By Bill Studebaker, CIO & President & Jeremie Capron, Director of Research, ROBO Global

Seemingly overnight, we have been tossed from one world into another. Just weeks ago, the global economy was thriving, the stock market was at an all-time high, and spirits were good. Today, our environment is uncertain. We face an invisible enemy and panic is everywhere. From where we sit in the eye of this storm, the only way to address the coronavirus and contagion is constant vigilance. The same is true when navigating the stock market drop, and it’s clear that investors have voted on a draconian outcome. We are certainly on the cusp of recession—if not already in one. Even so, it is a fair assumption that, after the outbreak has run its course (yes, this too shall pass), the markets will improve.

ROBO Global maintains a positive outlook over the long term thanks to the fact that we are investing primarily in disruptors that are likely to gain share coming out of this crisis—especially in the areas of artificial intelligence, automation, enterprise software, and healthcare technologies. In short, the companies in the ROBO Global indices are part of the solution. ROBO (Robotics & Automation), HTEC (Healthcare Technology & Innovation), and THNQ (Artificial Intelligence) are proprietary indices that are focused on disruptive innovation and market leaders. Notably, these are companies that have virtually no exposure to the maximum pain points in this crisis (energy, consumer, leisure, hospitality, and transportation).

While we are not prepared to call a bottom, we can share the facts:

Fact #1: ROBO Global Indices focus on market leaders with strong balance sheets

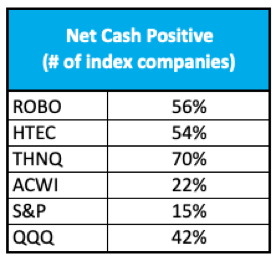

As uncertainty around near-term earnings and credit dramatically increases, the focus is shifting toward balance-sheet strength. The ROBO Global indices are focused on industry leaders and disruptors, which are poised to become stronger in this downturn due to the important innovations they provide. In fact, many have already proven their worth as we face this crisis. Importantly, these companies have the cash necessary to weather the storm.

The weighted average Net Debt to EBITDA ratio for the ROBO Index was just 0.2x at the end of 2019, and 56% of its members hold a net cash position (net debt <0), compared with approximately 15% of S&P 500 index members and 22% of MSCI ACWI index members

