sector was the best performing sub-sector, increasing 18%, as well as cognitive computing, cloud providers and semiconductors, all up double digits during the quarter. What is notable is that semiconductor sector is the second biggest weighting and has been an outperformer for the last 12 months, surging more than 82% followed by cognitive computing, up 80%, and healthcare and cloud also surging more than 70% each.

Continue strong demand for cloud and data center solutions are driving the upside for these sectors. In the consumer space, iRobot shares pulled back this quarter after rising over 50% last quarter. We believe despite the short-term volatility in the shares, long-term growth prospects for iRobot is intact. They deliver strong earnings results and will continue navigate through supply chain issues due to shortage of semiconductors and rising raw material costs.

Now, to dig a bit deeper into what's happening in network security sub-sector, AI infrastructure enablers such as Proofpoint, Rapid7, and Arista Networks, all posted strong first quarter results. And provided upbeat second quarter guidance. Second quarter saw series of major security breaches around the world with ransomware making headlines. And we are seeing the demand for AI-powered solutions continuing at a record pace. Also, the remote work phenomenon, which was given a huge boost by the lockdown measures combined with rising e-commerce trends represent structural shifts are permanent, and it's here to stay. And we're deploying more security solutions than ever to protect us from cyber criminals. For example, Cloudflare, one of our index members is a cloud infrastructure and security company, and their products are grounded in machine learning. Cloudflare was the biggest contributor for us, up 50% during the past quarter. Cloudflare is benefiting from the shifts we're seeing in the deployment of AI, data center, IoT and 5G. We strongly believe that spending around cloud capabilities and AI systems would continue the rapid rate in 2021 and beyond. And Cloudflare will continue to benefit from this trend. We are seeing that enterprises are looking for more than just a simple cloud capability, they are looking for more of a modern network environment with advanced capabilities powered by AI engines. They want faster data access without compromising security and Cloudflare has solutions to meet this demand.

The other company that really stood out for us during the quarter was Proofpoint. The overall demand for cloud solutions combined with AI capabilities and cybersecurity continues to gain tremendous momentum. Proofpoint was a strong performer, up 38% during the quarter, after receiving a buyout offer from a private equity firm, Thoma Bravo. We believe that Proofpoint realized that they had to expand their capabilities given the robust market opportunity out there driven by acceleration digital transformation. They have found a partner in Thoma Bravo and Proofpoint is able to go private during this time, so they can invest in their product development to capture some of this tremendous growth opportunity in this new threat landscape.

To share some insight on our rebalance in the quarter, we had four additions to the portfolio. Cyber security remains a very strong theme for us and we added NortonLifeLock and McAfee to the strategy. With the biggest data breach in the US history being discovered last year with a very rapid rise in identity theft, it's not just organizations looking for advanced security capabilities. Consumer focused companies like McAfee and NortonLifeLock are strongly positioned to benefit from increased security spending to prevent future attacks. McAfee management team recently just told us that data application and identity theft protection solutions with the latest machine learning capabilities are seeing rising demand as consumers are looking to safeguard their data.

Meanwhile, Lemonade is another notable addition during the quarter. Lemonade is a FinTech company. They became public last year and we believe they're a disruptor in the massive global insurance industry. The insurance industry is a $5 trillion industry and accounts for 11% of the GDP in the US. There are really no insurance companies that has more than 4% market share at the moment. So, Lemonade's very small player in this space, but we think that it's poised to grow the fastest with its unique business model centered around leveraging data and AI capabilities for the millennial generation. Lemonade is seeing record customer count up 50% from last year in the home renters insurance. And they're planning to expand into auto-insurance, which we believe is a significantly bigger market opportunity than renters insurance. So, now, I will pass it back to Jeremie.

Jeremie Capron:

Okay. Thank you, Lisa. And we're now going to take some of your questions, so please feel free to type them in. We have a few that have already come in. And so, we'll start by a question around the percentage of holdings that are loss-making in our portfolio. So, I want to start by saying that our selection process is very research driven and it takes the long-term view. We look for companies that have not only a very high revenue association with the sub-sectors for each client's [inaudible 00:29:38], but we also look for companies that have demonstrated a very strong technology leadership and a very strong market leadership. So, we score each and every company in our monitor research universe on a number of metrics, including those two. And the result is that in most cases, you end up with companies that have a very strong financial performance as well. So, if you pass the ROBO indices through the traditional investment factor lens, and you look at size, and you look at quality and momentum, and the likes, what you'll find is that our portfolio stands out particularly on two metrics. Number one is size. There's a lot of small and mid-caps in each of the three portfolios; in ROBO, and in HTEC, it's around 50% by weighting.

And the other factor is quality. Our selection process leads us naturally towards companies that have high return on capital, fat margins and superior growth. Now, in absolute numbers, if you look at the ROBO portfolio, there's only four out of the 84 companies that have negative accrual earnings. In the AI fund and in the HTEC fund and index, you'll know that the percentage is somewhat higher. And I'll ask Nina to comment on HTEC, in particular.

