By Louis-Vincent Gave, CEO, Gavekal Research and Jeremie Capron, Director of Research, ROBO Global

Media coverage of the robotics industry over the past two years has gone into hyper-drive, making it appear as if robots are set to take over the world or, at the very least, take over enough jobs to put the human workforce at risk. That focus has everything to do with the dramatic improvements in performance capabilities of robotics and AI. No longer confined to the factory floor, many new applications are now being deployed at scale in hospitals, on farms, in e-commerce distribution centers, on the roads, and in our homes. Clearly, the robotics and AI revolution is marching forward at a rapid pace. Yet after returning a stunning 46% in 2017, the ROBO Global Robotics & Automation Index advanced a much more pedestrian 2% in the first nine months of 2018. Is the robotics and AI revolution on hold?

RELATED: Investing in Robotics & Automation: Your Questions Answers

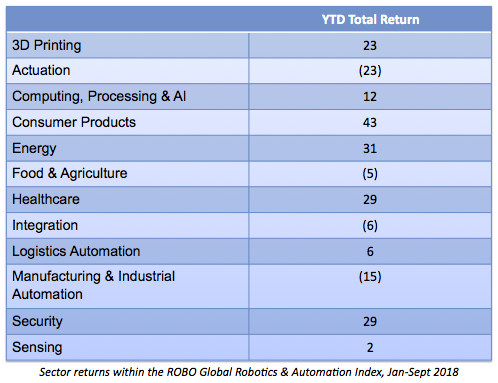

For investors, it is important to understand what is happening today in robotics and AI and how the sector’s trajectory will play out in the short- and long-term. To capture the full potential of this progress, it is also vital to invest across the global robotics and AI supply chain, and to make those investments based on actual research rather than media conjecture. A quick look under the hood reveals how significant dispersion of returns made this diversification so important this year. While healthcare (+29%), computing & AI (+18%), consumer (+43%), security (+29%), and 3D printing (+23%) all delivered market-beating returns, these were offset by declines in other areas, particularly in the manufacturing and industrial automation-related sectors in Japan (-22%), Taiwan (-21%), and Germany (-20%) where many of the top factory automation providers are headquartered.

So why is factory automation being hit with such a punch? The answer may be in China.

