By Bill Studebaker, CIO & President & Jeremie Capron, Director of Research, ROBO Global

As the global COVID-19 pandemic continues, countries and companies around the globe—from Asia to Europe to the Americas—are all at different stages of reacting to the crisis. For investors, this reality is creating unique opportunities. Now is the time to turn down the volume on the day-to-day volatility and focus on investing for future growth. At ROBO Global, we are investing primarily in disruptors that we think will gain share coming out of this crisis, especially in the areas of artificial intelligence, automation, enterprise software, and healthcare technologies—many at ‘sale’ prices. Our ROBO Global Robotics & Automation Index is now trading at the low end of its historical range on multiple valuation metrics. As we look to the future, we see investment opportunities playing out broadly across three waves of increased demand resulting from the pandemic:

Wave #1: Supporting stability and business continuity

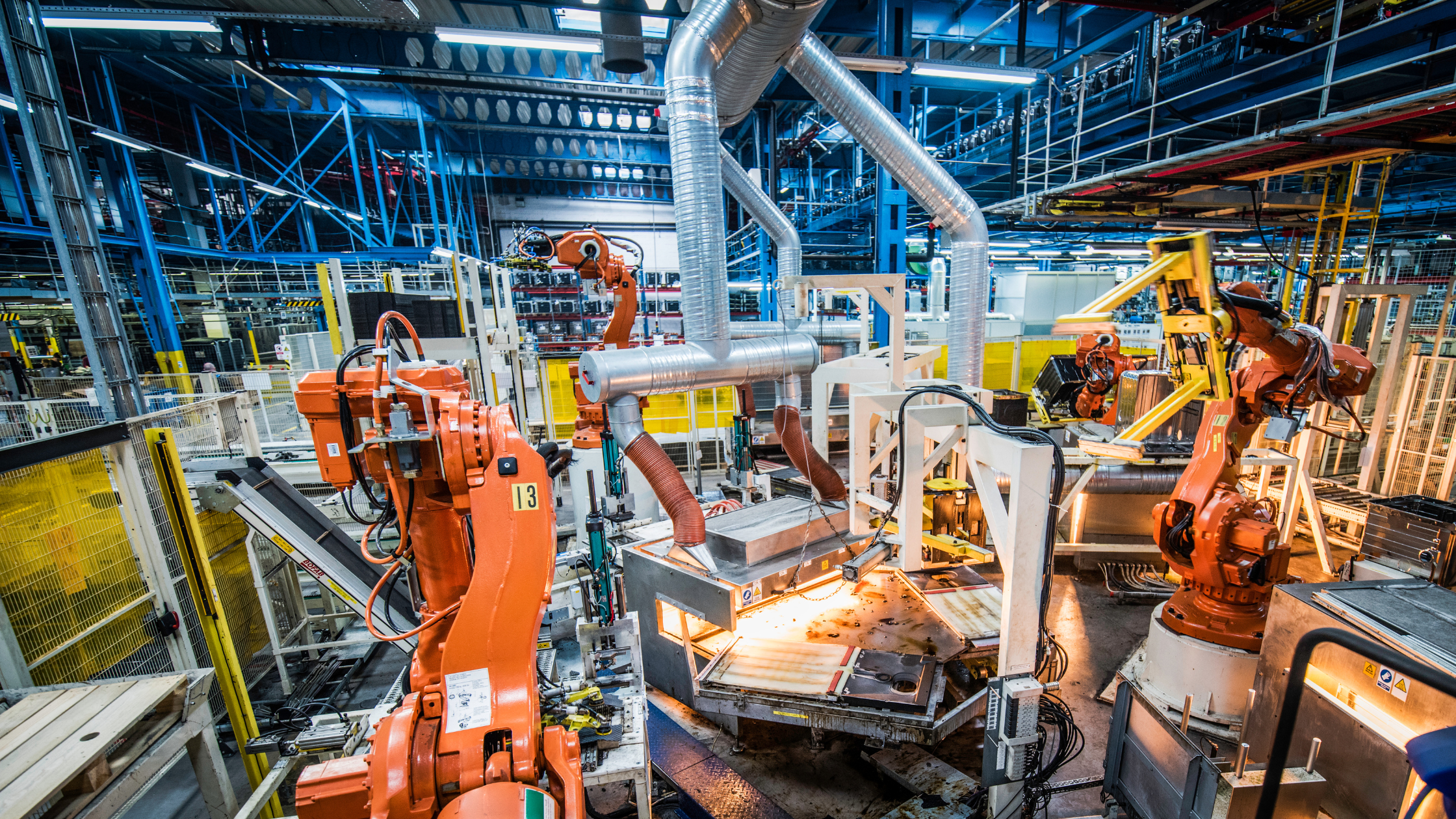

Ecommerce and warehouse automation technologies are enabling the global population to adhere to social distancing mandates and self-isolation requirements. While eCommerce was a welcome luxury in the past, it has quickly become a necessity in our new reality. As a result, growth in these areas is expected to accelerate. Our research suggests that the global market for warehouse and logistics automation topped $53B last year, and we estimate it will exceed $80B in 2023. Statista has also forecast growth to come, indicating that global retail eCommerce sales will reach $6.5T in 2023 (CAGR 16.6%). Here are just a few of the index members in our logistics and warehouse automation sector, which accounts for 11% of the ROBO Index:

- Daifuku. At-home spending has increased dramatically during the crisis, putting a strong spotlight on eCommerce logistics. We are upbeat on Daifuku’s next-generation logistics systems and comprehensive automated material handling solutions for eCommerce warehouses. The company’s greater use of IoT and AI positions it well to take share in eCommerce expansion. Daifuku’s six main business segments include factory automation & distribution automation; semiconductors; electronics factory automation; automotive factory; airport baggage handling; and electronics.

- Zebra Technologies. Zebra has evolved from a tactical productivity player to an essential partner for online as well as brick and mortar retailers who must now execute their omnichannel strategies with excellence in order to evolve and survive. We expect demand for asset tracking to strengthen and valuations to rise as secular growth drivers increase and new use cases emerge in retail, logistics, manufacturing, and healthcare.