Source: CapitalIQ

Source: CapitalIQ

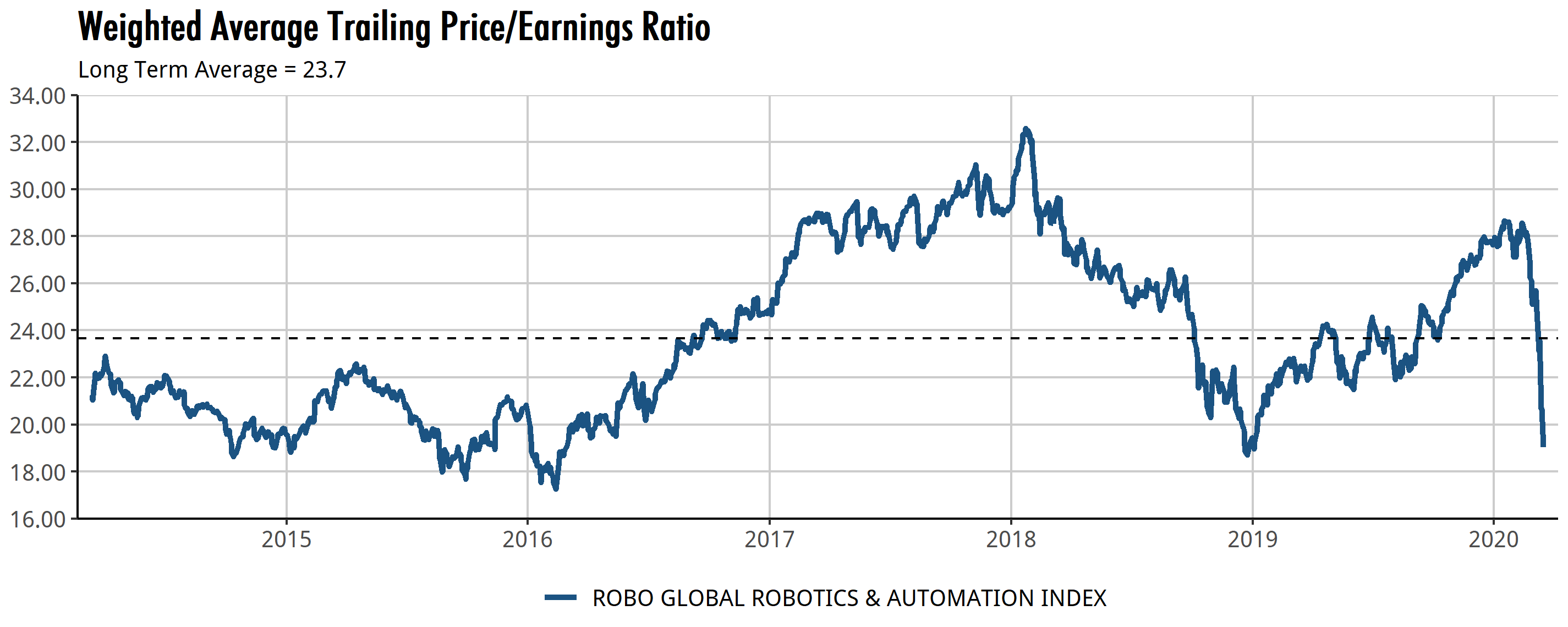

Fact #2: ROBO is at the low end of its historical valuation range

The ROBO Index was down 28% year-to-date as of 16 March 2020 and trades on a trailing P/E of 19.0x, compared to the 5-year average of 23.7x and a historical range of 17-32x.