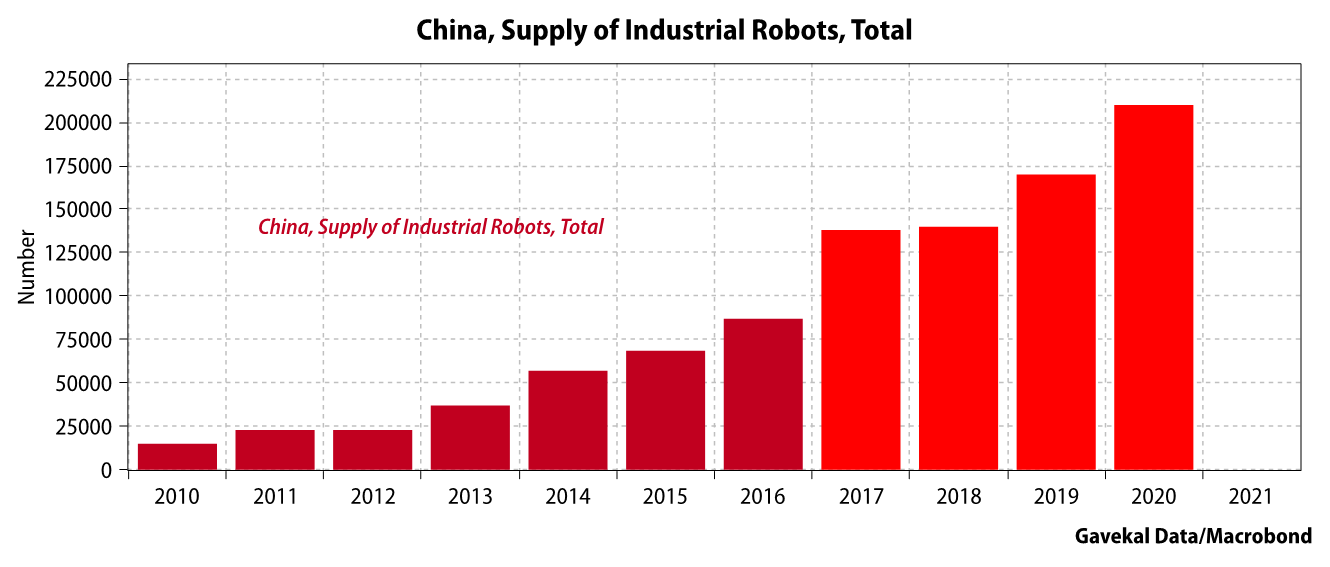

Just a few years ago, in late 2015 and early 2016, investors were concerned about one thing: that Chinese growth was set to implode—and take down global growth for another deflationary ride. To combat this threat, Chinese policymakers eased fiscal and monetary policies, a move that triggered a massive wave of capital spending across China and throughout the wider emerging markets. Unsurprisingly, with China already the single largest market for industrial robots, that easing of fiscal policies led to a sharp rebound in domestic robot growth in 2017. The resulting surge in supply was large enough to move the needle on the global supply of factory robots.

But following every dawn comes the inevitable dusk. Just as the easing of Chinese policy drove a surge in demand for industrial robots and factory automation equipment in 2016, the subsequent tightening of policy in 2017 created the opposite result: Chinese demand for robots flat-lined in 2018. So the simplest explanation for the recent slump in industrial robotics growth is the ‘hangover effect’ following a particularly strong bumper year in 2017. That hangover was made all the worse by the fact that China had accounted for the lion’s share of demand growth in recent years. Then, in 2018, Chinese demand was hit by two damaging events: the tightening of monetary policy, and the threat of a large-scale trade war with the US.

What happens next depends largely on the outcome of the trade war. Is the goal of the US to reduce the trade deficit, or to dismantle the supply lines that have been established following China’s entry into the WTO? It remains to be seen. Either way, the threat has created an environment in which foreign and domestic corporations are hesitating to increase their capital spending in the Middle Kingdom. If the past year was not a ‘perfect storm’ for the robotics industry, at the very least it set the stage for a significant double-blow.

For investors, the biggest question today is how long it will take for the industrial robotics tide to turn yet again? Considering the current state of robotics spending, we can draw two possible scenarios:

The first is that, having cultivated the appearances of a crisis (see Donald Trump’s book The Art of the Deal), the US and China may manage to find a compromise that mirrors the recent agreement between the US and other contentious trading partners: North Korea, Mexico, the EU, and Canada. In such a scenario, capital spending on robotics in China would once again pick up following the signature of a new trade pact.

The second possible scenario is that neither China nor the US chooses to compromise, convinced in the other party’s inherent weaknesses. In this case, China and the US would potentially fall into an economic cold war, and the supply chains that have been carefully constructed over the past two decades would be effectively dismantled. Some manufacturing jobs may then return to the Western hemisphere, but likely not in the proportions hoped (at least as far as the US is concerned given how tight the US job market remains). With this hypothetical dismantling of supply chains, spending on industrial robots in the West would rise sharply to compensate and meet pent-up demand.

Investors who believe that the economic stakes are simply too high for China and the US to afford a falling out should assume that China’s factory automation spending and the resulting demand will once again accelerate in 2019—a shift that would bode well for companies across the robotics supply chain in China, Taiwan, Korea, and Japan. Investors who believe that the trade war marks the start of a paradigm shift—the beginning of the end of “Chin-America”—may opt to position themselves for a rebound in robotics spending across North America and Western Europe, as well as in Japan and even Korea.

For anyone invested in the robotics and AI sector, the lackluster performance of industrial automation stocks over the past six months may have been discouraging. But this pedestrian performance has been the result not of lack of progress or enthusiasm about the industry, but instead of a complex economic reality: as trade uncertainties rose, capital spending fell. Rest assured that trade uncertainties won’t stay with us forever. In fact, the G20 meeting that kicks off at the end of November should provide some much needed guidance as to how our new ‘post WTO’ world will be governed. That direction should help the out-of-favor factory automation stocks and, hopefully, put robotics stocks back on track toward the level of growth every investor hopes for.