- Ocado. The UK’s pioneer in the online grocery space, Ocado’s revenues are driven by two key divisions: retail and solutions. The retail unit consists of a 50/50 joint venture with retail giant Marks & Spencer to deliver food directly to customers' homes. The company’s solutions unit sells Ocado technology to third parties all over the world. In recent weeks, demand has been off the charts, with delivery slots fully booked for several days ahead; Ocado has even had to take the exceptional step of closing its website for several days. Demand for technology solutions has also accelerated, and we see no barriers to long-term growth for this grocery disruptor.

- KION Group. Intralogistics data is one key to maintaining supply chain efficiency and adaptability. KION Group’s intralogistics 4.0 solutions enable intelligent trucks, fleet data management, automated trucks, and automated systems. The solutions collect data from on-vehicle sensors connected to the KION Cloud, and then evaluate the collected intralogistics data to optimize fleets. KION’s warehouse automation subsidiary, Dematic, applies the same technology to automate material-handling equipment, and its warehouse control system is used to direct warehouse activity in real-time.

Wave #2: Institutionalizing new ways of working

Stopping coronavirus requires ‘flattening the curve’ by radically changing how we go about our daily lives. As it appears today, it seems likely that things won’t return to normal after a few weeks. Some things, in fact, will never be the same. This reality has created new business models and distribution platforms almost overnight while accelerating a wide variety of existing technology applications. We recently discussed how this crisis has stressed our IT infrastructure and confirmed the reliability and security of AI-powered solutions in Crisis accelerates re-shaping of work with automation and AI. Another example is telehealth, which was thrown into the spotlight as patients around the globe suddenly saw online healthcare as an answer to avoiding exposure to COVID-19 at traditional healthcare facilities. We are also seeing a quick shift to more digital and mobile platforms as companies seek out ways to avoid business disruption. We recently discussed the uptick in demand for many ROBO Global Healthcare Technology & Innovation Index members’ offerings in our article Investing in the Face of COVID-19, including a notable leader in the space, Ping An Good Doctor. Here are two other index members we expect to ride this wave to growth:

- Teledoc. This US-based virtual care platform is now capable of supporting ~100M members, with 50K+ virtual visits daily, implying a $1B+ opportunity in annualized revenue capacity. Earlier this month, the company reported that patient visit volume surged 50%in a single week. Demand is continuing to rise, with visits accelerating to as many as 15,000 visits every day. Supporting this rapid growth is updated regulatory guidance from the US Centers for Medicare and Medicaid Services (CMS) that expanded telehealth services to more than 44 million Medicare beneficiaries as part of a strategy to combat COVID-19. The change provides the same reimbursement for telehealth visits as in-person visits—even those that are unrelated to COVID-19.

- ServiceNow.This provider of cloud-based workflow automation software uses a machine learning engine to improve productivity. The company has offered government agencies around the world with free access to its powerful design app to help them quickly and efficiently coordinate the work of millions of health department employees. ServiceNow is also giving these agencies access to new AI tools geared at helping them better coordinate responses to the pandemic by predicting outages, automating routing, and predicting outcomes.

Wave #3: Learning from the crisis to prioritize tomorrow’s tech transformation

As the need for robust network capacity and bandwidth accelerates, Cloud providers and infrastructure companies that enable AI and advanced analytics are seeing a massive increase in demand for data center buildouts. The need for high-frequency spectrums was already on the rise as a new generation of computers and mobile devices strained existing infrastructures. Shelter-in-place orders around the globe have forced a shift to remote work, virtual classes, video conferencing, and online training seminars—all of which have exacerbated the demand for greater capacity and the move to 5G. It’s no surprise that web traffic and streaming demand has spiked. And while the catalyst for this increased usage was an urgent lifestyle change because of the pandemic, it is likely that our reliance on such services will become the ‘new normal.’ Companies that were already driving this digital evolution are well-positioned to continue to lead the tech transformation long after COVID-19 has been relegated to history.

- Qualcomm. Even with the impact of COVID-19, the trajectory of Qualcomm’s planned 5G launches has not changed, and the company’s momentum remains strong. Operators and OEMs have become even more aggressive in shifting to 5G than was anticipated prior to the crisis. While Qualcomm is not updating guidance at this time, the company is already reporting a return to manufacturing at its Chinese customers, with factories now operating at 50-70% of original capacity. We anticipate Qualcomm’s 5G offerings will be in greater demand after the crisis as manufacturers choose to adopt higher-speed devices and networks when they are able to ramp-up to full capacity.

- Koh Young. This South Korean company develops 3D inspection and measurement equipment that uses advanced sensing technology. Its automated optical inspection (AOI) solutions have become a must-have for semiconductor device manufacturers and makers of smartphones. With Apple and others still expecting to roll out 5G devices in the second half of the year, Koh Young is poised to deliver double-digit growth in the coming years. The company has also expanded into the medical segment, making robots for brain surgery and developing machines for conducting biopsies.

- National Instruments. This mid-sized semiconductor company based in Texas may not be a household name, but it is a key player in the wireless communication ecosystem. In fact, it’s safe to say that today’s wireless R&D and the deployment of 5G would not have been possible without National Instruments. The company’s hardware and software support automation, testing, and the measurement of 5G spectrums for semiconductor companies like Qualcomm and Qorvo, for smartphone manufacturers like Samsung, and for the large global network of service operators.

At ROBO Global, we anticipate that companies that offer asset-lite products and solutions, such as data and algorithms, should prove more capital efficient and will emerge more quickly from the downturn than ‘heavy assets.’ Even more, those companies that are positioned within these three major waves of growth will enter the post-pandemic environment with, particularly strong momentum. For future-thinking investors, now is the time to identify portfolios that are positioned to excel in the months and years ahead and invest for a post-pandemic tomorrow.

ROBO Global currently offers three innovative portfolios, including our Robotics & Automation Index (ROBO), Healthcare Technology & Innovation Index (HTEC), and Artificial Intelligence Index (THNQ). To learn more, visit our website at www.roboglobal.com.