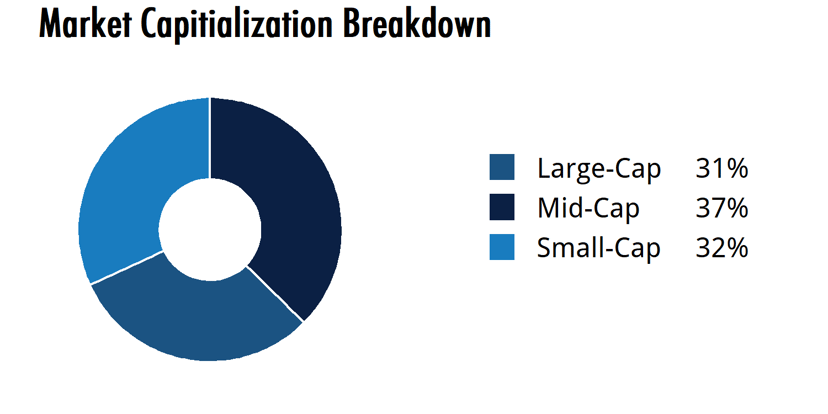

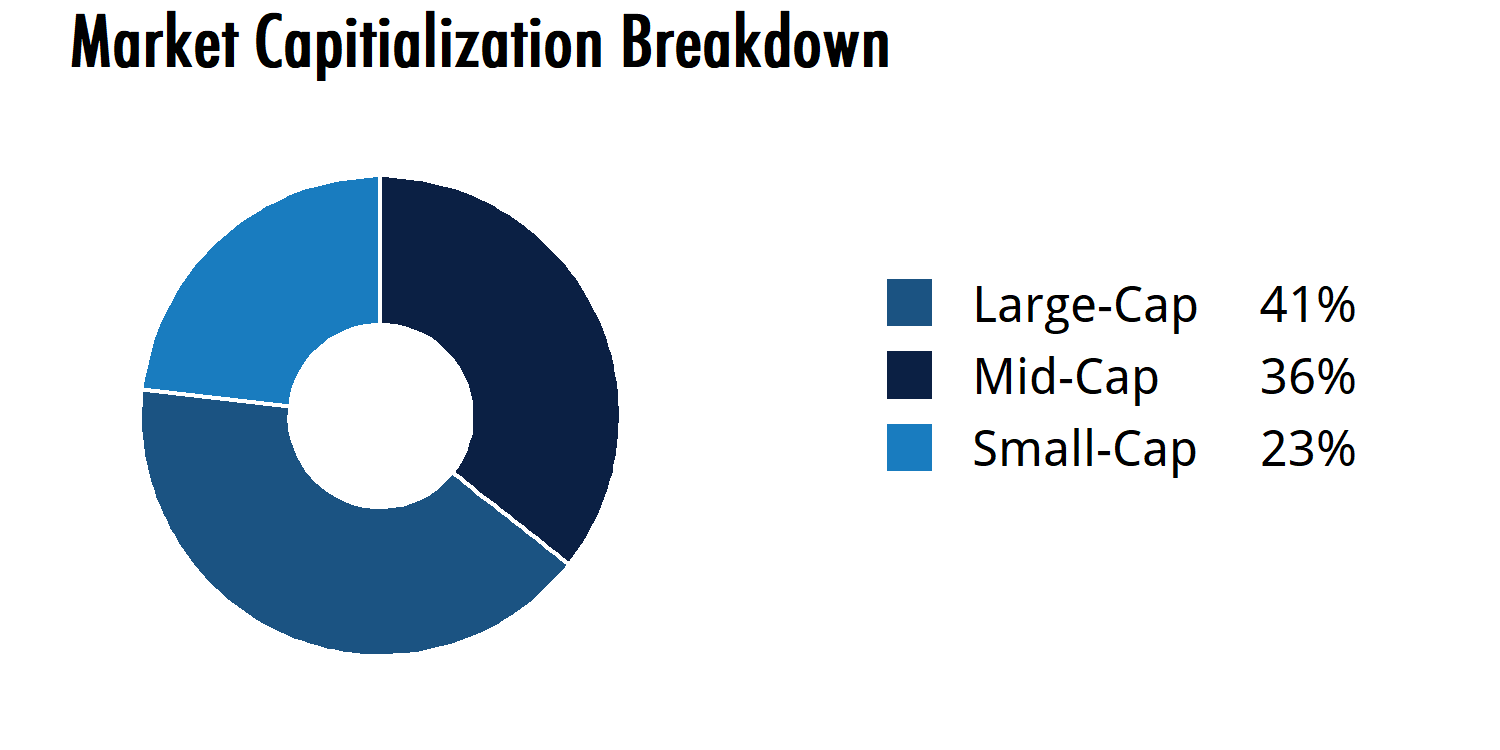

Fact #3: ROBO and HTEC are positioned to outperform in a market recovery.

Both indices are strongly tilted toward small- and mid-cap companies (60-70% each, respectively). Historically, small- and mid-cap stocks do well coming out of a recession because they are more levered to economic growth than large-cap stocks.

ROBO Index Market Cap Breakdown

(as of 29 February 2020):

HTEC Index Market Cap Breakdown

(as of 29 February 2020):

Fact #4: ROBO and HTEC index members will benefit from virus-related disruption

The combination of the coronavirus threat and global demographics is driving a massive increase in demand for automation.

- Online grocers like ROBO index member Ocado are major beneficiaries of the current environment. Already the global leader in this space, we believe Ocado is still in the early stages of growth with sustained structural and secular growth. Ocado and other online grocers have seen strong growth in response to the coronavirus. This has been aided by technologies like Instacart (the grocery version of GrubHub in the US) which offers a “Leave at My Door Delivery” option, and Ocado’s app which eliminates the need for drivers to go beyond the front door or collect used shopping bags. Ocado is not alone in the quest to capture the potential of the online grocery market, which is one reason why logistics and warehouse automation account for approximately 11% of the ROBO index.

- Non-grocery retailers are also enabling the global population to adhere to social distancing mandates and self-isolation requirements thanks to a recent explosion of ecommerce technologies. While more and more retailers have announced the decision to close their doors in response to the threat, ecommerce offerings not only enable them to continue to serve their customers, but also make it possible to maintain sales that would have been completely lost otherwise. While ecommerce was a welcome luxury in the past, it has quickly become a necessity in our new reality.