Nina Deka:

Yep. Thanks. So, similar to what Jeremie was saying, we're looking at the long-term and in healthcare technology and innovation, there is so much upside and actually roughly half of the portfolio are companies that are small and mid-tech. That actually fluctuates from quarter to quarter. And so, when you've got these smaller... Sorry, small and mid-cap companies, what you have is a lot of them just don't have positive earnings yet. So, if you look at the trailing earnings for HTEC as a portfolio, about 65% of the holdings are profitable at this time, but if you look at the forward earnings, 72% in the next 12 months of the holdings are expected to be profitable. So, it's a great way to capture the earnings over the long run and even in the near term, but another way that we value the entire portfolio is actually on [inaudible 00:32:22] sales because a lot of these companies are in growth mode at this time and don't have positive earnings.

Jeremie Capron:

Thank you, Nina. And we have a question around the semiconductor shortage situation. I think Lisa, you'll be in a good place to answer that. When do you expect the semiconductor shortage to end and how has this situation impacted your portfolio?

Lisa Chai:

Our analysis indicated that we expect the semiconductor shortage to end, for the most part, sometime late next year. I think that a lot of expectations centered around maybe... We should see some improvement by end of this year into early next year, but it's going to really vary based on the in-markets. We think the other sector is really suffering the most right now. The companies that are positioned around our AI theme are positioned much better. Companies have already allocated a lot of their resources in building other AI chip solutions. And it also does have a higher average selling prices. So, we're seeing a really big structural and secular trends happening.

So, the companies that have product roadmap around AI chips are probably going to see... They're not really seeing that much shortage at all at this point. And the impact's been so far positive. They are getting a lot of good transparency and visibility in their business model, I think so. It's been somewhat mixed in terms of what we're seeing with expectations and volatility in the share price, but actual fundamentals aren't that terribly bad at this moment, but we're going to keep an eye on things and see some of the dynamics around it, but I think we are seeing some impact in the ROBO strategy with some of the companies that provide to other market, but I think that they are planning out and they're navigating this pretty relatively well. Yeah. I think we have a technical issue here. So, I think the question is that, do you have a strategy to capture value from companies like OpenAI and Waymo besides just only the big players like Google and Microsoft? I think that's one of the questions.

We do. We think portfolio centered around companies that are pure play AI companies also are playing a big role in building the AI ecosystem. So, it's very important to include companies like Google because they are designing their own AI chips. And they are one of the biggest recruiter of data science talent at the moment, but at the same time, the large tech giants really represent about 10% of the entire THNQ index. Most of the companies are actually in different, various market cap and size and geographic locations. We have companies that are enabling collaborations using AI capabilities. Also, some smaller semiconductor companies as well as networking. So, you're seeing a very diversified group of companies that's playing a key role in building AI. So, you'll see that it's not just the larger tech giants represented in the THNQ index.

Jeremie Capron:

Thank you, Lisa. And I want to take this question around how the rising wage base may impact the automation industry. I think that's a question we get a lot that we've put a lot of thoughts into that from the inception of the ROBO strategy. We think demographics is one of the major trends that are supporting the growth of the automation industry. Demographics in a sense that the working age population is plateaued or even declining in some of the key regions of the world. You think about Japan, China, and Europe. And so, yes, demographics plays a big role. And in the current environment where we have rising inflation, wages are now going up. We think that's a catalyst for businesses to accelerate their automation strategy, and that's really what we saw starting last year. The pandemic really kick-started an arms race for businesses to automate more. And it's reflected in the older books of many of the companies in the ROBO portfolio, where the older books are largely exceeding production capacity.

So, there's a very tech market for automation equipment, particularly, in the areas of logistics and warehouse automation. You think about the boom in e-commerce that we witnessed last year that continues into 2021. There's a rush for not only e-commerce companies, but also traditional retailers and the parcel delivery companies and the postal services and everybody's ramping up. And the reason is that it's very hard to find workers that can cope with such a short surge in volumes. And those are very tedious positions to do hold in a warehouse. So, there's a lot of churn among the workforce there. So, in a nutshell, yes, we think that rising wages are going to support the trends around the automation industry.

And I want to shift gears a little bit here and pass it on to Nina for some of the healthcare technology questions that we've seen coming. And the first one is, what healthcare innovation are you most excited about? Nina, will you take that please?

Nina Deka:

Sure. So, it's really hard to pick just one. And that leads back to why I mentioned that we're diversified across nine different areas, but maybe I'll talk about a couple. First of all, this growing theme of virtual care. We strongly believe that virtual care is going to underlie every facet of healthcare in the next five to 10 years. We saw early examples of that with the pandemic, with telemedicine adoption. The inability to see a doctor in person and have to speak to one on the phone, accelerated telemedicine adoption by five years, but that's only just the beginning. There's still so much more adoption to be had in virtual care, for example, with doctor to doctor consults, patient device connectivity. Surgical robotics is now being done remotely. They just conducted a procedure on a naval ship not too long ago, and there was a study done on that.

