By Bill Studebaker, President & CIO, ROBO Global, LLC

It’s no secret that I’m incredibly bullish about the current trajectory of the healthcare sector when it comes to all things AI and digital. The ROBO Global Healthcare Technology & Innovation Index (HTEC) was launched in April 2019 to give investors a way to target their exposure directly toward this inevitable growth, and since that time, the strength of the sector has proven to be nothing less than spectacular. Last week, CB Insights delivered its 3Q19 VC funding report, and my bullishness is now officially on fire.

If that sounds overly dramatic, just look at the 3Q19 numbers, all according to CB Insights, which demonstrate the huge impact of AI and digital technologies on the healthcare sector. For investors, perhaps the most compelling piece of information in the report is the stunning level of funding that is already flowing toward research and applications in key areas like biotech, medical facilities & services, drug discovery and development, and disease diagnosis:

- Healthcare biotechnology came in #1 in deal activity among the top 7 internet verticals in Q3, with 59-68 deals in the quarter.

- Healthcare biotechnology came in #1 out of top 10 verticals by investments in the $1.1-$1.7B range.

- Digital Health took the #3 spot for investments, with between $1.3 and $2.2B invested in Q3.

- Healthcare dominated the top M&A exits in Q3, sharing the spotlight with internet software and services. Top deals included two $1B acquisitions: BlueRock Therapeutics being acquired by Bayer, and Semma Therapeutics being acquired by Vertex Pharmaceuticals.

- Healthcare number of unicorns rose to 37, with a total estimated value of $92.1B.

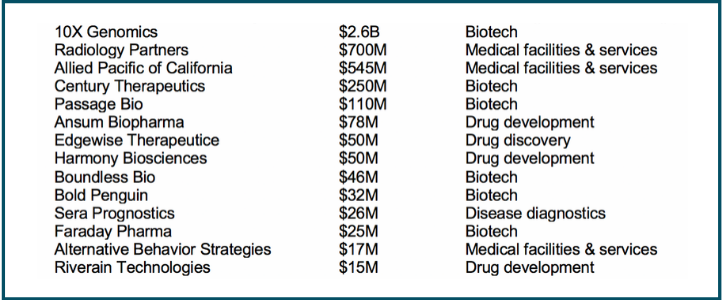

- Healthcare biotech companies led IPO and startup funding in Q3, including:

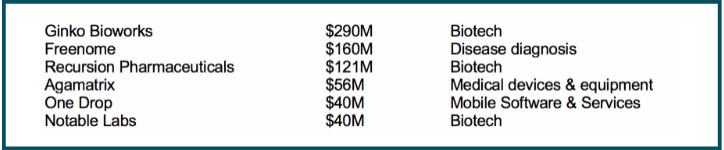

- Digital health startups raised multiple $100M+ rounds in Q3, including:

These numbers tell two stories. The first story is one of massive disruption in an industry that was late to the game when it came to adopting AI and automation, but is now leading the charge on every level. The second story is one of investor opportunity, pure and simple.

Healthcare disruption: the sudden wave of change

Perhaps no industry was more ripe for change in the face of the AI revolution than healthcare. As retail giants like Amazon and Walmart were quickly changing consumer expectations over the past decade by making online shopping, next-day delivery, and personalized marketing a reality, healthcare providers seemed complacent to continue with business as usual. But it didn’t take long for reality to set in. Longer average life spans, massive population growth, a shortage of physicians and healthcare workers, elevated consumer expectations, and the long, convoluted path to care all converged in a way that jolted the industry into action. Seemingly overnight, change became essential, and technology and AI adoption became an industry mandate. Here’s just a sample of the technologies and applications that are enabling this global shift:

- Telemedicine

The future of healthcare isn’t at the hospital—or even at the doctor’s office. Telemedicine is one of the biggest changes afoot, and it is literally reinventing healthcare. ROBO Global HTEC index member Ping An in China hosts more than 665,000 personal care visits every day using a telemedicine platform. The shift is filling the gap amid China’s dangerous shortage of doctors by reducing the need for face-to-face doctor visits by more than 250 million a year. Ping An reported Q3 results of 21.5% year-over-year growth and a 63.2% increase in net profit.