- Telehealth providers are witnessing rapid growth in demand as a result of the coronavirus. The requirement of isolating coronavirus patients has emphasized the importance of telehealth and its ability to address the need to offer remote patient care. HTEC index member Ping An is a leader in this expanding market. The largest mobile medical application in China in terms of user scale, Ping An Good Doctor employs more than a 1,000 medical personnel and contracts over 5,000 external doctors. Its in-house medical team is powered by AI capabilities to provide users with 24/7 online virtual care visits and online drug purchases. In the US, HTEC Index member telehealth provider Teledoc announced a 50% spike in daily patient visits since coronavirus hit the US, with 15,000 visits requested every day. Teledoc and Ping An are currently the top two holdings in the HTEC Index.

- Medical device manufacturers like ROBO and HTEC index member Varian Medical Systems are leveraging AI to improve the treatment of cancer and other medical conditions. While Varian’s AI solution isn’t applied directly to combat coronavirus, it is used to guide radiation and oncology treatments that must continue—even in the face of today’s global health threat. Varian’s new Ethos platform uses AI to help guide radiation therapy with a 50% margin reduction. Healthcare automation now accounts for approximately 10% of the ROBO Index.

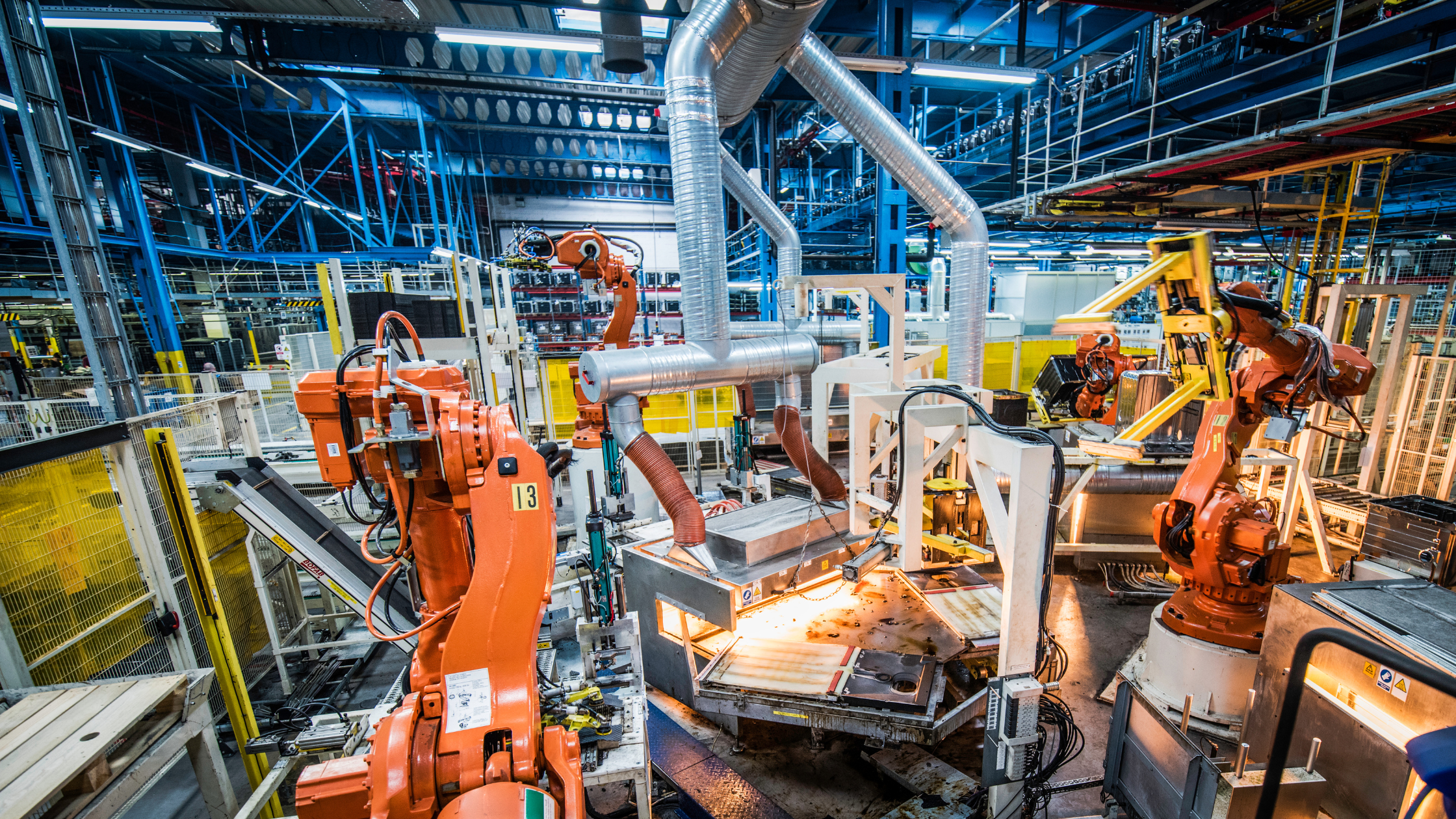

- Factory robots are making it possible for businesses to reduce the number of human workers