So, we're just in the very early stages. And I like to think of it as how the internet is kind of touching everything at this point. At some point, virtual care is going to be touching every part of healthcare and enabling all these other technologies even to take place. If you look at the world of clinical trials, patients are going to be connected to devices that are going to help capture data that's going to then prove whether or not the drug is working and ultimately whether or not the reimbursement will be in effect. So, to prove that the drug is, in fact, working. So, we're really excited about that.

Another area that we've been following closely is liquid biopsy and the areas of minimum residual disease. This is already commercialized. A company in our portfolio called Natera is really a first-mover with this type of technology. They're the world market leader already in prenatal testing. And now they're using their technology to identify patients who have been treated for colorectal cancer to see whether or not the cancer has returned. And with their technology, they're able to identify the return of this disease eight to nine months quicker than if the patient was waiting to have a scan done. So, really exciting stuff happening. And even in liquid biopsy, just to give you some examples is, it's a specimen collected by blood. Rather than surgically removing a part of a tumor, you can take the patient's blood and then analyze it to see whether or not there's cancer present. So, those are some examples. There's still a long runway of growth in robotics technology and not just for surgery, but in the pharmacy. Right now, we've got a lot that can be automated and healthcare is really behind in so many ways that can be automated. So, we're expecting to see more robotic adoption in many parts of healthcare as well.

Jeremie Capron:

Thank you, Nina. We have a question... There's a few questions around the overlap between ROBO and the two other funds. I think, Lisa, maybe you can talk about that. What companies do one or several of the funds? The overlaps are very low, but Lisa, can you give some color here?

Lisa Chai:

Yeah. Overlap is pretty low with HTEC and also with AI. I think for THNQ, you're looking at companies that have to have high revenue purity around AI capability. So, it's real pure play AI strategy while for ROBO, AI is just part of the component of the sub-sector. So, you're looking at maybe 10% to 15% overlap between the three strategies. So, for THNQ, for example, we have a healthcare sub-sector. Most of those companies are in the HTEC strategy but HTEC has a little bit more rigorous valuation or screening that THNQ doesn't have. So, you'll see some overlap there. You'll see some companies in the healthcare versus the THNQ, and then you'll also see some in ROBO as well, but the overlap is still very low teens type of digit.

Jeremie Capron:

Thank you, Lisa. I see a few questions around, what are our biggest concerns for the next six to 12 months and some questions around valuations. And I think everybody's got this surge and inflation in the back of their mind that's clearly the main concern in the near term.

Lisa Chai:

I think we have another technical glitch. I think some of the valuation questions, I get that a lot, especially with the THNQ portfolio. Obviously, we are going to continue to see probably a little bit more volatility going forward, but we talked to the management team, we talked to some of the industry leaders. And as our channel [inaudible 00:43:10] show that fundamentals and the visibility remains very strong around companies are building these cloud enabled AI services and capabilities, we think that longer term, we believe that we're going to have more automation and more robotics, more AI in our lives, and that's not going to change.

And probably the COVID pandemic has accelerated all of this digital transformation. So, we take a very long view in the way we constructed the index and the companies that we identify and decide to include into this strategy. So, I think that they are... Maybe the THNQ strategy is a little bit more vulnerable to the volatility because it does have a higher valuation, but also does... Remember, it does also have a very multiple higher growth rate as well.

Jeremie Capron:

Okay. So, we'll take the last question which is around the holding size. How do you size your holdings? I think that's a really important question. We'd like to say our portfolios combine the benefits of research-driven selection of companies and then the benefits of index investing, and that's where the position sizing comes in. And so, the position size, fundamentally, we're looking at an equal weighting, but that equal weighting is modified by the score that each company has received through our research process. So, we'll score companies on a number of metrics and the highest scoring companies end up with a higher position weight, but ultimately, you'll find that most companies are between 1.8% at the top end, for the largest holdings, and then 0.8% at the low end. So, it's really, again... Fundamentally, it's kind of an equal weighting. We call it modified equal weighting.

And every three months, importantly, we'll rebalance to that score-driven weighting. And that means every three months, we'll naturally be selling our biggest winners and buying our biggest losers, assuming that those are companies we continue to want to own for the long run. And that kind of ensures that you have this mechanism to buy low and sell high. So, I hope that answers your questions. If you have more questions, feel free to direct them to our website or info@roboglobal.com. I want to reiterate that we do share some of our research via a bi-weekly newsletter that you can sign up for on the website, roboglobal.com. And we very much look forward to speaking to you again very soon. Thank you all and have a great day.