In the US, HTEC index member Teladoc offers a similar model, delivering care by phone, video, or app 24 hours a day, 7 days a week. The company reported year-over-year Q3 revenue growth of 24% to $138M and a 45% increase in patient visits, totaling 928,000 in Q3 alone. Globally, projections point to over 1 billion virtual care visits by 2025.

Imaging and diagnostics

The sensor revolution that is taking place in every industry sector is creating science-fiction-like innovation in healthcare. As sensors migrate inside the human body, medical imaging and diagnostics are rapidly moving from microscopic to nanoscopic. As a result, patients and their healthcare providers are about to learn a lot more about every aspect of their physical bodies.

Using data from sensors attached to our bodies—and even embedded in our bodies—doctors will be able to add years to our lives by eliminating annual check-ups and relying instead on massive amounts of 24/7 streaming data telling doctors everything they need to know about each patient’s physical state. Companies like HTEC members Agilent (which reported revenue of $1.27B for its Q3 ending 7/31/19) and Hologic (which reported revenue of $865.8M for 4QFY2019 ending 9/28/19) are using advanced imaging techniques to accelerate and improve all sorts of clinical diagnostics.

A tiny, implantable device from Semma Therapeutics (which was acquired by Vertex for $950M in September) treats diabetes by delivering millions of replacement beta cells that treat type 1 diabetes by letting glucose and insulin through but keeping immune cells out. At MIT’s CSAIL laboratory, headed by ROBO Global Strategic Advisor Daniela Rus, researchers are developing a configurable robot that is ingested in the form of a pill. The vision is to have these robots act as non-invasive mini surgeons.

Other areas of healthcare are seeing similar levels of discovery and change. Using 3D printing, researchers are building body parts—everything from bionic eyes to antibacterial teeth, to silicone hearts and artificial skin. Biotech companies are using AI to cut the time it takes to develop a new drug from an average of 10 to 15 years down to just days. Universities and hospitals are using virtual reality for everything from training physicians, enabling collaboration by healthcare providers, and providing anytime, anywhere access to treatments like physical therapy and rehab. Human genome research has emerged as a leading industry where none existed before, and AI algorithms are scanning millions of medical research papers to consolidate information and put it to use to enable new drug discoveries, patient treatment options, and much more.

A prescription for investor opportunity

Whenever disruptive technologies upend entire industries and reinvent the future, the opportunity for investors can be pretty spectacular—if they invest early and hang on for the ride. Apple is Wall Street’s greatest example. Famously founded in 1976 by the young threesome of Steve Jobs, Steve Wozniak, and Ronald Wayne, it took Apple a long 23 years to reach a valuation of $10 billion—but less than half that time for it to ‘suddenly’ become the first public US company to be valued at over $1 trillion. (And though it fell from that high for a time, it climbed back to the $1 trillion mark in September 2019.)

The story is far different today. Thanks largely to the rise of AI (in every form), innovators are driving disruption faster than the founders of Apple could have dreamed. Founded in 1994, Amazon took about a decade before its disruption of the retail industry took hold. By January 2019, Amazon hit $810B in valuation. It took 10 years for Teledoc to gain enough traction to reach 1 million virtual visits—and 1 month to gain 1 million more today.

Everywhere you look, disruption is occurring at a rate that was unthinkable in the past. That reality makes investing at the individual company level practically impossible. The ROBO Global HTEC index offers exposure to those companies around the globe that are driving the greatest innovation and growth—including more than 80 stocks across 9 subsectors in 15 countries. Companies that meet the criteria for membership in the ROBO Global Industry Classification for Healthcare Technology and Innovation are consistently researched and tracked by our experienced research team, including our strategic advisory board comprised of some of today’s most respected experts in robotics, automation, and AI.

For investors seeking the next ‘sure thing’—a wave of disruption that simply cannot be overlooked—now is the time to set your eyes on healthcare technology and innovation. The CB Insights data leaves no doubt: the money is flowing toward healthcare innovation. And where VC dollars run, growth is sure to flourish.