required to pick, pack, and ship goods to consumers and to stock warehouses. This is a critical function as companies in every country are striving to reduce the number of workers needed to get goods—everything from cleaning products to food to toilet paper—from warehouse to consumer as quickly as possible. Amazon alone has more than 200,000 robots at work in its distribution centers across the US. Factory automation accounts for approximately 35% of the ROBO Index.

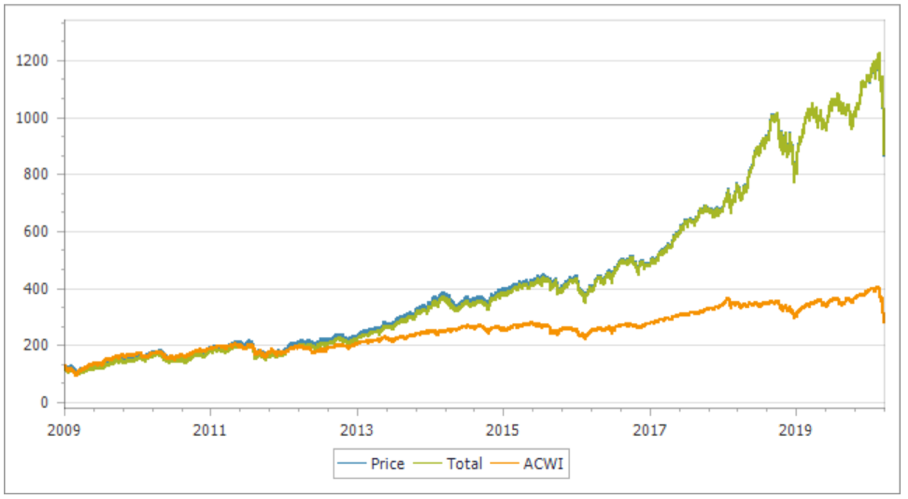

Fact #5: ROBO is continuing to outperform—even amid the downturn.

While the overall performance numbers are poor across the board due to the market downturn, ROBO and HTEC continue to outperform. As of 16 March 2020, ROBO is down -28.0 vs. ACWI which is down -27.3. ROBO outperformed the ACWI 30.3 to 26.6 in 2019. HTEC is down -23.3 vs. ACWI’s -27.3. HTEC also outperformed the ACWI 34.9 vs. 26.6 in 2019.

ROBO Index performance

Source: ROBO Global, Factset. Note: index performance prior to inception in 2013 represents a back test.

Source: ROBO Global, Factset. Note: index performance prior to inception in 2013 represents a back test.

Even in the face of COVID-19, the facts point to long-term growth to come.

There’s no question that we are swimming in unknown waters, but even today, indications point to long-term growth for the entire landscape of robotics, automation, and AI (RAAI), with a strong emphasis on healthcare. At ROBO Global, we have no doubt that individual companies, the markets, and the economy will struggle as we confront the threat of the coronavirus. However, once the pandemic is finally behind us, we anticipate the challenge will ultimately deliver even greater innovation and growth from companies in this innovative space.