Jason Zweig, author of the Wall Street Journal column The Intelligent Investor, began a recent article with this intriguing question: “How could a microscopic organism destroy nearly $15 trillion in global stock-market wealth in five weeks?”

The article offers an important history lesson for investors. His premise is that ‘risk’ can often be hidden or delayed, but it can never be eliminated. Over the course of contemporary history—from the Great Depression that began in March 1933 through the Great Financial Crisis (GFC) of 2009—the financial markets have attempted to control risk, or even make risk obsolete. And yet even that statement personifies the market. In reality, of course, ‘the market’ isn’t doing anything. It is investors who create market volatility and, indeed, market panic.

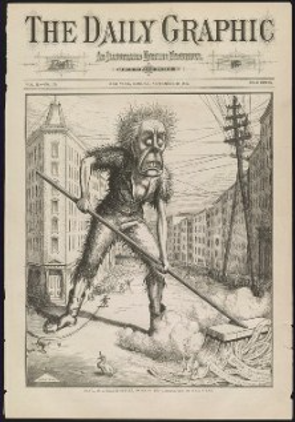

Zweig’s article includes this brilliant cartoon by Frank Bellew that appeared in The Daily Graphic just days after the market panic in 1873, including the original caption: “Panic, as a Health Officer, Sweeping the Garbage out of Wall Street”:

Image Credit: Frank Bellew, The Daily Graphic, Sept. 29, 1873, Library of Congress

Image Credit: Frank Bellew, The Daily Graphic, Sept. 29, 1873, Library of Congress

The theme of Zweig’s piece is market panic—what causes it, and how we as individual investors can control how we react to it. “It isn’t investments that make or lose money; it’s investors,” he writes, “...and market panics aren’t a good time for reaction, but for introspection.” He then prompts investors to ask themselves these two important questions:

- “Have I taken more risk than I realize?”

- “How can I turn panic into opportunity?”

For many investors, especially those who found themselves intentionally or unintentionally chasing returns in popular stocks during the long bull market, the answer to the first question is a definitive “YES!” For more than a decade, returns were almost too easy to capture, which pushed the realities of risk out of investors’ minds and, unfortunately, into their portfolios. But while there is little we can do to correct past mistakes, what we can do is move forward with conviction to create opportunity. If you’re seeking ways to turn panic into opportunity in the wake of today’s coronavirus calamity, here are some tactics to consider:

- Study the history of business cycles.

Between the years 1854 and 2009, the average business cycle lasted 16 months from peak to trough. In recent years, however, the length of each cycle has contracted. In the 11 cycles that took place between 1945 and 2009, the average length was just 11 months. If that contraction continues, it begs the question: “Will the stocks and ETFs that returned the most over the past 10 years be repeat winners in the decade ahead?” My guess is no. As business cycles run their course, business itself is transformed, which will create new winners (and losers) in the future.

- Study the history of bear markets.

ROBO Global advisor Louis-Vincent Gave, the founding partner and CEO of famed independent research firm Gavekal, recently contributed this commentary, which includes key insights into past bear markets—including the fact that the magnitude of this recent market drop has only occurred five times before. Looking at the 50-day moving average each time the S&P 500 market fell by 25% or more, investors with a two-year or more time horizon ended in positive territory. The only exception was the Great Depression: two years after the market crashed in 1929, the market was still down -39.31%. Luckily, today is very unlike the late 1920s. Heading into the pandemic situation, the global economy and global businesses were very strong, which points to a recovery more consistent with a two-year return to positive growth. Being positioned for that turnaround is key.

- Be intentional about managing risk.

The definition of risk is “the possibility of loss.” Of course, investors are ultimately rewarded for taking risk. It is an essential component of growth, gain, and return. Welcome to the age-old risk/return paradigm! Wise investors know that one way to manage risk is to diversify investments by building a portfolio of different asset classes. Including asset classes with low correlations (meaning assets that don’t typically move in the same direction at the same rate) can help further by reducing volatility risk. This can be achieved within the equity portion of your portfolio by adding carefully selected stocks (ideally in the form of an ETF, or Exchange Traded Fund)) to the mix. By balancing “the possibility of loss” with the potential for gain, you can create a portfolio that is aligned with your own appetite for risk. Re-balancing your portfolio when the market shifts can help you maintain that ideal balance. In short, be sure you don’t have all your eggs in one basket. Look at the top ten holdings of each mutual fund and ETF and make sure you don’t own the same stocks in every fund.

- Diversify among sectors poised for growth.

Most US ETFs are market-cap weighted, so they are crowded with the same top-10 stocks: the FAANG stocks (Facebook, Apple, Amazon, Netflix, and Google), as well as big names like VISA, Starbucks, Microsoft, and JP Morgan. While these are all considered great stocks and great companies, it is unlikely that they will all perform as well as they did in the past 10 years for the next 10 years. Yet there are many companies that are almost certain to see a greater performance in the decade ahead, especially those in the fast-accelerating sectors of robotics, automation, AI, and healthcare technology.

At ROBO Global, we have been speaking with many top investment professionals who are in the process of rebalancing portfolios for their clients. In nearly every instance, they are seeking ways to intentionally manage risk and reposition portfolios—all with the current length of business contraction in top of mind. Very often, our Robotics & Automation Index (ROBO) and Healthcare Technology & Innovation Index (HTEC) options fit the bill. From a diversification perspective, the ROBO Global indices include about 60% non-US and 70% small-cap and mid-cap stocks. Because of this, they typically have a <3% overlap with the stocks in most growth-oriented portfolios. From a risk perspective, this mix also offers access to many lower-correlated stocks relative to the S&P 500. (And if you’re a stat nerd like me, the ROBO index has a .5 correlation to the HTEC index. Drop the mic!)

Perhaps the best way to “turn panic into opportunity” as Zweig recommends is to take steps to invest for growth today. The coronavirus has certainly created panic on Wall Street, but it has also highlighted how innovations in robotics, automation, AI, and healthcare technology are paving the way for a better tomorrow. After the bear market has run its course, it is the companies that are focused on these innovations that are likely to see the strongest growth. When combined with other equity investments, the ROBO Global indices could help diversify risk while helping investors make the most of the market growth of tomorrow.

ROBO Global currently offers three innovative portfolios, including our Robotics & Automation Index (ROBO), Healthcare Technology & Innovation Index (HTEC), and Artificial Intelligence Index (THNQ). To learn more, visit our website at www.roboglobal.com.